- Prices of the WTI trade on a volatile fashion above $60.00.

- The situation around the Suez Canal returns to normality.

- API, EIA weekly reports come in later in the week.

Prices of the West Texas Intermediate fade the initial spike to levels above the $61.00 mark per barrel and return to the $60.00 neighbourhood on Monday.

WTI corrects lower following the Suez Canal jam

The barrel of the American reference for the sweet light crude oil comes under some selling pressure following earlier tops beyond the $61.00 mark.

With the Suez Canal situation now normalized, prices look to the recent usual fundamentals for direction, which remain dominated by the combination of escalating COVID-19 cases in the Old Continent, poor pace of the vaccination campaign (with the exception of the US, UK and Israel) and new lockdown measures in many developed economies.

Against this backdrop, the demand for crude oil is poised to suffer while the economic recovery in Europe looks postponed for later in the year.

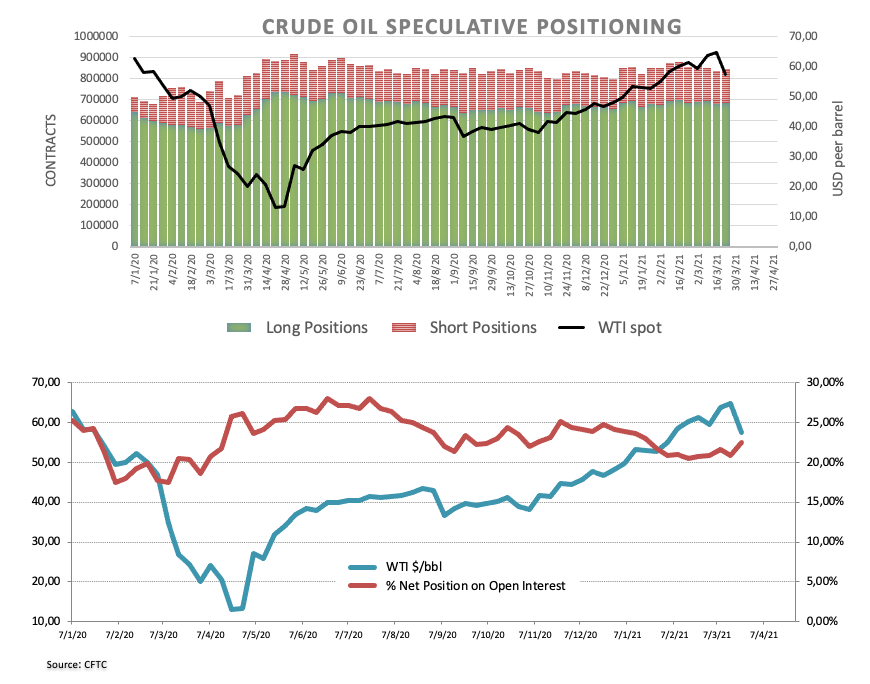

News from the speculative community shows crude oil net longs eased to 3-week lows during the week ended on March 23rd (as per the latest CFTC Report) on the back of rising Chinese imports from Iran, traders’ concerns over the crude oil demand amidst the unabated pandemic and the end of supply disruptions in the US, Libya and Russia.

What to look for around WTI

Prices of the West Texas Intermediate extends the choppy activity seen in past sessions. In fact, the recent rally in the commodity came to a halt just below the $68.00 mark per barrel (March 8), as traders remain worried about new lockdown restrictions in Europe coupled with the slow vaccine rollout and the impact on oil demand and gasoline. Adding to the downward trend, the stronger note of the dollar has been also weighing on prices along with diminished inflows into commodity-based ETFs. On another front, refineries are expected to go into maintenance-mode for the next 1-2 months, putting prices under extra pressure.

Key events in the crude oil space: Weekly reports on US crude oil supplies by the API (Tuesday) and the EIA (Wednesday) – US oil rig count (Friday) – OPEC meeting on April 1st.

Eminent issues on the back boiler: Higher crude oil prices could spark fresh interest in US shale and potential increase in production. Demand-supply balance could prompt a moderate correction lower later in the year. Potential overheating of the oil market if current tight conditions extend into H2 2021. Bouts of geopolitical effervescence, mainly in Africa (Libya, Nigeria) and the Middle East (Saudi Arabia, Yemen).

WTI significant levels

At the moment the barrel of WTI is down 0.93% at $60.23 and a breach of $57.28 (weekly low Mar.23) would expose $53.90 (monthly high Jan.13) and then $47.20 (2021 low Jan.4). On the upside, the next hurdle is located at $62.01 (weekly high Mar.22) seconded by 67.94 (2021 high Mar.8) and finally $70.00 (key level).