- The barrel of WTI adds to Tuesday’s gains near the $54.00 mark.

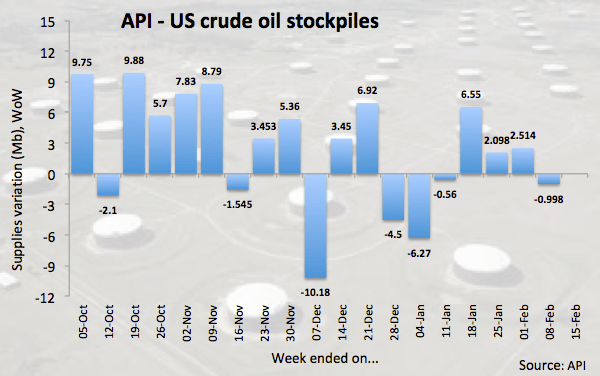

- US oil supplies dropped by nearly 1M barrels last week, API reported.

- IEA revised lower its forecast for demand for OPEC crude this year.

Prices of the American reference for the sweet light crude oil are prolonging the recovery on Wednesday, trading at shouting distance from the $54.00 mark per barrel ahead of the EIA report.

WTI looks to EIA, trade

The barrel of West Texas Intermediate is up for the second session in a row today on the back of firm optimism over a potential agreement in the US-China trade talks, all despite latest news seems to leave the final decision to a Trump-Xi meeting.

WTI has also derived some support after the API reported late on Tuesday a nearly 1M barrel drop in US crude oil supplies during last week.

Further news from the IEA’s report said the agency now sees demand for OPEC crude at 30.7 mbpd this year vs. 31.6 mbpd previous.

What to look for around WTI

Hopes of a US-China trade deal have lent extra oxygen to crude oil prices in past sessions and this should remain a key driver in the very near term. On the broader picture, the ongoing OPEC+ agreement to curb oil production, US sanctions against Venezuelan and Iranian oil exports and the so-called ‘Saudi Put’ should keep a firm floor under crude prices.

WTI significant levels

At the moment the barrel of WTI is up 1.36% at $53.98 facing the next hurdle at $ $55.59 (2019 high Feb.4) ahead of $57.55 (100-day SMA) and then $58.00 (high Nov.16 2018). On the downside, a breakdown of $53.23 (21-day SMA) would aim for $51.15 (low Feb.11) and finally $50.88 (55-day SMA).