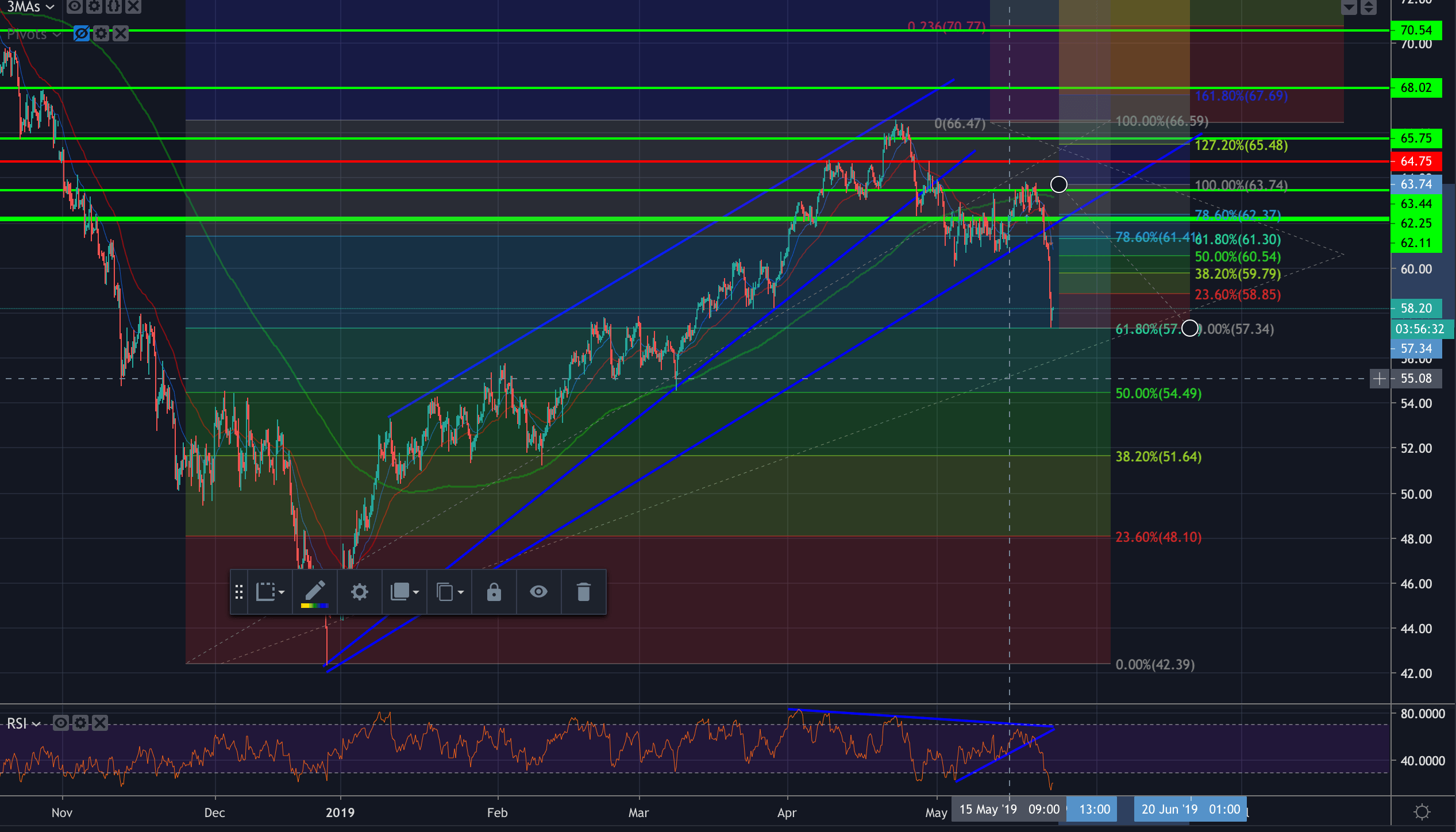

- WTI dropped below the golden cross (50/200 DMA cross-over) overnight.

- This was a key level that was coinciding with the 23.6% Fibo, late Dec-late April range, and ascending channel support.

- Bears are now in control below the 60 handle with a touch-down at 57.36 the overnight low, to the 61.8% Fibo, (late Dec 2018 to April highs).

- 54.50 and the 50% retracement of 2019 range come in next ahead of the 200-W MA down at 52.40.

- Below there, we have and the 38.2% Fibo and Feb lows at 52.50/51.40 respectively.

- Stochastics are oversold, so a move higher is likely.

- 60.50 comes in as the 50% mean reversion of the 20th May weekly stick’s range and a double top target ahead of 60.80.

- Higher up, the 17th May low of 62.51 and 26th April lows comes in at 62.26.