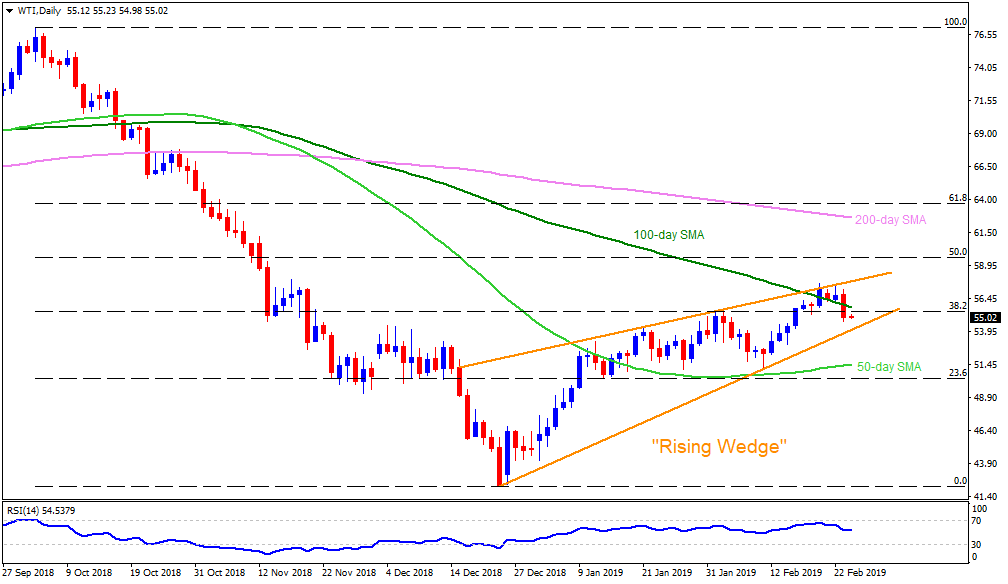

WTI daily chart

- WTI trades around $55.20 during early Asian sessions on Tuesday.

- The crude benchmark maintains its position below 100-day simple moving average (SMA) with gradually softening 14-day relative strength index (RSI) highlighting the importance of $53.90 support including an upward slanting support-line connecting lows of December and February.

- If we also look at the ascending trend-line joining highs marked since mid-December, there prevails a “rising wedge” bearish formation between $53.90 and $57.80 on the play.

- Hence, a sustained downside break of $53.90 can confirm the bearish technical pattern and may open doors for its decline towards 50-day SMA level of $51.45 and then to 23.6% Fibonacci retracement of its October-December downturn, at $50.30.

- In doing so, $53.00 and $52.40 may offer intermediate halts to the south-run.

- Alternatively, 100-day SMA level of $55.85 could act as nearby resistance, a break of which can escalate the moves to $57.20.

- If at all prices rally beyond $57.20, $57.80 might challenge bulls failing to which could recall $59.30 and $60.00 on the chart.

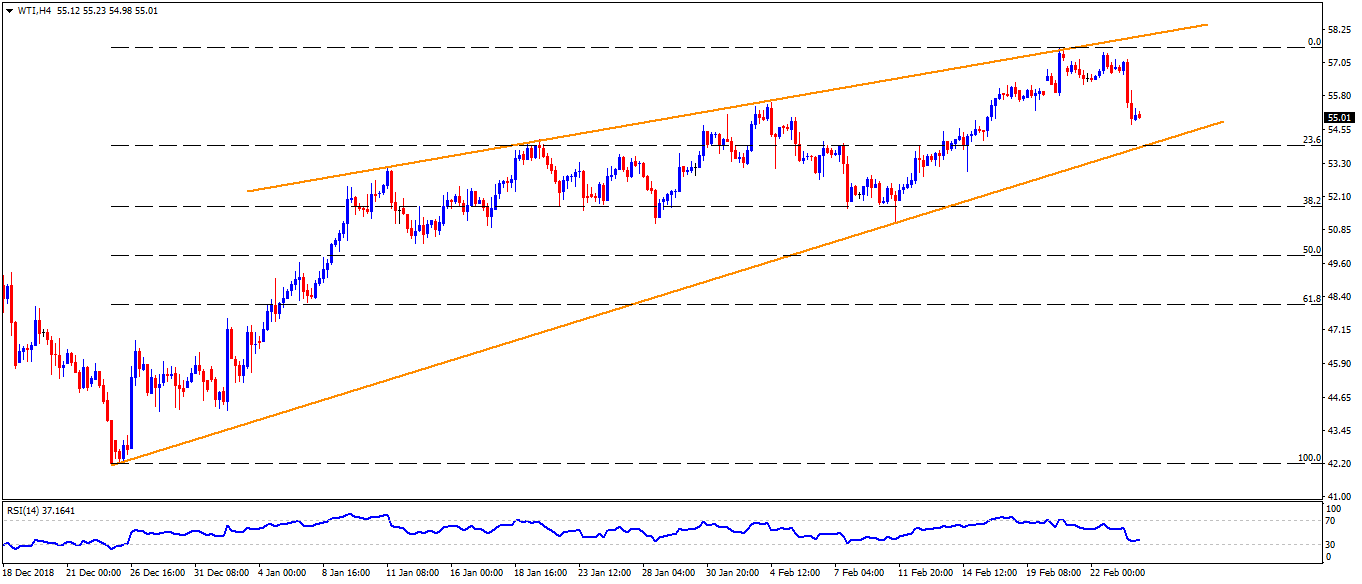

WTI 4-Hour chart

- While a break of $53.90 signals the energy benchmarks slid to $51.45 on the daily chart, there prevails an intermediate halt at $51.70 as shown by the 38.2% Fibonacci retracement of December – February moves.

- On the upside, $56.30 may become a buffer between $55.85 and $57.20 levels.

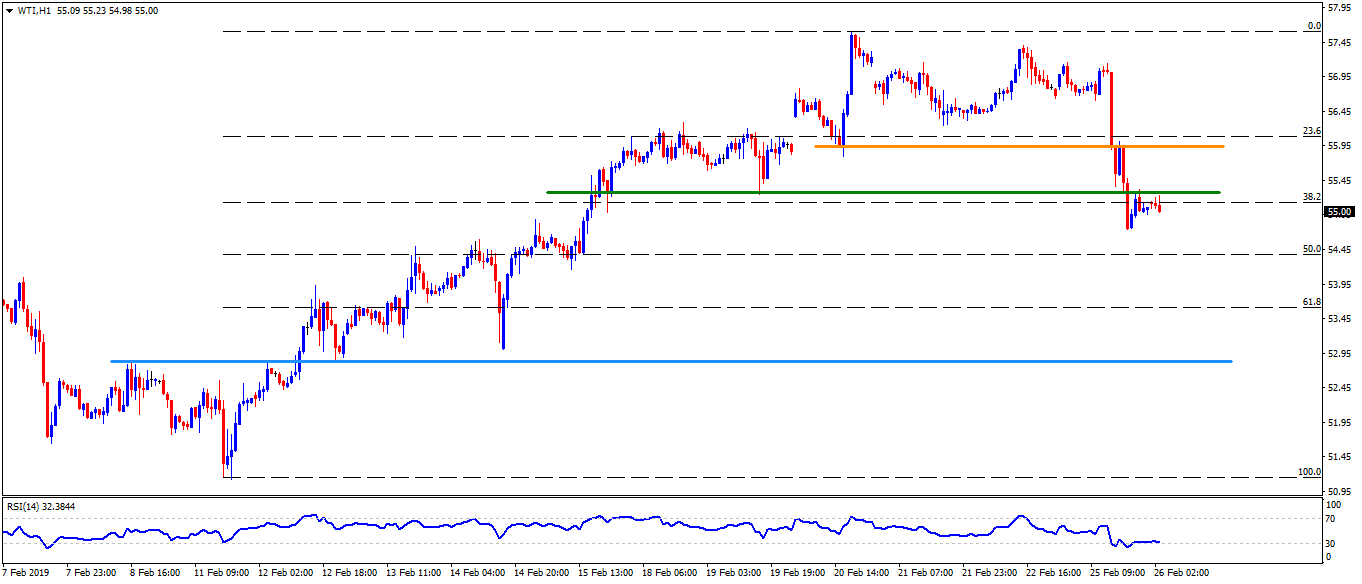

WTI hourly chart

- Having breached $55.30 horizontal support, now acting as resistance, WTI may revisit $54.70 prior to taking rest on $53.90 whereas $52.80 can flash on sellers’ radar then after.

- Meanwhile, an upside clearance of $55.30 highlighting $55.85 and $56.30 for short-term buyers.