Overall it has been another volatile year in the currency markets with seismic moves which included the major currencies. The impact of Central Banks stepping up their aggression to help boost domestic growth has had a huge impact on currency movements and momentum.

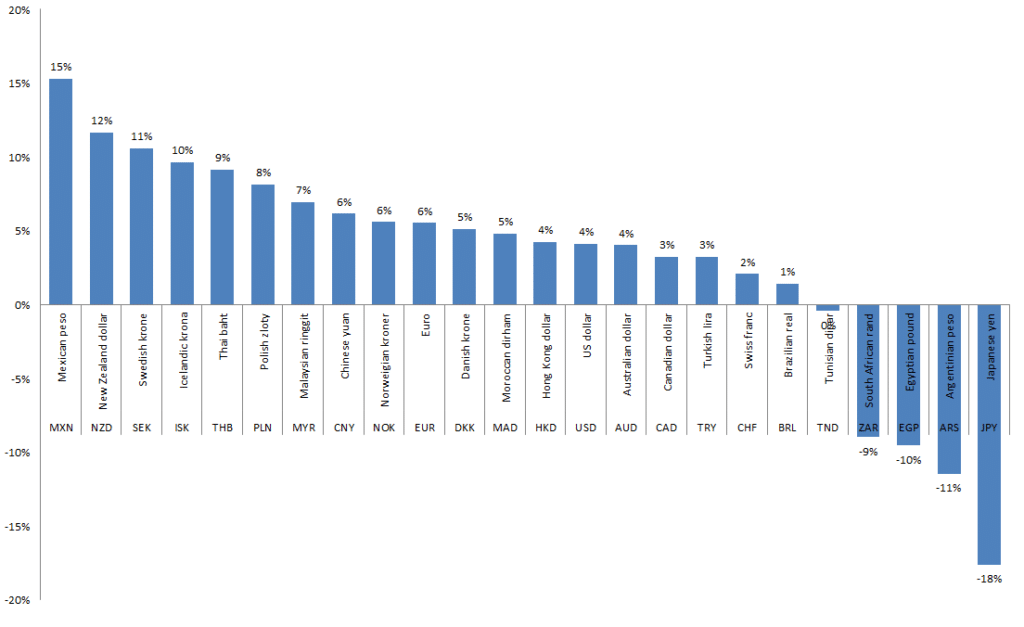

The Japanese Yen (JPY) has been the biggest loser shedding 21 per cent against the pound following a fundamental shift in monetary policy by the Bank of Japan to become more aggressive which favours a weaker JPY. The notion of currency wars and a race to the bottom has emerged since the aggressive action by the BoJ and other central banks are also stepping up their policy actions to help stabilise and drive growth and at the same time devalue their domestic currency to boost exports.

Guest post by Phil McHugh, senior analyst, Currencies Direct

The US Federal Reserve (FED) in the last year have also stepped up their monetary easing initiatives with open ended asset purchases. However the expectation is that this programme will start to taper in September this year and this has now been priced to some extent into the USD leading to recent USD strength against the pound.

The other big losers have been the Argentinian peso and the Egyptian pound. The peso has devalued more in line with government policy and high inflation spooking holders of Peso’s and the Egyptian pound due to adapting to a new but still fragmented political system. In both cases the currencies are expected to weaken further and this effect could eventually help the economies by bolstering exports and stimulating domestic production.

The big winners over the 12 month period have mainly emanated from economies that have lacked the same central bank clout and aggression as the major western economies and at the same time have shown positive growth projections. The biggest winner against the pound was the Mexican peso which surged on expectations that government reforms will boost growth and encourage an increase of foreign inflows. The New Zealand dollar and the Australian dollar have outperformed on strong commodity related growth especially driven by flows from China and interest rates that although falling are still at normal levels compared to the UK for example. The Swedish krone, Norwegian kroner and Danish krone have all performed well against the pound with steady to robust underlying economic performance supporting the their domestic currencies; a concern here will be for currency appreciation.

We can expect volatility to remain high with further Central Bank jostling and an uncertain trajectory for global growth.