Best Forex Brokers South Africa 2021

If you are looking to trade the forex market in South Africa, one of the essential elements to consider is the broker you choose to trade with. Selecting a suitable broker can ensure you trade effectively and safely over the long term – so you must do your research and opt for a broker that suits your goals.

With that in mind, this guide will highlight the Best Forex Brokers South Africa 2021 – covering all the key points you need to know and showing you how to sign up with a top South African broker so you can start trading right away.

Best Forex Brokers South Africa 2021 List

Are you looking for a breakdown of the best South African forex brokers? Look no further – the forex brokers list below shows the best forex brokers in South Africa today. The following section will review a selection of these brokers, providing you with all the information you need to make an effective broker choice.

- Capital.com – Overall Best Forex Broker in South Africa

- Avatrade – Best Forex Broker in South Africa with MT4 support

- Vantage FX – Best Forex Broker in South Africa for ECN accounts

- Pepperstone – Best Forex Broker in South Africa with Low Fees

- IG – Best Forex Broker in South Africa with User-Friendly Platform

- ABSA – Best Forex Broker in South Africa for Experienced Traders

- FP Markets – Best Forex Broker in South Africa for Asset Selection

- Blackstone Futures – Best Forex Broker in South Africa for Regulation

- FXTM – Best Forex Broker in South Africa for Educational Materials

- HotForex – Best Forex Broker in South Africa with Low Minimum Deposit

Top South Africa Forex Brokers Reviewed

The list above has showcased the best forex brokers in South Africa this year. As you can see, there is a solid selection of brokers for South African clients, each one offering a slightly different set of features and offering different fee structures. Furthermore, some options are forex brokers with ZAR accounts, whilst others are forex brokers with bonus offers.

So, to help you narrow your decision even further, this section reviews the five best South African forex brokers in detail – ensuring you have everything you need to know before entering the market.

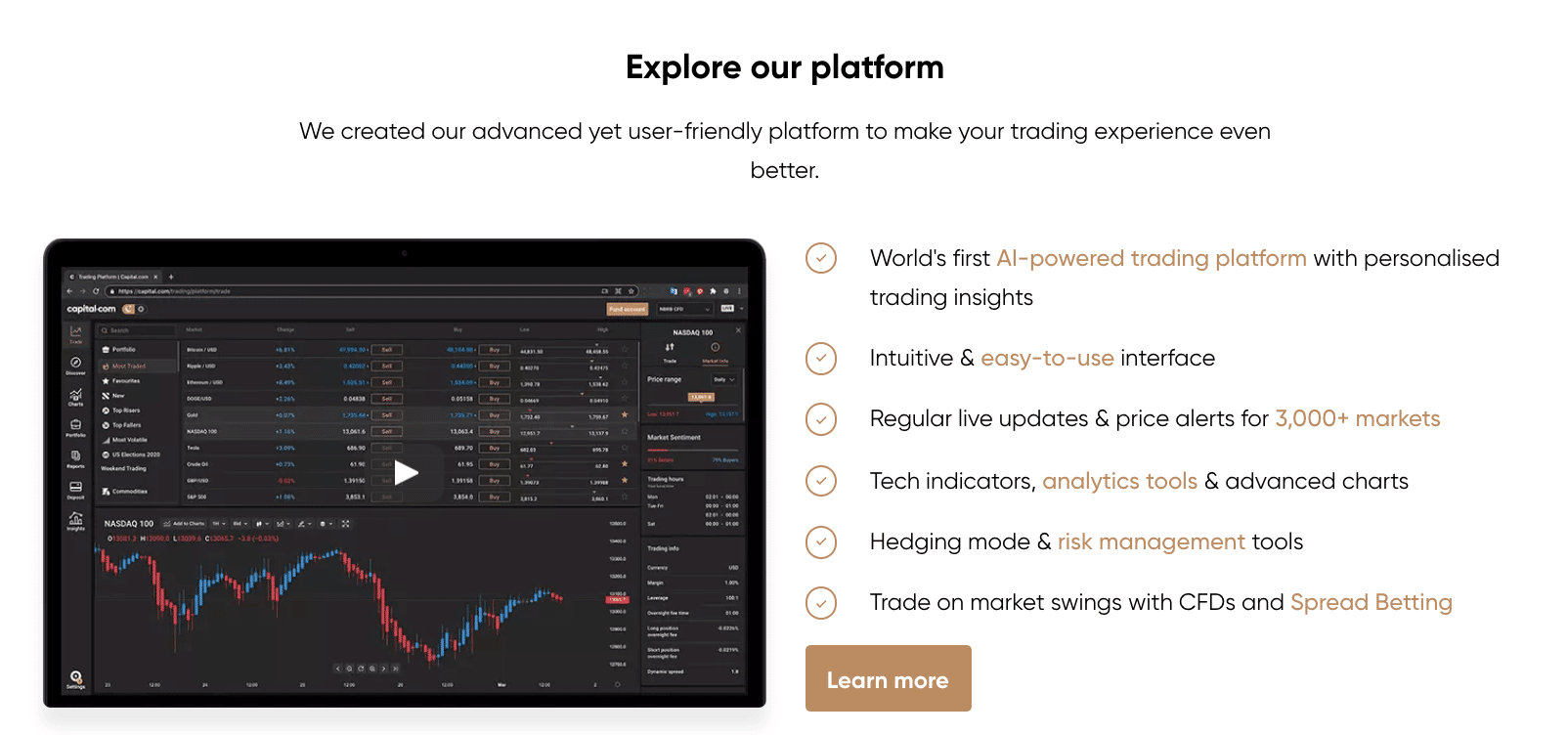

1. Capital.com – Overall Best Forex Broker in South Africa

Our number one pick when it comes to forex brokers in South Africa is Capital.com. Capital.com is the favoured broker of traders worldwide thanks to its strictly regulated trading platform and attractive fee structure. In terms of the former, Capital.com is regulated by entities such as the FCA and CySEC – two of the top institutions for trading protection.

As one of the best CFD brokers, Capital.com does not charge any commissions when you place a forex trade. Instead, the broker fee is included in the spread, which is the difference between the buy and sell prices on a currency pair. These spreads tend to be very competitive in peak trading hours – for example, Capital.com’s typical spread on GBP/USD is only one pip. Spreads can even be as low as 0.6 pips for EUR/USD, ensuring traders can operate in the markets cost-effectively.

Aside from trading fees, Capital.com does not charge anything else – no withdrawal, deposit, inactivity, or monthly account fees. Furthermore, Capital.com offer one of the lowest minimum deposit thresholds in the industry, as users can deposit as little as $20 (287 ZAR). Finally, Capital.com provide a vast selection of educational resources for traders, including guides, webinars, articles, courses, and even a handy demo account!

Pros:

Cons:

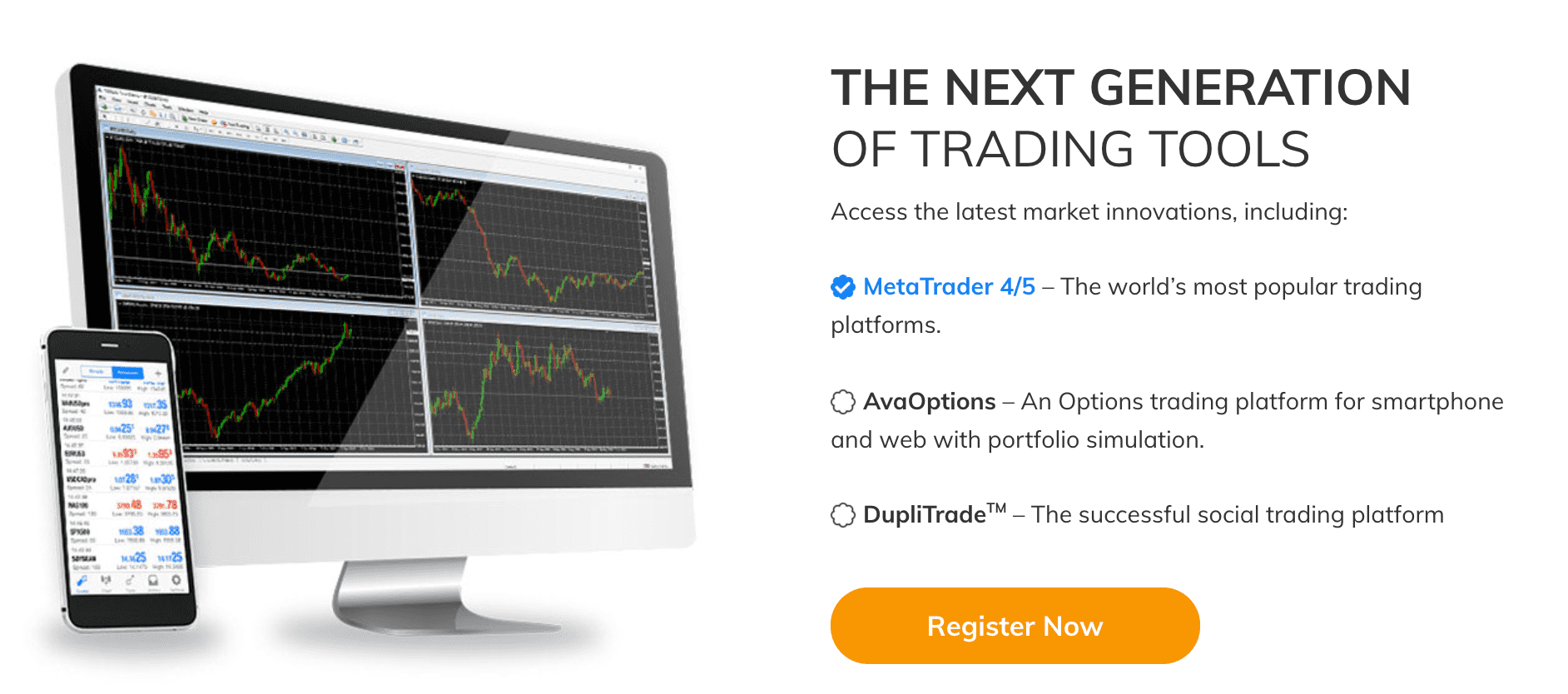

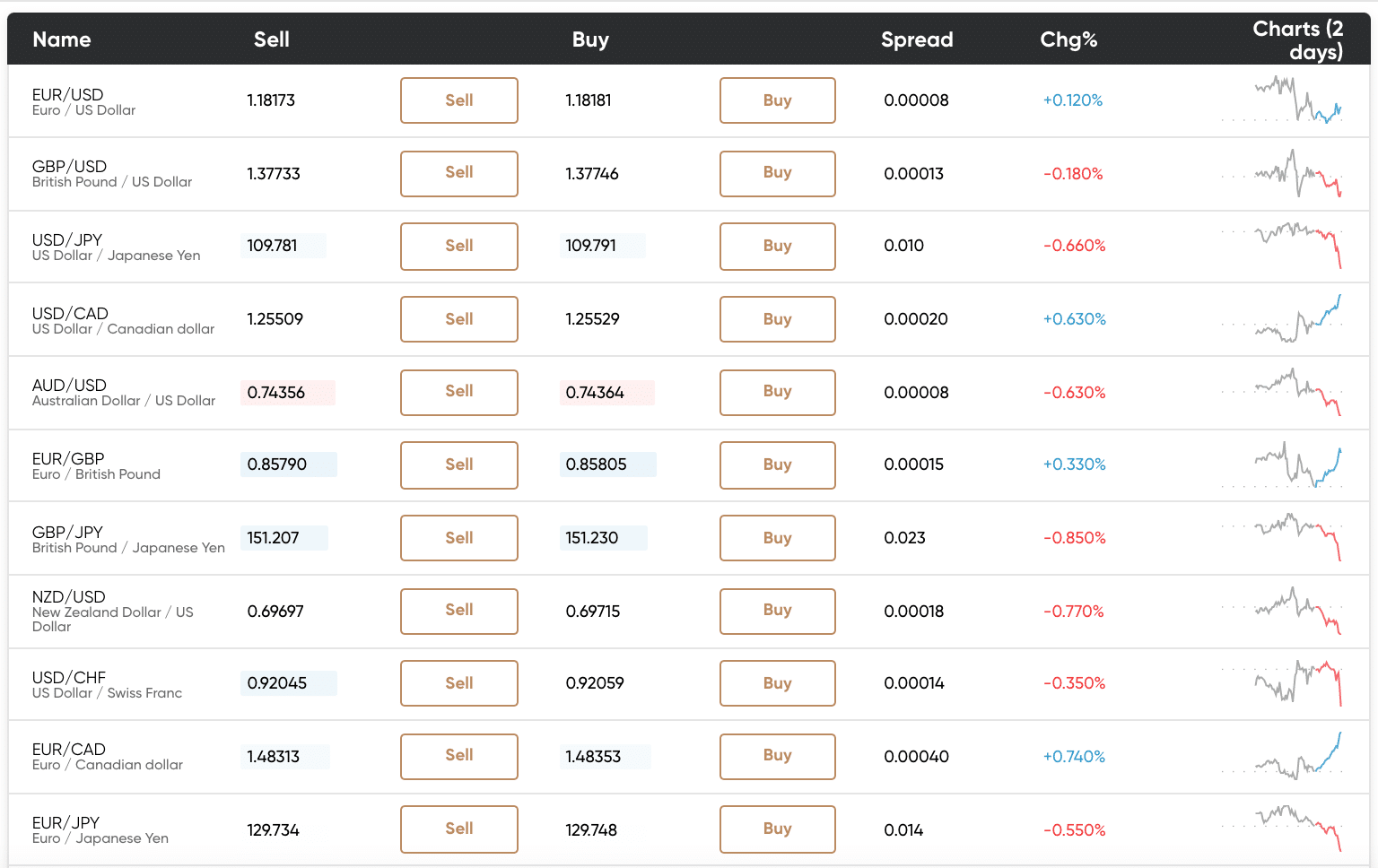

72.6% of retail investors lose money trading CFDs at this site. Much like Capital.com, Avatrade’s fees are built into the spread. Avatrade’s spreads are also very tight – for example, average spreads for EUR/USD and GBP/USD are 0.9 pips and 1.6 pips, respectively. In terms of non-trading fees, Avatrade does not charge any deposit, withdrawal, or monthly account fees. The broker does charge a small inactivity fee if you do not trade for three months straight; however, this isn’t something to worry about if you are active in the market. The account opening process at Avatrade is very smooth, and the minimum deposit threshold is only $100 (1439 ZAR). Users can make deposits via credit/debit card, bank transfer, or various e-wallets such as Neteller, Skrill, and Klarna. Finally, Avatrade offers full support for MT4 and MT5, which is perfect for forex traders who wish to use custom indicators or forex robots. Pros: Cons: 71% of retail investor accounts lose money when trading CFDs with this provider One of the best high leverage forex brokers available to South African users is Vantage FX. Vantage FX is an Australia-based broker that accepts clients worldwide and boasts regulation from ASIC and CIMA. One of the most appealing things about Vantage FX is the different accounts that they offer. Users can select from a Standard STP account, a Raw ECN account, or a Pro ECN account. Fees differ depending on which account you opt for; however, the vital thing to note is that the Standard STP account is commission-free, whilst the two ECN accounts are not. Notably, the ECN accounts offer spreads from as low as 0 pips, whilst the STP account’s spreads tend to be around 1.4 pips for EUR/USD. If you do opt for an ECN account, the minimum deposit thresholds are much higher; Raw ECN accounts require a deposit of $500, whilst Pro ECN accounts require a deposit of $20,000. Like other brokers, Vantage FX accepts fee-free deposits via credit/debit card, bank transfer, and various e-wallets. Vantage FX also offers full support for MT4 and MT5, ensuring FX traders have access to all the forex tools they require. Finally, Vantage FX offers a helpful demo account feature that can provide a risk-free experience using the MT4/MT5 platform – ideal for beginner traders. Pros Cons Your capital is at risk when trading financial instruments at this provider Another fantastic broker choice for South African traders is Pepperstone. Pepperstone was founded in 2010, so it has been involved in the industry for over a decade. The broker is regulated by top-tier organisations such as the FCA and ASIC – ensuring users can trade safely and securely. If you decide to use Pepperstone, you have the choice of two account types – a standard account or a Razor account. The standard account doesn’t charge any commissions but has a higher average spread than the Razor account. On the other hand, the Razor account does charge a commission (based on which platform you use); however, spreads are incredibly low and can even be as little as 0 pips for specific pairs. Also, Pepperstone offers an Active Trader program that provides a rebate on the fees you pay if you are active in the market – the more you trade, the more you get back. The great thing about Pepperstone is that there is no minimum deposit – users can deposit as little as they like! Deposits are free to make and can be completed via credit/debit card, bank transfer, or e-wallet. Users can trade through MT4, MT5, and even cTrader if they wish. Furthermore, all of these platforms can be used to trade on mobile – which is ideal for users who want to trade on the go. Pros Cons Your capital is at risk when trading financial instruments at this provider Rounding off our list of the best forex brokers in South Africa is IG. IG has been around since 1974, making them one of the most well-established brokers in the world. Furthermore, IG is regulated by multiple top-tier bodies such as the FCA and BaFin – and is even listed on the London Stock Exchange! IG’s forex fees are incorporated into the spread, which varies depending on market conditions. During peak trading hours, the spread can be very tight – the average spread for EUR/USD tends to hover around one pip. Furthermore, IG doesn’t charge any deposit, withdrawal, or account fees – although users will have to pay an inactivity fee of $12 per month after two years of no trading. Another great thing about IG is that there is no minimum deposit if you fund your account via bank transfer – although this does rise to $300 if you use a credit/debit card or PayPal. IG also offer their own proprietary trading platform, which is incredibly user-friendly and has many features and order types to utilise. Finally, IG also has a handy ‘Trading Ideas’ section that provides insight into which direction currencies may head and in which timeframe. Pros Cons Your capital is at risk when trading financial instruments at this provider As you can see from the section above, some great forex brokers are available to South African clients. Although it’s challenging to determine which is the best forex broker in the world, you can narrow down your broker choices by using the table below. This table presents a breakdown of critical factors such as fees, spreads, and leverage so that you can compare options and make the best decision. STP: 0% commission + variable spreads STP: 1.6 pips RAZOR: Variable commissions + variable spreads Standard: 0.88 pips Choosing between the best forex brokers in South Africa can be tricky – there are so many factors to consider, such as whether to use a copy trading platform or opt for a broker with a more basic set of features. Regardless of your preferences, there are certain elements to assess before choosing your forex broker. With this in mind, the categories below highlight some of the most important things to research when choosing between the best South African forex brokers. The FCSA is the top-tier regulator in South Africa, so finding a broker that is regulated by them will stand you in good stead in the future. However, even if a broker isn’t protected by the FCSA specifically, as long as they are regulated by a top institution such as the FCA or ASIC, then that will ensure there is an element of credibility to the broker’s services. Another factor to consider is the broker’s fee structure. Most brokers will charge either a commission or a spread when trading – although some broker accounts will require both. A commission is usually either a flat fee or a percentage of your position size, whilst the spread is the difference between the buy and sell prices of a currency pair. Low spread forex brokers are ideal for active traders, as it ensures that users can conduct trades as cost-effectively as possible. Forex brokers with bonus offers will also try and draw people in by offering low fees for a certain period; however, it’s essential to think long-term and understand what you’ll be paying in the future. Finally, users should also consider non-trading fees such as withdrawal, deposit, and inactivity fees. The number of currency pairs available to trade is something to consider when choosing a broker. Most brokers will offer the major pairs such as EUR/USD, GBP/USD, and USD/JPY. These pairs are the most traded and offer the highest levels of liquidity – which means they tend to have the tightest spreads. Some brokers will also offer a selection of minors and exotics, which usually have much less liquidity and higher spreads. These pairs are often best left to experienced traders as they tend to move in different ways than other FX pairs. Tools such as customisable charts and alerts are elements that can enhance your trading effectiveness. Technical analysis is an integral part of FX trading, so analysing the charts in the same place that you place your trades can streamline the whole process. Some brokers will also offer valuable tools which can help take your trading to the next level. Capital.com provides a handy ‘Capital.com TV’ feature that breaks down current market events, ensuring you are updated with what’s going on in the economy. Demo accounts are also a helpful tool to look out for, as these can provide a risk-free experience for beginner traders. Many brokers will offer their own trading platform, available on the web, desktop, or mobile. Proprietary platforms like this will differ from broker to broker – some provide extensive feature sets, whilst others are more basic. It’s a good idea to check this out beforehand to ensure the broker you choose has a platform that suits your needs. A selection of forex brokers with ZAR accounts will also support MetaTrader 4 and MetaTrader 5 (MT4/MT5). These platforms are mega-popular with FX traders as they allow for ample customisation options – and even support automated trading tools. Usually, these brokers will link to your MT4/MT5 program, meaning you can trade through these platforms using the trading capital in your brokerage account. Forex brokers with ZAR accounts are ideal for South African traders, as they ensure that currency conversion fees are not a factor. However, many broker accounts will come with a set of ‘base currencies’ that users can deposit in – and if you make a deposit that isn’t in one of these currencies, then you’ll often be charged a fee to convert. Other account types to be aware of are those offered by STP brokers and ECN brokers. These accounts are ideal for traders who operate on the lower timeframes, such as day traders or scalpers, as the fast execution speeds ensure an optimised trading experience. Often, these accounts will offer lower spreads but will require a commission per trade and a larger minimum deposit. The final factor to consider is payments. Some forex brokers with bonus offers will offer an additional sum of money on top of your initial deposit. For example, Avatrade provides a 20% bonus on the deposit you make (minimum of $200). This is ideal for most traders as it provides additional trading capital to use, allowing for more significant profits. Payment methods are also essential to consider. Most brokers will accept credit/debit cards, bank transfers, and various e-wallets such as PayPal, Skrill, Neteller, and Giropay. This can vary from broker to broker, so it’s important to double-check this beforehand. Also, some brokers will charge a fee for depositing via credit card, which can rack up if you are using large amounts. Now that you have a comprehensive overview of the broker options available in South Africa, let’s take a look at the process of opening an account and beginning to trade. When it comes to forex trading in South Africa, our favoured broker choice is Capital.com. So, in this section, we’ll show you how to go about signing up and placing a trade with Capital.com – all in under ten minutes. Head to Capital.com’s homepage and click ‘Trade Now’. Enter a valid email address and choose a password to create your account. If you’d like, you can also complete this process on Capital.com’s handy smartphone app – one of the best forex apps available to traders. As Capital.com are protected by strict regulatory policies, new users must complete some KYC checks and verify their account before trading. Luckily, this process is super easy and can be completed online. Simply enter the required personal information and upload proof of ID (a copy of your driver’s license or passport) and proof of address (a bank statement or utility bill). Capital.com will then verify these documents, which usually only takes a few minutes. New Capital.com users can benefit from one of the lowest deposit thresholds in the industry, being able to deposit only $20 (287 ZAR)! In terms of deposit methods, Capital.com accept the following: Click into the search bar on the Capital.com trading platform and type the name of the pair you’d like to trade. For the purposes of this guide, we’ll be looking to trade EUR/USD. Once the pair appears in the search results, click ‘Buy’. An order box will now appear on the right side of the screen, similar to the one below. In this box, enter your position size and choose the amount of leverage you’d like to employ. Finally, double-check everything is correct and click ‘Place Trade’. And that’s it! You’ve just placed a commission-free trade with one of the best South African forex brokers – all in less than ten minutes! As this guide has shown, there’s a great selection of South African brokers available in the market today. By using this guide, you’ll have the best chance of partnering with a suitable and reliable broker, ensuring you can trade the forex market optimally. However, if you’re looking to get started trading right away, we’d recommend signing up with Capital.com. Capital.com are the top forex broker for South African traders as they are regulated by multiple top institutions, ensuring a safe trading environment for all users. What’s more, Capital.com allow trades to be placed with 0% commissions – and the minimum deposit for new users is only $20 (287 ZAR)! 72.6% of retail investor accounts lose money when trading CFDs with this provider.

2. Avatrade – Best Forex Broker in South Africa with MT4 support

3. Vantage FX – Best Forex Broker in South Africa for ECN accounts

4. Pepperstone – Best Forex Broker in South Africa with Low Fees

5. IG – Best Forex Broker in South Africa with User-Friendly Platform

Best Forex Brokers in South Africa Comparison

Pricing (Spreads/Commissions)

Average GBP/USD Spread

Deposit Fee

Withdrawal Fee

Max Leverage

Capital.com

0% commission + variable spreads

1 pip

None

None

30:1

Avatrade

0% commissions + variable spreads

1.6 pips

None

None

30:1

Vantage FX

ECN: ZERO spreads + Commission

ECN: ZERO

None

None

Up to 500:1

Pepperstone

Standard: 0% commissions + variable spreads

RAZOR: 0.28 pips

None

None

30:1

IG

0% commissions + variable spreads

1.4 pips

None

None

50:1

How to Choose the Right Forex Broker for You

Safety

Fees

Range of Assets

Trading Tools

Platforms

Account Types

Payments

How to Get Started with a South African Forex Broker

Step 1: Create a Capital.com Account

Step 2: Verify your Account

Step 3: Fund your Account

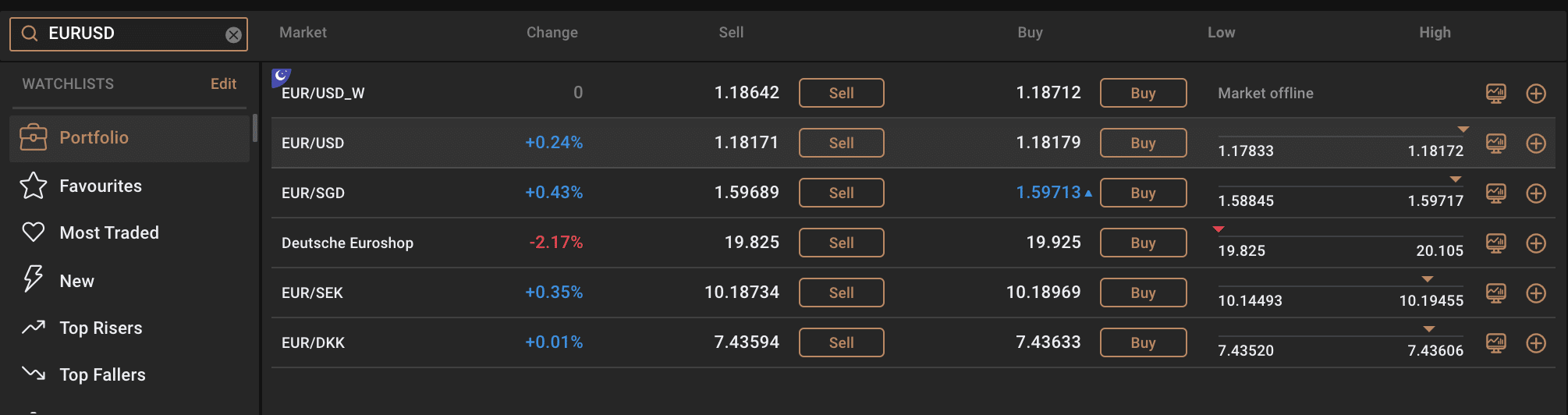

Step 4: Search for Currency Pair

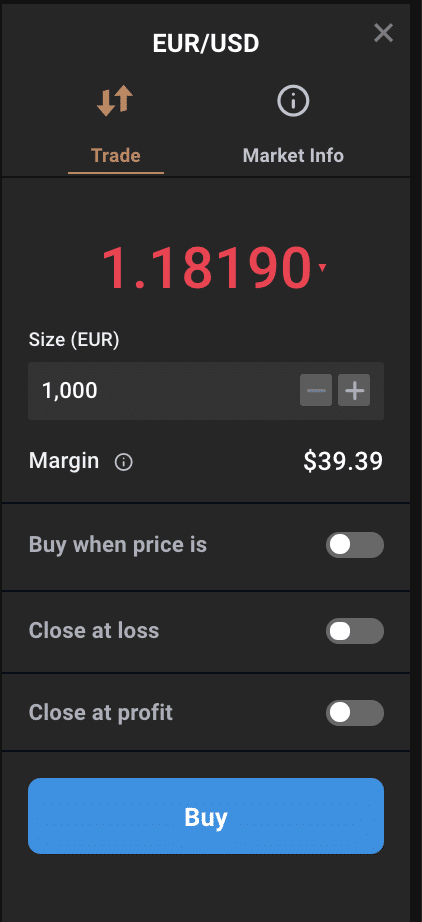

Step 5: Trade Forex

Best Forex Brokers South Africa 2021 – Conclusion

FAQs

What is a forex broker?

Which forex brokers accept South African clients?

How do forex brokers make money?

Which forex broker is the best for South African traders?

What is the spread in the forex broker?