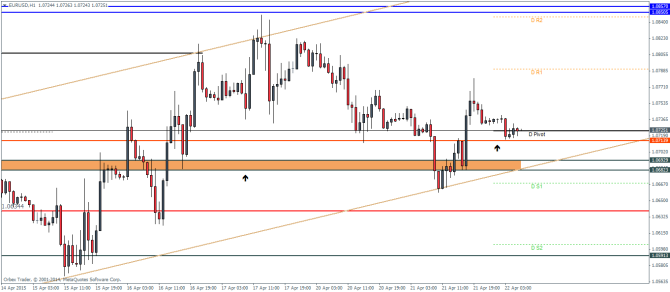

EURUSD Daily Pivots

| R3 | 1.0911 |

| R2 | 1.0841 |

| R1 | 1.079 |

| Pivot | 1.0724 |

| S1 | 1.0668 |

| S2 | 1.0603 |

| S3 | 1.0547 |

EURUSD saw a brief decline to the support level at 1.063 before managing to reverse its losses and thus establishing a successful test of the support. We expect to see another test to 1.0714 following which on a successful test should see the Euro rally higher with a confirmation of a break of the previous high at 1.075 levels. This would open up the way to test the next resistance near 1.085 region. To the downside, we expect the support at 1.0714 or even 1.063 to hold but if these support levels fail, price could look lower towards 1.0635 and 1.06 levels eventually.

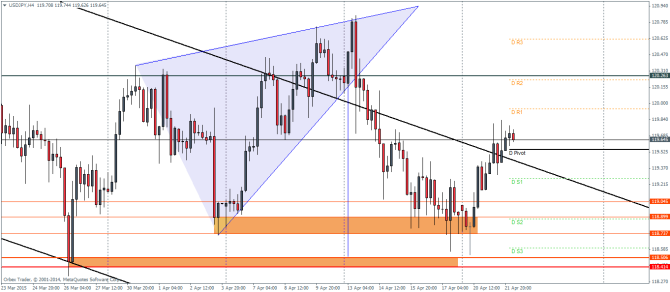

USDJPY Daily Pivots

| R3 | 120.619 |

| R2 | 120.224 |

| R1 | 119.943 |

| Pivot | 119.549 |

| S1 | 119.268 |

| S2 | 118.878 |

| S3 | 118.598 |

USDJPY has been pushing modestly higher and broke out from the falling price channel’s trend line. However the move has been very choppy and slow, indicating the move to the upside seeing a lot of resistance. Nonetheless, a dip down to the daily pivot level which coincides with the break out from the price channel will see USDJPY target 120.26. Alternatively, a break into the price channel will see a test back to 118.89 and eventually 118.5, the eventual minimum target of the breakdown from the rising wedge pattern.

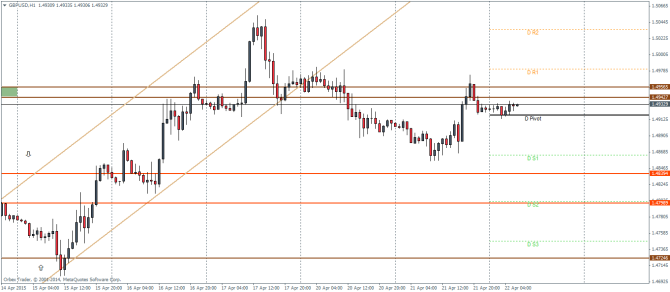

GBPUSD Daily Pivots

| R3 | 1.5097 |

| R2 | 1.5035 |

| R1 | 1.4980 |

| Pivot | 1.4918 |

| S1 | 1.4864 |

| S2 | 1.4802 |

| S3 | 1.4747 |

GBPUSD has tested the support/resistance level near 1.495 and could possibly look towards some short term declines. Support comes in at 1.483 and 1.48 levels and a break below this support will see a test down to 1.472. To the upside, if price breaks out of the current resistance level, we could perhaps see another leg up, to test the 1.50 levels. Only a break above the previous high will see a sustained upside rally in GBPUSD.