After the ECB hinted more QE and China cut rates, will Japan be the next to follow?

The team at BNP Paribas lays out 4 scenarios for USD/JPY in any case of BOJ action:

Here is their view, courtesy of eFXnews:

BNP Paribas economists’ base case expectation is that no further easing will be announced at the BoJ meeting on 30 October, due to the heightened cost of additional easing and less favourable cost-benefit analysis of further JPY depreciation (ie, the benefits to exporters are being increasingly offset by the costs to consumers).

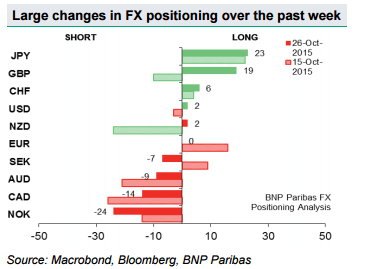

However, BNPP notes that the current FX market positioning suggests that positioning short JPY ahead of the BoJ is attractive.

“The JPY appears vulnerable heading into Friday’s BoJ meeting. Net positioning in the JPY stands out as the largest net long across G10 with a score of +23 according to BNPP Positioning Analysis. This represents the highest scores since mid-2011,” BNPP adds.

BNPP outlines 4 potential outcomes for USD/JPY from this week’s meeting.

“Scenario 1 – No change in policy, no details on how to fill JPY 10trn gap.

USDJPY implications: The pair moves lower, but only to a limited extent given FX positioning. Pair unlikely to break below support around 118.70.

Scenario 2 – IOER rate cut.

USDJPY implications: This would be considered a surprise to the market. Given FX positioning, we would expect a similar sized reaction as last October (ie, a 2-3% move higher to 123.00-124.00) with persistent JPY weakness over the following weeks.

Scenario 3 – Maintain the JPY80trn monetary base target, with an increase in ETF purchases filling the JPY 10trn.

USDJPY implications: This would not be considered an aggressive easing of policy, but the support for Japanese equities would likely support USDJPY given their close correlation. Moderate upside pressure for USDJPY over time, but immediate reaction is likely to be muted.

Scenario 4 – Increase gross JGB purchases and extend the maturity of purchases.

USDJPY implications: An increase by more than JPY10trn can be considered an aggressive easing of policy.USDJPY moves higher by 2-3% to 123.00-124.00),” BNPP clarifies.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.