With poor inflation data coming out of Japan, can we expect more stimulus from the Bank of Japan?

Or perhaps from the Japanese government? Here is outlook from Deutsche Bank:

Here is their view, courtesy of eFXnews:

Deutsche Bank remains constructive on USD/JPY but expects rising volatility as the trend matures.

“Although Japan’s basic balance has strengthened over the summer, we expect unhedged FDI outflows and pension buying to remain dominant supports for the cross. Exports, manufacturing and inflation look vulnerable to the deteriorating external backdrop, raising the odds of further monetary stimulus by January. The upcoming IPO of a large, state-owned bank is an extra incentive for renewing the ‘Abe put’,” DB projects.

BoJ could push Abe put.

“With the inflation rate stuck at zero, we consider further monetary policy easing increasingly likely. The BoJ may be at risk of placing too much hope on base effects and a narrowing output gap from rebounding growth in Q3. Contrary to BoJ forecasts, we expect the economy to have shrunk by 0.2% saar. Data taken since the onset of market turmoil in mid-August, such as the Eco Watchers Survey, point to deteriorating confidence in recent weeks. We believe the unwaveringly optimistic rhetoric of BoJ in the face of weakening data largely owes itself to the perceived sensitivity of inflation expectations to the official policy stance.1 A dovish policy shift could thus be precipitated by a decline in inflation expectations despite BoJ efforts at anchoring them,” DB argues.

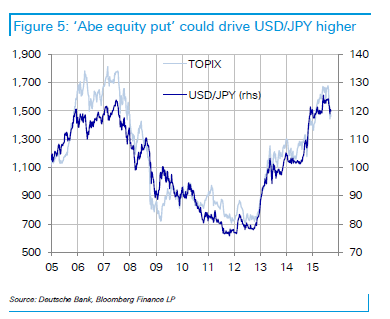

“Political pressure on the BoJ is likely to rise during the run-up to the IPO of a large, publicly owned bank in November. With three quarters of the shares hoped to be bought by domestic retail investors, the government has political incentives to facilitate a bullish equity backdrop. Abe’s popularity ratings have been closely linked to stock prices. Having spent considerable political capital on unpopular policies in national defense, nuclear energy, and free trade, Abe stands to gain from reviving the fledgling arrows of Abenomics. Public pensions could further accommodate Abenomics by using their flexibility around the benchmark weights for domestic equities. Fresh, largely hedged equity inflows could follow suit. A bullish turn in equities would thus help drive USD/JPY higher in line with the long-standing positive FX-equity relationship,” DB adds.

Buy USD/JPY.

In line with this view, DB recommends buying USD/JPY in anticipation of a move up to 125-128 by the end of the year and eventual peak around 130.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.