The Canadian dollar reached a new 11 year low last week, and the next event that could push the loonie lower is upcoming elections in Canada.

Here is the view from CIBC:

Here is their view, courtesy of eFXnews:

Governor Poloz would vote for a weaker C$, as the BoC continues to look towards non-energy exports to drive the economy, says CIBC World Markets.

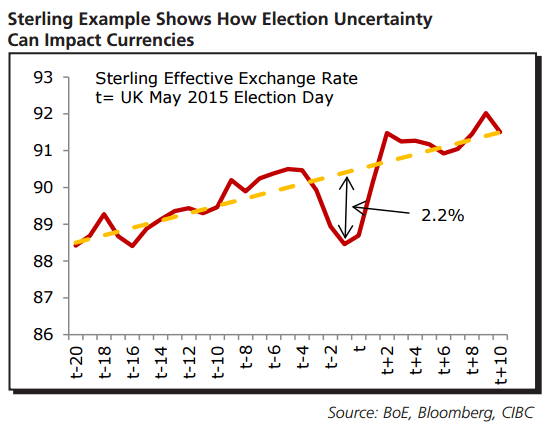

“Voters wouldn’t elect to have a weaker currency, however with no clear front-runner emerging as October 19th approaches that’s exactly what they may face. We only have to look across the pond to the UK to see how election uncertainty can impact a currency. The sterling effective exchange rate was more than 2% weaker than its underlying trend in the run-up to the UK elections, only to rebound when a clear winner emerged,” CIBC argues.

“The loonie could see a similar slide in the weeks to come. And if no clear winner emerges, could stay weaker than it otherwise would for a period of time afterwards,” CIBC projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.