Euro dollar is on high ground, breaking the critical line it lost last week. that was a huge success: over 489 billion euros. This is an indirect form of QE, which helps sovereigns by encouraging banks to buy sovereign debt. Will this operation provide a long term ssalvation? Or is it a move upwards before another fall? We have an interesting US figure today as well.

Here’s an update on technicals, fundamentals and what’s going on in the markets.

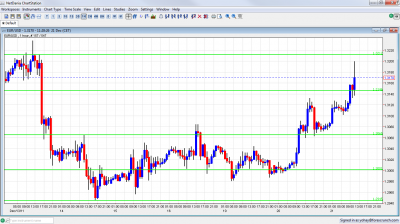

EUR/USD Technicals

- Asian session: A quiet session saw the pair securing the 1.3060 line it conquered earlier. A breakout attempt above 1.3145 was seen at the wake of the European session.

- Current range: 1.3060 to 1.3145.

- Further levels in both directions: Below 1.3060, 1.30, 1.2945, 1.2920, 1.2873 , 1.2720 and 1.2580.

- Above: 1.3145, 1.3212, 1.3280, 1.3380, 1.3420, 1.3480 and 1.3550.

- 1.2945 is the trough reached after 1.30 was lost, but the really important support is the YTD low of 1.2873.

- 1.3145 remains critical resistance now after 1.3060 is reconquered.

Euro/Dollar looking to reconquer lost ground- click on the graph to enlarge.

EUR/USD Fundamentals

- 7:00 German Import Prices. Exp. +0.6%. Actual +0.4%.

- 9:00 Italian GDP. Exp. 0%. Actual -0.2%. The Italians had something to hide.

- 10:20 – Expected results of ECB LTRO.

- 14:00 Belgian NBB Business Climate. Exp. -11.8 points.

- 15:00 US Existing Home Sales. Exp. 5.04 million.

- 15:00 Euro-zone consumer confidence. Exp. -21 points.

* All times are GMT.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- ECB Indirect QE: The European Central Bank conducted a massive 3 year financing operation (LTRO). Banks can pledge collateral, including of low grade and get financing. This could explain the huge success of Spain’s bond auction. Indirectly, the ECB encourages banks to buy sovereign bonds, and gives them a nice arbitrage. Consensus stood on around 300 billion, while the actual result was above 489 billion euros.

- Greek talks stuck: Greece’s bondholders are struggling to reach an agreement about the “voluntary” debt restructuring. The parties aren’t getting close. And, the pace of withdrawals from Greek banks intensified recently, as the chances of leaving the euro-zone rose. This Greek bank run could bring down the system.

- Trade volume dropping: Christmas is just around the corner and volumes are lower, so it’s important to be cautious.

- IMF Loan in Trouble: One of the EU Summit decisions was to provide loans to the International Monetary Fund of around 200 billion euros in total. There is objection from some countries, within the euro-zone and outside of it, and also a major flaw: Italy is expected to contribute to the IMF, and then receive some aid from it.

- France downgraded awaited Standard and Poor’s warned all euro-zone countries, apart from Greece, that their rating is endangered. France, Italy, Spain and others received a two-notch warning. The rating agency promised an answer within days and official talk from Paris begins preparing the public for a downgrade, saying “it’s not the end of the world” and similar comments. If France loses the AAA rating, so does the EFSF bailout fund. Moody’s and Fitch also added their warnings.

- US – Initial housing data positive :Building approvals and housing starts exceeded expectations. The real test now is existing home sales, which better reflect the real estate market.