Euro dollar is ticking up, but with great hesitation, as creative solutions are awaited from Europe towards the European summit. The leaders seem determined to work out a solution, but yet again, details are missing. Will the ECB use its firepower? Italian and Spanish yields continue falling, and this helps the euro as well.

Here’s a quick update on technicals, fundamentals and what’s going on in the markets.

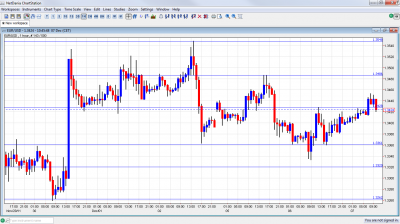

EUR/USD Technicals

- Asian session: The pair climbed up in a quiet session and eventually crossed the 1.3420 line.

- Current range: 1.3420 – 1.3480

- Further levels in both directions: Below 1.3420, 1.3360, 1.3320, 1.3250, 1.3145. 1.30 and 1.2873.

- Above: 1.3480, 1.3550, 1.3650, 1.3725 and 1.38.

- 1.3360 is weakening after a first attempt to break lower. 1.3250 is the next critical line.

- 1.3550 is strong support above, after 1.3420 was breached.

Euro/Dollar leaning lower- click on the graph to enlarge.

EUR/USD Fundamentals

- 7:45 French Trade Balance. Exp. 5.9 billion. Actual -6.2 billion.

- 11:00 German Industrial Production. Exp. +0.3%. Yesterday’s factory orders were great. Will we see another positive surprise? Indeed, it rose by 0.8%.

- 13:30 US FOMC member Sarah Bloom Raskin talks.

- 20:00 US Consumer Credit. Exp. 7 billion.

* All times are GMT.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Merkel and Sarkozy details awaited: The leaders of France of Germany announced an agreement for tighter budget rules. The announcement lacked details, especially on utilizing the ECB and also on the situation in Italy. This agreement will be handed to EU President Herman Van Rompuy today. Details about using both bailout mechanisms, the EFSF and the ESM will be discussed.

- ECB Closer to QE?: A report that surfaced over the weekend discusses conditions under which the European Central Bank will provide (or print) a giant sum of one trillion euros, to lower the yields of Spain and Italy, allowing them sustainable funding. Stronger budget rules and strict enforcement are discussed. This can be the ultimate weapon to fight the debt crisis, but may weaken the euro as well. In the meantime, Italian and Spanish yields continue falling, and this certainly provides relief for the euro. Tomorrow, the ECB is expected to cut the interest rate once again. In the meantime, European banks are leaning very heavily on the ECB for loans in dollars.

- Greeks withdraw money: The pace of withdrawals from Greek banks intensified recently, as the chances of leaving the euro-zone rose. This Greek bank run could bring down the system.

- Everyone is warned: In a move that shocked markets, credit rating agency Standard and Poor’s warned all euro-zone countries, apart from Greece, that their rating is endangered. Some countries, such as Germany, got a warning about a one-notch downgrade, while France, Italy, Spain and others received a two-notch warning. The decision on a downgrade depends on the result of the summit on Friday. The move certainly looks as a political move to put pressure on the leaders before the summit.

- Italian plan convincing markets, not unions: Italy’s Prime Minister, Mario Monti, presented a plan to balance Italy and reassure markets. Success of these measures as Europe enters a recession is doubted, as well as the ability to pass everything through parliament. The new taxes aren’t popular with unions, who plan a strike, and not with Berlusconi’s party.

- Asia Pacific region slowing : Australia enjoyed strong GDP growth of 1% in Q3, as expected. But the future doesn’t look too good. Australia cut its interest rate once again, to 4.25%. This reflects the worries for the global economy. In China, official and independent manufacturing and services PMIs are moving lower. The commerce minister warned about problems with the export sector in 2012. China reversed previous hikes and lowered the reserve ratio rate, allowing banks to lend more. This time, China will not be able to pull the global economy forward.

- Not all US figures are positive: In recent weeks, most US figures have been positive. This is also reflected in the all-important job data. The US continues to gain jobs at a nice pace, with the unemployment rate falling to 8.6%. On the other hand, the services PMI dropped and also factory orders fell. This is somewhat disappointing, although US PMIs still reflect growth.