Euro dollar continues sliding lower after hitting high resistance yesterday. The relatively weak Chinese GDP weighs on the common currency, as global demand is essential for European growth. A busy day in the US closes the week, including QE3 related inflation figures and a speech by Ben Bernanke just before markets unwind. Will Bernanke hurt the dollar on Friday the 13th?

Update: EUR/USD breaks lower below support. Here’s an update on technicals, fundamentals and what’s going on in the markets.

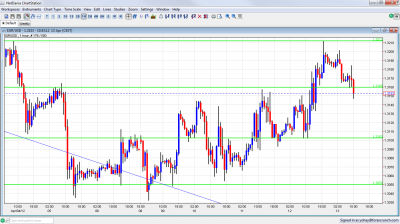

EUR/USD Technicals

- Asian session: The pair continued falling, finding support at 1.3160 but challenging the line in the European session.

- Current range: 1.3160 to 1.3212.

- Further levels in both directions: Below: 1.3160, 1.31, 1.3050, .1.30, 1.2945, 1.2873, 1.2760, 1.2660 and 1.2623.

- Above: 1.3212, 1.33, 1.3360, 1.3437, 1.3486, 1.3550 and 1.3615.

- 1.3212 worked well as the upper border for the pair once again.

- 1.3050 is the first frontier before the round and strong figure of 1.30.

Euro/Dollar sliding from high resistance to support – click on the graph to enlarge.

EUR/USD Fundamentals

- 6:00 German Final CPI. Exp. +0.3%. Actual +0.3%.

- 12:00 US FOMC Member William Dudley speaks.

- 12:30 US CPI. Exp. +0.2%. Core CPI. Exp. +0.2%.

- 13:55 US UoM Consumer Sentiment. Exp. 76.4 points. See how to trade this event with EUR/USD.

- 17:00 US Federal Reserve Chairman Ben Bernanke speaks.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Chinese Growth Slows: The economic giant reported a growth rate of only 8.1% in Q1. This disappointed markets that thought growth would stand at 8.4% or even higher. The upside is that the slowdown in growth is slow and not a crash. In any case, the official Chinese numbers are always questioned. Europe needs strong Chinese demand for its growth. Currently Europe is in recession.

- ECB to help Spain?: Europe’s fourth largest economy is still struggling to find a way to cut its deficit while enabling some growth. In the meantime, Spain and Italy are exchanging not-so-nice comments. The ECB stepped up its rhetoric against the high yields and hinted that it might intervene using its SMP program. This hasn’t been used so far. Spanish banks borrowed over 300 billion euros from the ECB in March, much higher than in February. The danger of a credit crunch is still here.

- More Worrying US Employment Numbers: Weekly jobless claims rose to 380K and triggered worries. This is the first release after the disappointing Non-Farm Payrolls released on Friday, that showed only a small gain of 120K. Is the economy cooling down again, or is it only temporary? Here are 5 reasons why this may be temporary.

- QE3 battle leans towards hawks: Many FOMC members have spoken up about the situation of the economy and future monetary policy. Some support more accommodation while others oppose it. Even within the supporters, it seems that the bar still remains high for more action. Nevertheless, Bernanke can still provide dovish hints and hurt the dollar. Note that QE2 certainly helped the Federal government’s debt raising in 2011.

- Asia still strong: Recent data confirms stronger growth in the Asian markets. Unemployment has dropped in Australia and South Korea, and exports jumped 15% in Malaysia and the Philippines. The mood in the Far East is bright, in sharp contrast to the pessimism engulfing Europe.