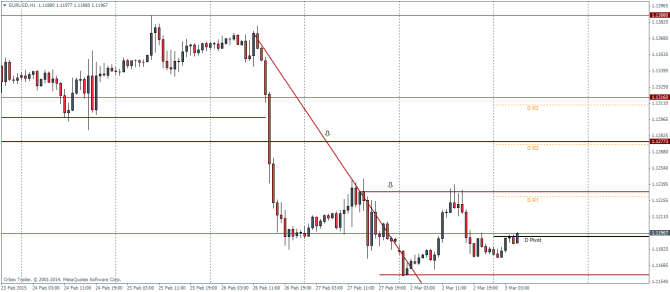

EURUSD Daily Pivots

| R3 | 1.1309 |

| R2 | 1.1274 |

| R1 | 1.1228 |

| Pivot | 1.1194 |

| S1 | 1.1148 |

| S2 | 1.1113 |

| S3 | 1.1067 |

EURUSD rallied to reach its target of 1.1233 as noted yesterday after breaking out from the short term falling trend line. The pair quickly bounced off this level but managed to hold its declines above the previous low indicating that further upside gains could be in store if price manages to form a base near the daily pivot levels and a break out above 1.1233 is successful. The next upside target in EURUSD would come in at 1.1277 levels, while any declines to the downside will see a dip to the support at 1.116.

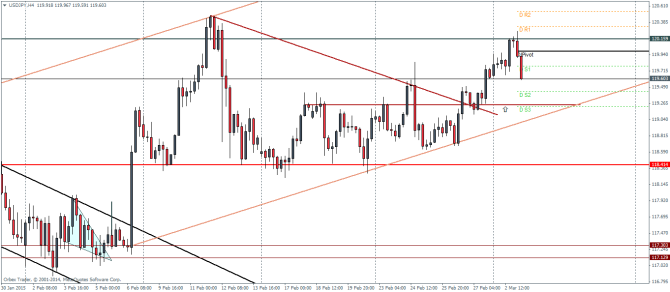

USDJPY Daily Pivots

| R3 | 120.88 |

| R2 | 120.54 |

| R1 | 120.328 |

| Pivot | 119.98 |

| S1 | 119.776 |

| S2 | 119.429 |

| S3 | 119.225 |

USDJPY broke out from the smaller term trend line and managed to rally towards 120.16 levels. Current price action shows a dip to the downside and we expect this short term decline to hold above 119.25 levels, supported both by a short term support level and the major rising price channel’s support line. A retest back to 120.16 cannot be ruled out and a break above this level will see USDJPY aim for 120.8 levels.

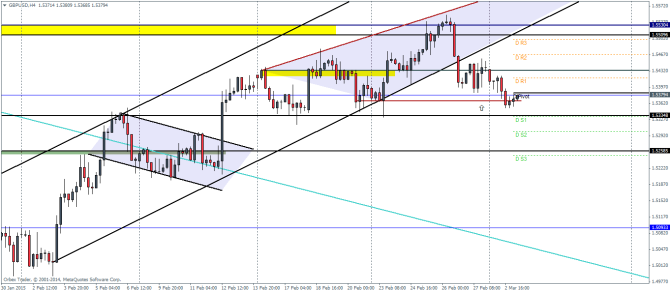

GBPUSD Daily Pivots

| R3 | 1.5499 |

| R2 | 1.5467 |

| R1 | 1.5416 |

| Pivot | 1.5383 |

| S1 | 1.5332 |

| S2 | 1.5300 |

| S3 | 1.5248 |

GBPUSD managed to drop to the lower support at 1.536 after the break out from the ascending triangle. With the objective met, GBPUSD could be looking for a move in any direction. Upside gains will be limited to 1.543 and only a break higher above this level will see another test to 1.553. To the downside, a break below 1.5334 will see a retest lower to 1.5258.