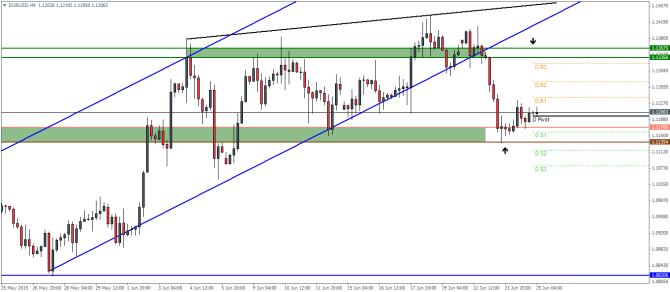

EURUSD Daily Pivots

| R3 | 1.132 |

| R2 | 1.1277 |

| R1 | 1.124 |

| Pivot | 1.1196 |

| S1 | 1.1158 |

| S2 | 1.1115 |

| S3 | 1.1078 |

EURUSD (1.120): EURUSD recovered some of its losses from earlier this week with yesterday’s candlestick closing on a modestly bullish close. On the intraday charts, the bounce is supported by the support zone near 1.117 through 1.1135. The rising wedge pattern indicates a test to 1.0985 on break of the support level at 1.1135. We can however expect a bit of a rally in the short term either back to the broken resistance at 1.1335 or closer before the next leg in the decline sets in. A break below 1.0985 will see EURUSD test the next support at 1.082.

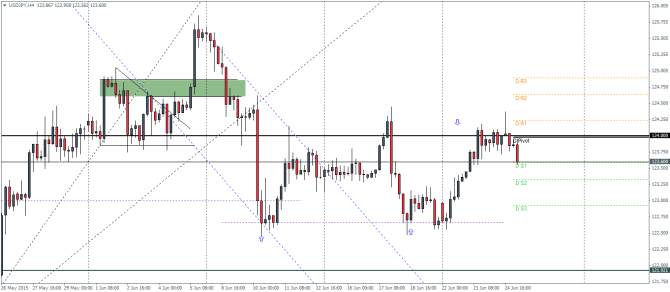

USDJPY Daily Pivots

| R3 | 124.894 |

| R2 | 124.636 |

| R1 | 124.241 |

| Pivot | 123.976 |

| S1 | 123.589 |

| S2 | 123.323 |

| S3 | 122.929 |

USDJPY (123.59): USDJPY closed yesterday in a potential shooting star pattern which could be confirmed if we see a bearish close today. On the H4 charts, we notice that at 124 support/resistance level there was a strong shooting star pattern indicating potential weakness to the downside. If the bearish momentum continues, USDJPY could dip lower back to the double bottom base at 122.66. A break below this level could see USDJPY test 121.92 – 122 level of support.

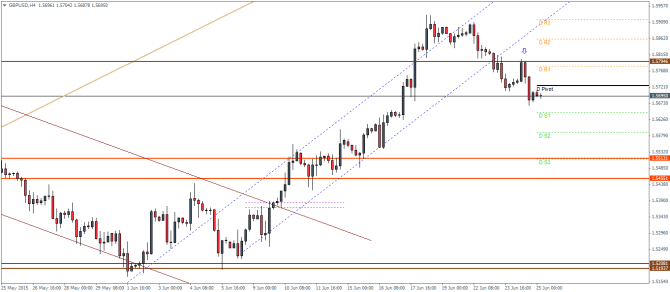

GBPUSD Daily Pivots

| R3 | 1.5917 |

| R2 | 1.586 |

| R1 | 1.5781 |

| Pivot | 1.5724 |

| S1 | 1.5647 |

| S2 | 1.5588 |

| S3 | 1.5511 |

GBPUSD (1.569): GBPUSD looks to continue with its weakness after a break of 1.57525 level of support. The declines could now see a test to 1.552 level. On the H4 charts, we notice that price made a quick retest to 1.58 level of break out from the rising price channel and the Cable looks poised for a test to 1.5513 through 1.5455 level of support. We could expect to see some kind of bounce from the support level. Failure to hold prices could see GBPUSD turn very bearish with a further decline to the next support at 1.52.