Euro/dollar is now recovering from the lows it fell into, as some hope for a forming a government is emerging in Greece. A moderate left wing party is now shifting towards a compromise with the pro-bailout parties. Worries about Spain’s banking issues and lower growth forecasts weigh on the euro. With a relatively light calendar, news from Europe will set the tone for the close, in a bad week for the common currency.

Update: Government hopes in Greece are now lower again as Kouvelis (Democratic Left) says he won’t participate in a unity government. The euro doesn’t budge.

Here’s an update on technicals, fundamentals and what’s going on in the markets.

EUR/USD Technicals

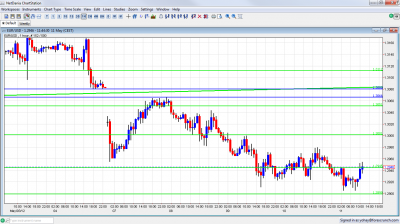

- Asian session: EUR/USD fell towards 1.29 on the JPMorgan news, and recovered back to the 1.2945 battle line in the European session.

- Current range: 1.2945 to 1.30.

- Further levels in both directions: Below: 1.29, 1.2873, 1.2760, 1.2660 and 1.2623.

- Above: 1.3050, 1.3110, 1.3165, 1.3212, 1.33, 1.34, 1.3437, 1.3486, 1.3550 and 1.3615.

- The gap was never closed and this is a bearish sign.

- 1.2945 is now a pivotal battle line.

- 1.2873 is the next support level if 1.29 is broken.

Euro/Dollar enjoying a small relief – click on the graph to enlarge.

EUR/USD Fundamentals

- 6:00 German Final CPI. Exp. +0.1%. Actual +0.2%.

- 12:30 US PPI. Exp. 0%. Core PPI exp. +0.2%.

- 13:55 US Consumer Sentiment. Exp. 76.4 points.

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- Hope for a government in Greece: After it seemed certain that Greece was heading to a second round of elections, the Democratic Left party which is against austerity but is pro-European, got closer to the mainstream PASOK and ND parties regarding forming a unity government that would renegotiate the bailout terms. How this would be done seems unclear. This isn’t exactly what voters wanted Alexis Tsipras, leader of SYRIZA, declared the country’s commitment to the international rescue deal was null and void. In recent polls, his party gains more support, suggesting a rise from the second to the first place, if elections are held in June. There is a growing chance that Greece will exit the euro in 2012, in any political constellation.

- JPMorgan mess: The large US bank reported a loss of $2 billion on derivatives. When banks continue acting like hedge funds, the implications are felt everywhere. The news sent safe haven flows to the dollar and away from risk currencies. The effect will likely be limited.

- Spain going Irish?: Spanish financial institutions and the autonomous regions are shut out of money markets. The credit crunch is pushing Spain’s government to nationalize banks, starting with BFA and Bankia (45% nationalized). Plans for a bad bank, something that PM Rajoy refused earlier, are now hastily put up. Ireland took over the banks and turned their debt into a national debt that ended in a bailout. Spain can follow Ireland or choose the Icelandic path. Rajoy’s austerity measures and transfers to banks are a toxic mix for Spaniards, which will protest on Saturday, May 12th.

- Merkollande’s first test: Francois Hollande will soon enter the Elysee palace in Paris and will soon fly to Berlin. German chancellor Angela Merkel and the new French president will also have to get along in the G8 summit. While Hollande wants to renegotiate the fiscal compact against Germany’s will, it seems that the too leaders will find some common ground. The predictions that EUR/USD could eventually plummet to 1.20 due to Greece and Spain, but not on France alone.

- US Economy Muddling Through: The data form the US continues to be mixed. The good news is that jobless claims are back to previous levels in the very sensitive job market. The drop in oil prices could help the economy if it is sustained. US indicators play second fiddle to European events so far.

- Recession deepening in Europe: The European commission left the contraction forecast unchanged at 0.3%. But the details make a difference: Germany is expected to grow by 0.7% (up from 0.6%) while Spain is expected to squeeze by 1.8%, much worse than the previous estimate of 1%.

- QE3 Move by Fed Unlikely: Fed Chairman Bernanke didn’t rule out :balance sheet measures” (QE3), and keeps declaring that “all options remain on the table”. As time passes by, however, QE seems quite unlikely. A “hands off” policy of low interest rates for the foreseeable future may not make for dramatic moves in market, but it is supportive for the greenback.