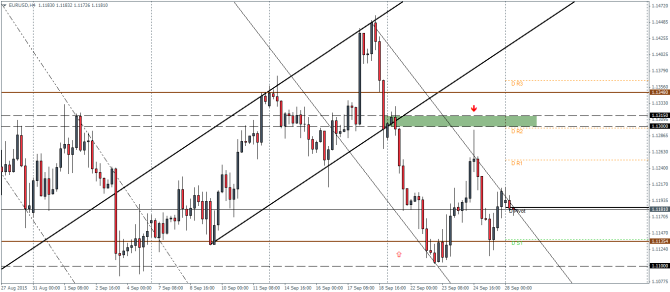

EURUSD Daily Pivots

| R3 | 1.1365 |

| R2 | 1.1297 |

| R1 | 1.1251 |

| Pivot | 1.1183 |

| S1 | 1.1137 |

| S2 | 1.1069 |

| S3 | 1.1024 |

EURUSD (1.11): EURUSD’s decline has been swift and plotted by the new falling price channel. Price is currently trading near the upper range of the falling price channel and we could anticipate a potential break out to the upside. Support comes in at the previously identified level of 1.1135 followed by a dip to 1.11 region. To the upside, there is a pending resistance level at 1.1315 – 1.13 region that could be tested in the near term on breakout of the falling price channel.

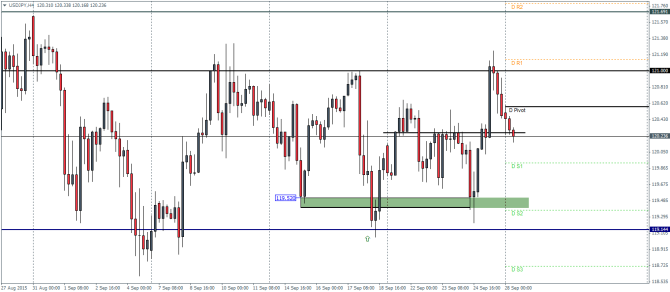

USDJPY Daily Pivots

| R3 | 122.344 |

| R2 | 121.787 |

| R1 | 121.131 |

| Pivot | 120.579 |

| S1 | 119.932 |

| S2 | 119.371 |

| S3 | 118.716 |

USDJPY (120): USDJPY remains range bound after Friday’s attempt to break above 121 failed. Price action has seen a sharp decline off these levels with a test back to the 120.27 level of support/resistance. A close below this could see another decline back to the 119.5 region of support, while if prices manage to hold above 120.27, we could expect another attempt to break the 121 level of resistance. Price action remains range bound on the daily charts and we could expect this to continue in the near term.

GBPUSD Daily Pivots

| R3 | 1.5388 |

| R2 | 1.5324 |

| R1 | 1.5265 |

| Pivot | 1.52 |

| S1 | 1.5141 |

| S2 | 1.5077 |

| S3 | 1.5017 |

GBPUSD (1.51): GBPUSD continues to remain weak after Friday’s bearish close came after the previous day’s doji candlestick pattern. Support comes in at 1.5121 – 1.509 region in the medium term. On the intraday charts, GBPUSD is trading near the short term support of 1.5178 and if this level holds we could expect to see a retest back to 1.5343 level of support/resistance that could be retested for resistance. Alternatively, a break below 1.5178 could see GBPUSD decline sharply to the main support at 1.5121/1.509.