The British pound has suffered 9 consecutive days of falls against the dollar and it’s hard to find a good reason for that.

The team at Credit Suisse stays bullish and lays out the risks for GBP/USD and EUR/GBP:

Here is their view, courtesy of eFXnews:

Credit Suisse remains medium-term bullish on GBP, but notes that the scale of the recent Sterling underperformance has led them to tone-down their forecasts.

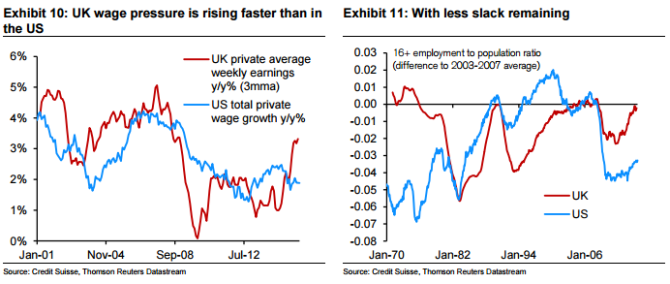

“The BoE repricing, particularly compared to the FED, looks overdone. We expect GBP to gain as this pricing differential is corrected and other major G10 central banks deliver additional stimulus.

However, there are several risks, particularly from the global backdrop, which could weigh on GBP. GBP vulnerability to a severe global risk-off cannot be dismissed,” CS argues.

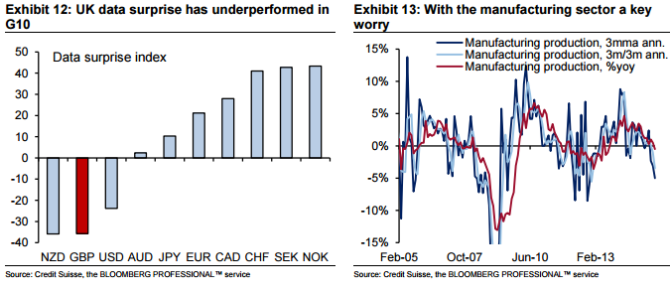

Risk 1: Growth worries can intensify. “UK surprise index is now almost the lowest in G10 (only narrowly behind New Zealand’s). It is the manufacturing sector, which appears fairly weak, with soft EM growth and sterling strength likely introducing significant challenges for the sector. For now, we are inclined to downplay this factor,” CS clarifies.

Risk 2: GBP remains structurally exposed to a severe risk-off. “We have on several occasions highlighted Sterling’s underlying vulnerability to a severe risk off environment if it were to be associated with a set-back to global financial flows and some deleveraging pressure (see here for a more detailed discussion),” CS notes.

Risk 3: EU Referendum. “Finally, we continue to believe that the EU Referendum poses significant risks to the economy as well as the currency – for instance, through likely a negative impact on FDI inflows,” CS adds.

New Forecasts:

CS now expects EURGBP at 0.71 and GBPUSD at 1.55 in three months (vs. 0.69 and 1.59 previously).

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.