The Canadian dollar managed to recover quite nicely from the 11 year low against the US dollar, and it now faces a new test: the BOC decision.

The team CIBC analyze the pair:

Here is their view, courtesy of eFXnews:

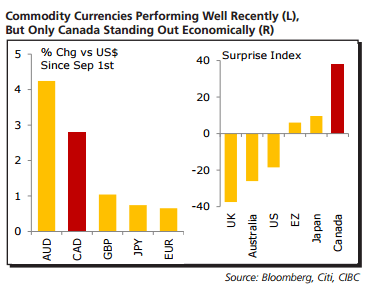

Since September 1st, oil prices have been fairly stable between $45-50 bbl, but it’s commodity currencies such as the Aussie, Kiwi and Canadian dollars that have performed best during a period of broad USD weakness, notes CIBC World Markets.

“But should the loonie have been doing even better? Despite much better domestic economic data, the C$ has gained less during the past 6 weeks or so than the A$. That could be because of uncertainty regarding the upcoming election, or because of concern regarding Canada’s exposure to a slowing US,” CIBC argues.

“Either way, we like buying the C$ against the Aussie, even if both lose ground again against the greenback once the Fed initiates the first hike,” CIBC advises.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.