- There is a high chance that Japanese authorities intervened again to support the yen.

- Powell maintained that the Fed was still looking to cut interest rates.

- The gap in long-term government bond yields between Japan and the US is 376 basis points.

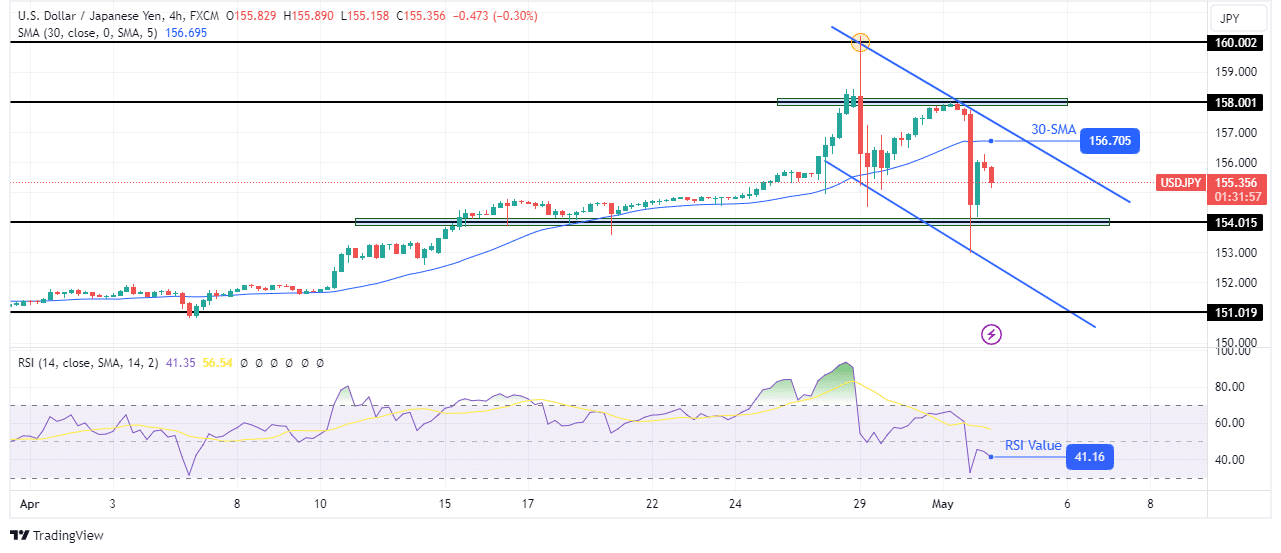

The USD/JPY forecast indicates a bearish trend as the yen gains ground following speculation of another Bank of Japan intervention. Meanwhile, the dollar weakened as Fed Chair Powell’s tone was less hawkish than anticipated.

–Are you interested to learn more about crypto signals? Check our detailed guide-

The yen had another sharp increase on Wednesday night, leading to a significant decline in the USD/JPY pair. There is a high chance that Japanese authorities intervened again to support their currency. However, they refused to comment on this.

Furthermore, the BoJ intervention had a more significant impact since it came when the dollar was weak. Notably, the Fed maintained rates and signaled a delay in rate cuts due to the recent higher-than-expected inflation figures. However, Powell maintained that the central bank was still looking to cut interest rates. This eliminated any fears in the market that the central bank would indicate possible rate hikes.

However, despite the recent strength in the yen, fundamentals still point to future declines. Notably, the gap in long-term government bond yields between Japan and the US is 376 basis points. As long as this gap remains wide, there will always be a reason to sell the yen and buy the dollar. However, the Bank of Japan is now focused on $160.00 as its line in the sand, making it a strong resistance.

Meanwhile, mixed reports from the US showed a bigger-than-expected increase in employment and a drop in job vacancies. Investors are now waiting for Friday’s NFP report.

USD/JPY key events today

- US unemployment claims

USD/JPY technical forecast: Bears take control after a surge in momentum

On the technical side, the USD/JPY price has broken below the 30-SMA, indicating a shift in sentiment to bearish. The first indication of bearish strength came when the price made a bearish engulfing candle at the 160.00 key level.

–Are you interested to learn more about forex robots? Check our detailed guide-

The decline paused at the 30-SMA, where bulls attempted to resume the uptrend. However, they found resistance at the 158.00 key level. This resistance allowed bears to breach the 30-SMA support barrier and retest the 154.01 support level. With this new sentiment, the price trades in a bearish channel. Therefore, the decline will likely continue with the next target at 151.01.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.