USD/CHF was up 140 pips this week, as the US dollar continued to rally. The dollar reached close to the 0.96 level, and ended the week at 0.9536. There are only two releases in the upcoming week. Here is an outlook for the Swiss events, and an updated technical analysis for USD/CHF.

The dollar continues to take advantage of stronger US economic data and the lingering debt crisis in Europe. With the Swiss economy heading towards a recession, traders are favoring the greenback over the European currencies.

Updates: Swiss retail sales were a positive surprise. The rise of 1.8% more than exceeded expectations and pushed USD/CHF lower, after a high start to the week. The Swiss franc strengthened after the immediate resignation of Hildebrand, but then returned to normal. It is trading around 0.9550 following the stark warning of Fitch about the euro-zone.

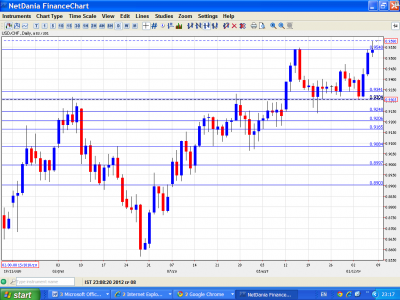

USD/CHF daily graph with support and resistance lines on it. Click to enlarge:

- Unemployment Rate: Monday, 06:45. This important indicator tends to show very little change from month to month, with readings usually of about 3%. A consistently low unemployment figure is an important contributor to the overall stability and health of the Swiss economy.

- Retail Sales: Monday, 08:15. This indicator has been in negative territory for the past three readings, each time well below the market forecast. This month’s prediction calls for the indicator to climb up to 0.6%. Will the indicator reverse the trend and climb into positive territory?

USD/CHF Technical Analysis

Dollar/Swiss showed strong pressure on the franc this week. The pair opened the week at 0.9394, dipping slightly to a low of 0.9304. It then climbed all the way to 0.9579, breaking the resistance level of 0.9540 (discussed last week). The pair closed at 0.9536, as the dollar continues to shine.

Technical lines from top to bottom:

We begin with the lines of parity and 0.9915, both of which are strong resistance levels which have not been tested since the end of 2010. These are followed by the resistance level of 0.9780, which was last tested by the pair in February. Next is a resistance line at 0.9636, followed by 0.9540, which was breached this week by the surging dollar. Next, 0.9340 is now providing support to the pair, followed by a strong support level at the round number of 0.9300. Below, 0.9250 is a strong support level. 0.9205 is an important support line, followed by 0.9165, which was severely tested in December 2011.

0.9085, which was a strong support level in mid-October, is once again providing support for the pair. The round number of 0.90 is the next important support level. The final line for now is 0.89, which acted as strong resistance in mid- 2011 and is now a major support level.

I am bullish on USD/CHF.

The US economy appears to be improving, and the dollar has looked sharp against most major currencies. The Swiss economy appears headed towards a recession in 2012, and the lingering debt crisis in Europe is continuing to weigh on the Swiss franc.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar.