The NZD/USD outlook is now bullish in the short term as it found traction during the New York Session on Friday. Although the price started the week on a positive note, it failed to maintain the bullish tone near a key level of 0.7100. The price closed the week near 0.7000 on most CFD brokers platforms.

The NZD/USD pair remained under selling pressure in the whole week as the Greenback got strength amid rising cases of Delta virus across Europe and Asia. However, the safe-haven appeal of the US Dollar keeps it underpinned.

However, this week’s Fed’s meeting minutes could not surprise the market, and we found no clear pattern. Fed’s members reiterated cutting bond purchases earlier. But, at the same time, they found out a slower economic recovery that could halt their tightening policy.

On the other hand, the rise in jobless claims figures weighed on the US Dollar, and it entered a bearish corrective mode across the board. Moreover, rising US Treasuries yields paused their way and started dropping from their peaks. The fall of yields on Friday gave a breather to the Kiwi and other peers. However, the relief rally may find it hard to extend the momentum next week.

The next week comes with some important economic releases, including US Core CPI, Retail Sales and New Zealand’s cash rate and RBNZ’s statement. We expect not much volatility from US Core CPI even as it seems like the market has already priced in the impact of higher inflation. However, the RBNZ statement and US Retail Sales can provide fresh impetus to the pair.

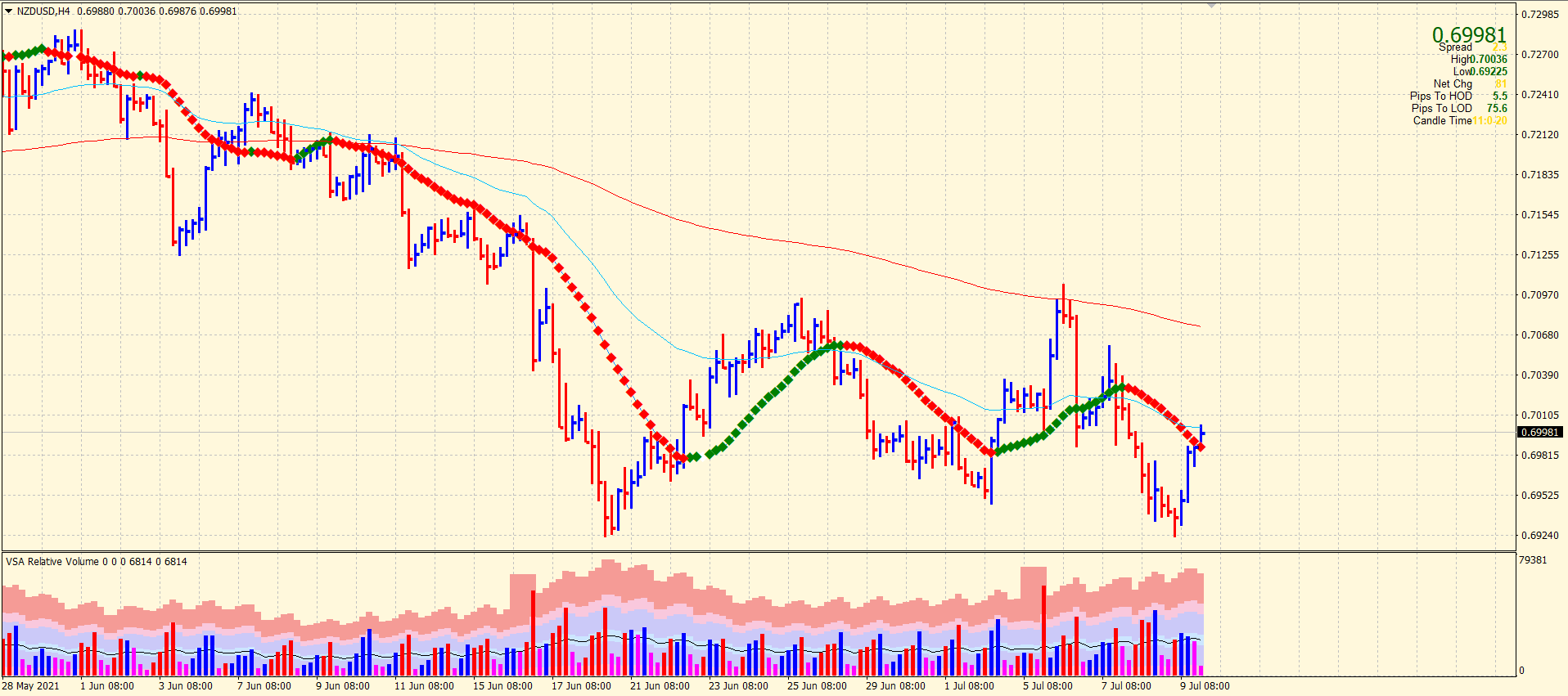

NZD/USD technical outlook: Bearish volume to stay intact

The NZD/USD pair found a rejection near 0.7100 level this week. The 200-SMA on the 4-hour chart lies in the same region. It has formed a double bottom around 0.6920 (previous swing area of 17 June). The rise from the double bottom is now near the congestion of 20 and 50 moving averages. This could be a strong rejection zone for the pair as well. Moreover, the volume of the pullback wave is not supportive as it remained low with a declining mode. Most forex signals have appeared with a selling bias.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.