The Swiss franc climbed against the dollar at the start of last week, but then gave up those gains. The upcoming week has two important indicators, as well as more news from the Euro Zone, which is completely focused on the Greek debt crisis. Here is an outlook for the Swiss events, and an updated technical analysis for USD/CHF.

The Swiss economic indicator dropped for the sixth consecutive month in October, signalling a deepening economic slowdown. Exports have taken a hit due to the surging Swiss franc, which has gained 12% in the past year against the Euro.

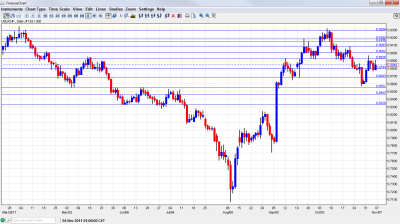

USD/CHF daily graph with support and resistance lines on it. Click to enlarge:

- CPI: Monday, 8:15. For the third consecutive month, the CPI index has been on the rise. CPI was up 0.3%, exceeding the forecast of 0%. gain. A small rise is expected in this month’s release. A low CPI could trigger the SNB to act.

- SECO Consumer Climate: Tuesday, 6:45. According to SECO, there is deep pessimism among surveyed households about the economy. The previous reading came in at -17, well below the forecast of -7. The indicator is expected to rise, but remain in negative territory.

* All times are GMT.

USD/CHF Technical Analysis

Dollar/Swiss dropped to as low as .8608, and then rebounded sharply, reaching a brief high of .8960. However, .8930 served as strong resistance in October (discussed last week). The pair closed the week at .8846.

Technical lines from top to bottom:

0.9295 capped the pair in March and earlier worked as support. Although it was run through, the pair didn’t manage to conquer it, so it prevails. The peak of 0.9182 reached in September is the next line. It also worked as support in February and March and is strong.

It is closely followed by 0.9145, which provided support at the beginning of October. The more recent cap of 0.9085 is another minor line of resistance. The round number of 0.90 is an important line. It capped the pair on a recovery attempt in April and was an important separator in September. It will be tested on any upwards move.

Below, 0.8930 served as support in April and also worked as resistance in September – more than once. It is strong resistance now. The round number of 0.88 is of higher importance now after stopping the pair’s drop.

0.8680 is another minor line that provided support for the pair in September. More important downside support is at 0.8550. This was an all time low that served as resistance during the spring of 2011.

0.8460 is a minor line after providing support in May. The final line for now is 0.8330 which was a strong support line.

I am bullish on USD/CHF

As the Swiss franc is slowly getting back to its safe haven currency status, it significantly strengthened against the euro. EUR/CHF is now too close to the 1.20 floor (and 1.2125 unofficial floor). The SNB might intervene, and this may send USD/CHF shooting up. The situation in Europe is dire.

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar