Oil prices are correlated to the US dollar, but correlations also break, especially with bigger events. The team at Goldman Sachs casts doubt about the correlationÑ

Here is their view, courtesy of eFXnews:

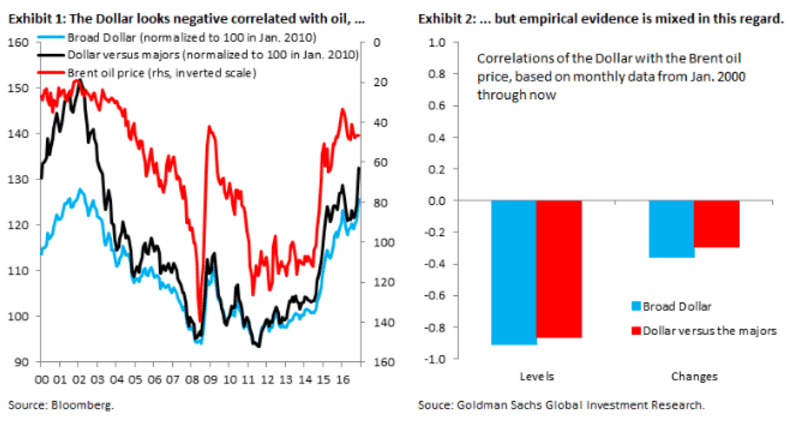

Historically, the Dollar has been negatively correlated with oil prices, meaning low oil prices have coincided with a strong Dollar, while high oil prices have typically come when the Dollar has been weak.

We argue that the importance of this empirical relationship is overstated for two reasons.

First, many of the counterpart currencies in broad Dollar indices belong to commodity exporting countries, so that falling (rising) oil prices push down (up) their terms of trade, which weakens (strengthens) their currencies. The negative correlation thus exists almost by construction, i.e. is a bit like looking at the correlation of oil prices with their reciprocal (commodity exporters’ terms of trade). In short, the correlation isn’t really about the Dollar per se, but about commodity exporters.

Second, fluctuations in oil prices often coincide with other developments that have effects on the Dollar, including global demand shocks or monetary policy changes. Both of these are present in Exhibit 1, which shows the drop in oil prices during the global financial crisis, which – being a negative demand shock originating in the US – moved rate differentials against the Dollar, and the pronounced drop in oil prices in 2014, which coincided with the BoJ and ECB increasing monetary stimulus, moving rate differentials in favor of the Dollar. This is perhaps one reason why the correlation of the Dollar with oil prices is less pronounced in changes than in levels

We examine the correlation of the Dollar with oil prices using daily data, controlling for interest differentials, risk appetite and other factors. It concludes that rate differentials are the most important driver behind recent Dollar moves, followed by oil prices.

We conclude that it is primarily the forces of economic divergence that are driving recent Dollar direction, in line with our forecasts which anticipate more Dollar appreciation (around 7 percent) on these grounds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.