GBP/USD is still flirting with 1.30. Deutsche Bank joins our view that there is lots of room to the downside from here:

Here is their view, courtesy of eFXnews:

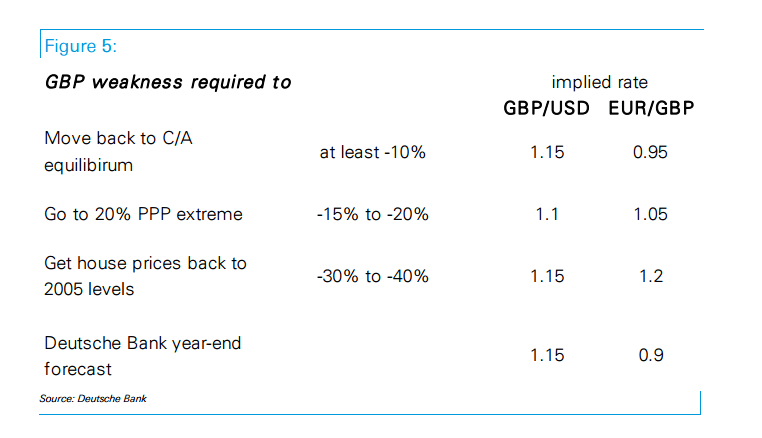

1- A starting point is purchasing power parity, which measures the exchange rate that equates the price of a “big mac” between two countries. Our assumption is that the UK is undergoing an unparalleled negative “terms of trade” shock, which requires GBP to reach historical (under)valuation extremes.

2- An alternative metric is the fundamental effective exchange rate. This measures the exchange rate that is required to bring a country’s current account deficit back in “equilibrium”, which here we define as the 20-year historical average, or in absolute annual terms about -40bn GBP, or 2.5% of GDP.

3- A final metric is to look at the underlying value of assets. What is the level of the exchange rate that would make UK assets “cheap” again and thus keep attracting the capital inflows that are needed to finance the current account deficit? Here we look at the London housing market priced in both dollars and euros as a proxy for “international UK assets” and assume “cheap” would be a return of house prices back to the currency-adjusted levels seen in 2005.

The conclusion from all three frameworks is that GBP has much more to go. Indeed, our aggressive forecasts may still be under-stating the level of weakness required.

Our forecasts for GBP/USD and EUR/GBP are at 1.15 and 90 pence by the end of this year respectively.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.