The Bank of Japan meets this week amid high expectations and talk about helicopter money. Nomura sees three reasons for three easing measures:

Here is their view, courtesy of eFXnews:

We expect the BOJ to decide on additional easing at the meeting this week (28-29 July), as widely anticipated by the market.

Our economists expect the BOJ to announce a policy package including: 1) additional purchases of ETFs (to JPY6trn/year) and REITs (to JPY180bn/year); 2) the introduction of negative rates on current loan support programs; and 3) IOER cut to -20bp from -10bp. We agree with this view and also see this policy package as the most likely outcome from this week’s meeting.

Financial markets have been gradually stabilizing following the initial shock of the Brexit vote. USD/JPY is now trading around 106, while Japanese equity prices have recovered by about 12% from the bottom after the Brexit vote. USD/JPY is at almost the same level as ahead of the June meeting, while Japanese equity prices are higher now.

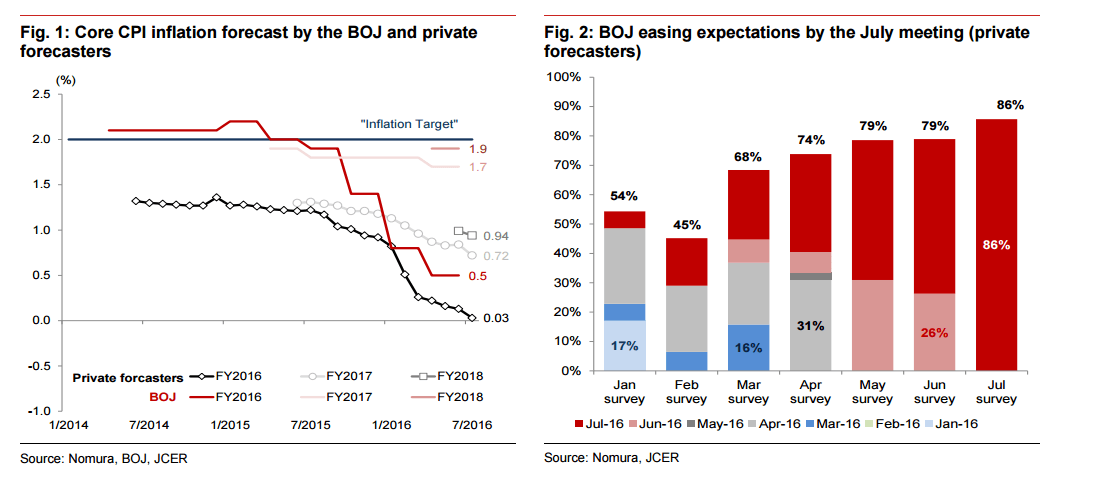

Although calmer market conditions may be a reason for the BOJ to stay on the side lines again for now, we see three reasons to expect BOJ easing this week: 1) further weakness in underlying inflation momentum; 2) much more elevated expectations for easing; and 3) political incentives to demonstrate a joint effort to stimulate the economy with fiscal stimulus.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.