Never believe a rumor until it is officially denied? Well, markets currently buy the denial with USD/JPY crashing under 106 on a denial that helicopter money is on the cards.

However, we know that this topic has been discussed with former Fed Chair Ben Bernanke. But now, BOJ governor Kuroda says that outright printing of money or “perpetual bonds” is not an option, not a possibility. In addition, he says there’s no need for this. Should we believe him?

Our assessment is that Japan will eventually go for this move, but after the US elections. Why? Japan and China, the world’s No. 3 and No. 2 economies, are eyed by the US. In addition, trade has been a big deal for Republican nominee Trump, and it would be wiser not to add fuel to the fire. Making a move in November or December, in the “lame duck” session, would probably be wiser.

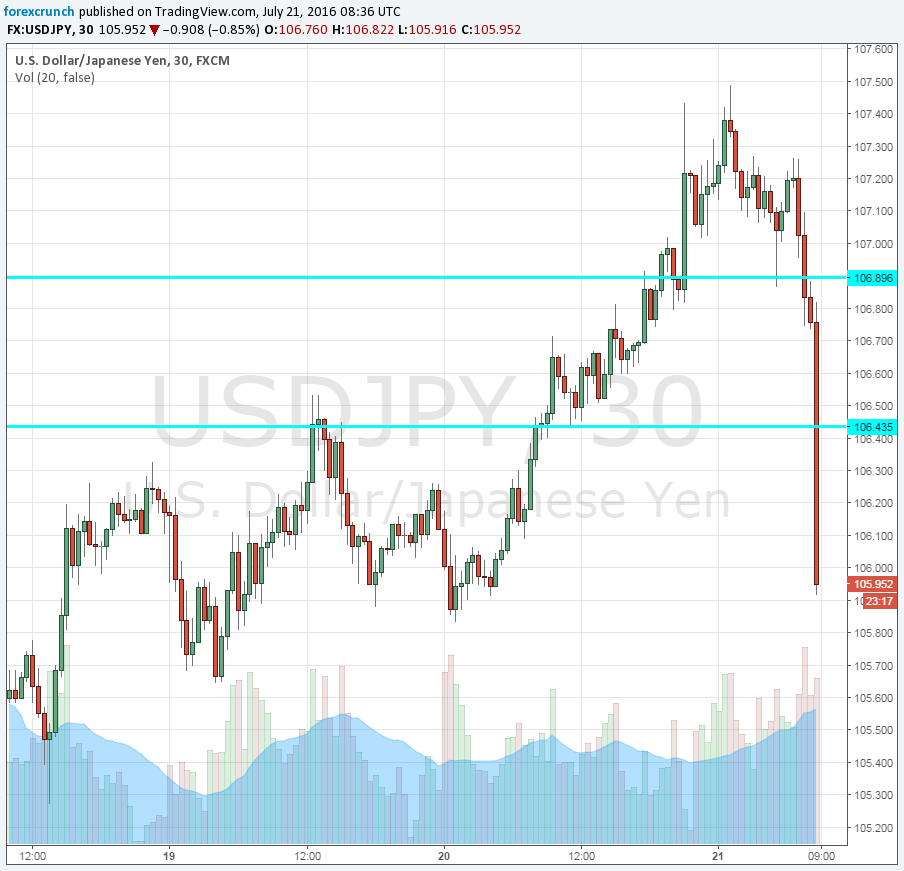

For USD/JPY, this is a big turnaround. Earlier we heard that the government is considering a 20 trillion yen stimulus program – double the initial reports. This sent USD/JPY all the way to 107.49.

Here is the chart:

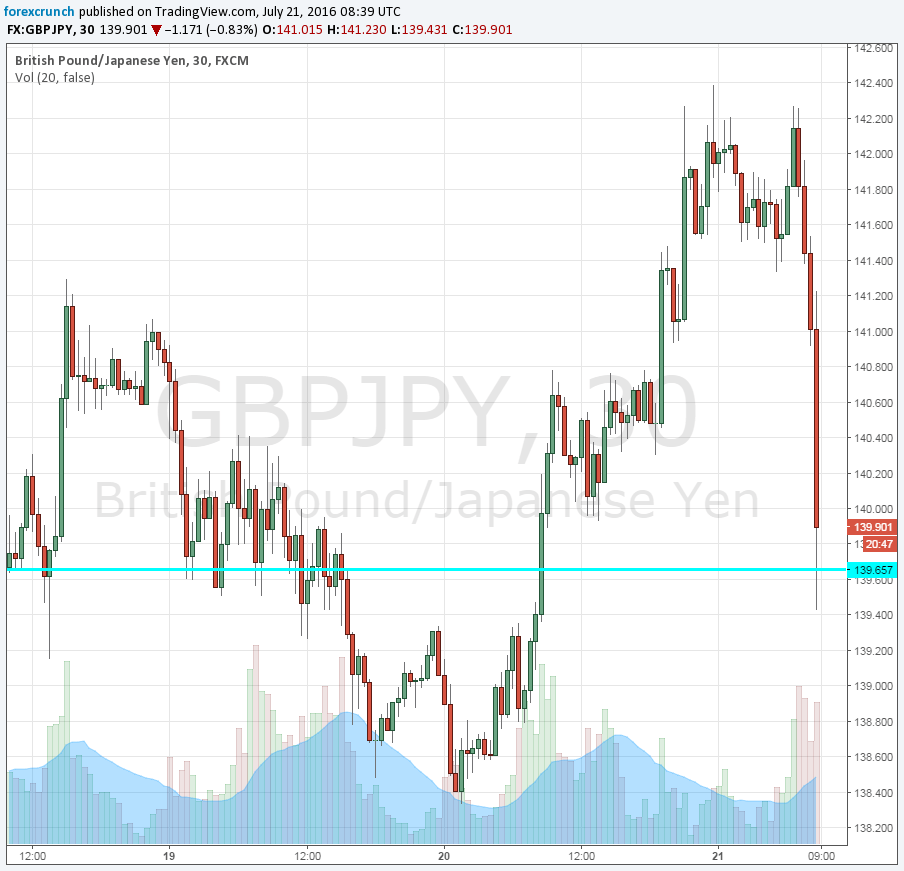

For GBP/JPY, this is a one-two punch. UK retail sales came out worse than expected and weigh down on the pound. Together, we have a big fall of nearly 300 pips in a short period of time.