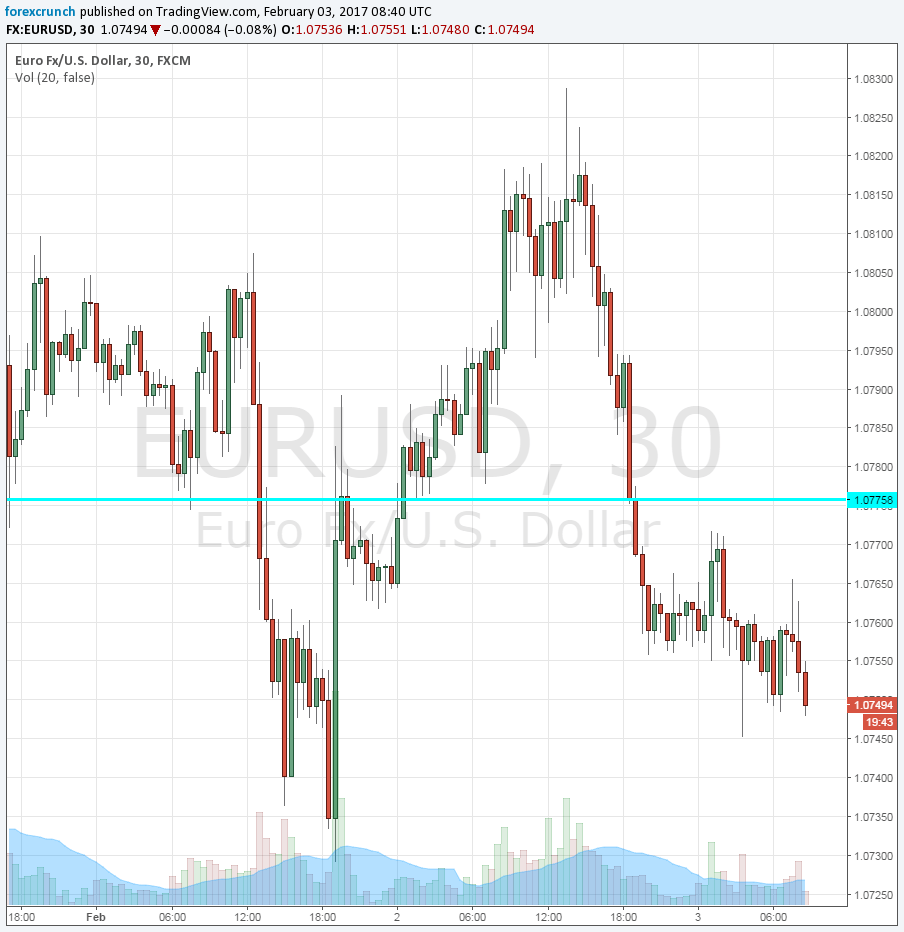

The US dollar is off its lows against major currencies, with EUR/USD trading at 1.0750, USD/JPY at 113.20 and GBP/USD licking its wounds at 1.2530.

Here are reasons why this could be a selling opportunity on the USD:

- This is only a correction: The greenback gained strength without any clear event related to the move. A correction is necessary within the general trade, but could be short-lived.

- NFP expectations are too high: After ADP and ISM manufacturing beat expectations, the real estimates for the all-important Non-Farm Payrolls report are probably higher than the 170K implied in official calendars. Sure, the actual outcome could certainly meet the higher projections: job gains could easily top 200K and annual wages could continue advancing, perhaps topping 3%. However, this is already priced in. We could see a “buy the rumor, sell the fact” phenomenon.

- Weak dollar desired by the Donald: The new US President is completing his second week in office. While we should wait 100 days, it is fair to say that so far, trade wars with the likes of Mexico are more frequent on Trump’s agenda than fiscal stimulus. This is not what markets were subscribing for. The USD rally was based on hopes for the best (tax cuts, infrastructure spending) and ignoring the worst (trade wars, conflicts). So far, it is not materializing. Worse off, Donald Trump and his economic advisor David Navarro have both been talking about other currencies doing competitive devaluation. Navarro bashed Germany’s euro advantage and Trump referred not only to China but also Japan. If the US administration is seeking a weaker dollar, they may get it. This change of tone has not been fully digested by markets.

More: trading the NFP with EUR/USD