The US presidential campaigns are moving one step up with the first debate between Hillary Clinton and Donald Trump. With the race tightening towards Trump, there is a lot at stake. Clinton represents continuation vs. the Donald Disruption: a gray, mainstream candidate that will continue the current path while the challenger is disruption, and we do not know how. He is extremely unpredictable and constantly contradicts himself.

Update: Clinton wins debate – markets cheer, USD/JPY rises

Markets want certainty and that’s Clinton. Usually, a pro-business, pro-market Republican candidate is the markets’ favorite, but Trump is no normal nominee. The 90-minute debate has already been spun, will undergo heavy spinning during the event and endless spinning and analysis afterward.

Want to know what financial markets really think? Look no further than USD/JPY. Why?

- Timing: The debate is held at 1:00 GMT, well into the Tokyo session and when US and European markets are closed. This means more trading on dollar/yen and less on others.

- The yen is special: The yen is a safe haven currency: more risk, more yen buying. Less risk, and the yen is sold off.

- Fed fear: In case Trump wins, it’s not only fiscal uncertainty but monetary one as well. The Fed delayed a rate hike now but made heavy hints of a move in December. You can call off a hike if Trump wins.

So, a rise in USD/JPY means markets think Clinton won. A drop in the pair represents a Trump win in the debate.

Needless to say, we have six more weeks of campaigning after the debate and until the vote, but this tight polls, the stark differences between the candidates and the importance of the first encounter all amount to this becoming a big event.

More:

- Debate preview: 3 reasons why Clinton could win and markets will like it

- USD and the first Presidential Debate – Barclays

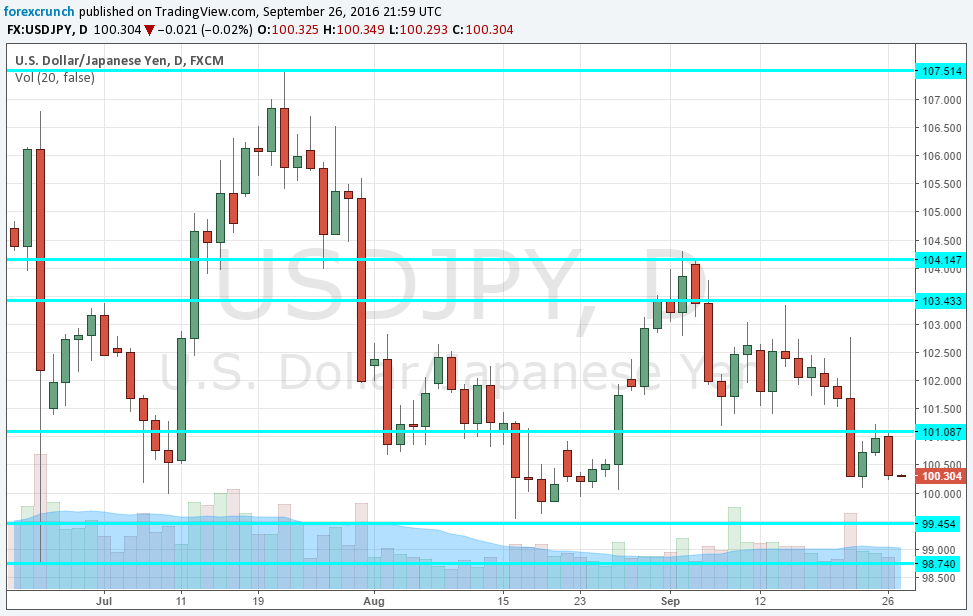

Here is USD/JPY, weakening towards 100 before the event. 100 is support, followed by the post-Brexit low of 99. Resistance awaits at 101 and 103.40.

Where will the pair trade afterward?