EUR/USD made its way towards 1.10 but after failing to touch this round level, the world’s most popular currency pair turned down. Is it not a safe haven anymore? Not exactly, but it certainly has reasons to lean to the downside.

Here are three reasons for the downside pressure in EUR/USD:

- Falling oil is due to demand: The return of Iran to international markets adds pressure on oil prices. This was no surprise but crude continued its crash on the upcoming addition of 500mbpd. So why didn’t EUR/USD advance with falling oil as it did in previous days? The euro is a safe haven, falling on times of trouble. When the fall in oil prices is related to lower global demand, which is the usual case, there’s reason for worry and repatriation and risk aversion. But when it’s only supply related, the euro seems less affected.

- Fear of the ECB: On Thursday, the ECB meets for the first time since the Draghi Disappointment in December. Opinions are mixed of whether it wants or can do more, but with lower inflation, anything is possible in March. This keeps upside moves somewhat limited.

- Profit taking: After the moves higher on Friday, some range traders may be booking some profits. While the narrow range may be frustrating for many, it is an opportunity for those seeking small pips.

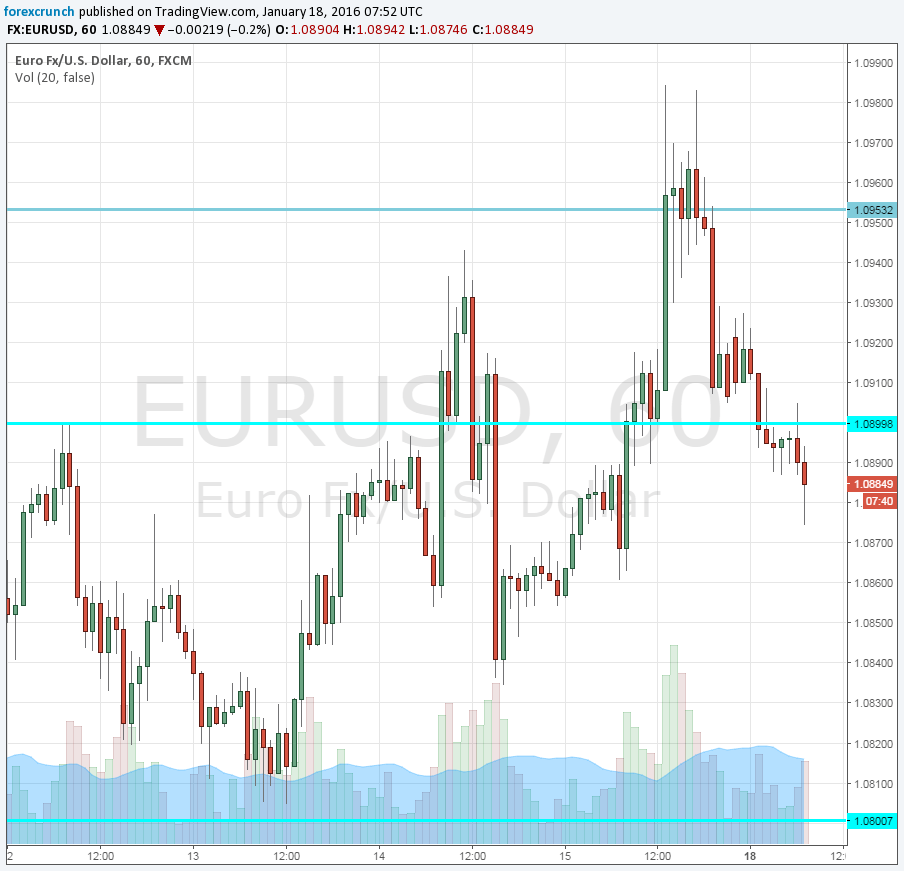

This is how EUR/USD looks on the chart. Support awaits at 1.08 and 1.0710. Resistance at 1.09 and 1.10980.