Iran fulfilled its part in the nuclear deal, said the IAEA and the international sanctions against the Islamic Republic were lifted by the EU and and the US. While the move was fully expected, the vulnerable price of oil and the Canadian dollar took another hit.

The lifting of sanctions, as agreed back in July 2015, are set to send another 500 million barrels per day to global petroleum markets, which are already flooded with oversupply. The celebrations in Iran, which will also enjoy a re-integration in global trade, are not a happy moment for prices of the black gold.

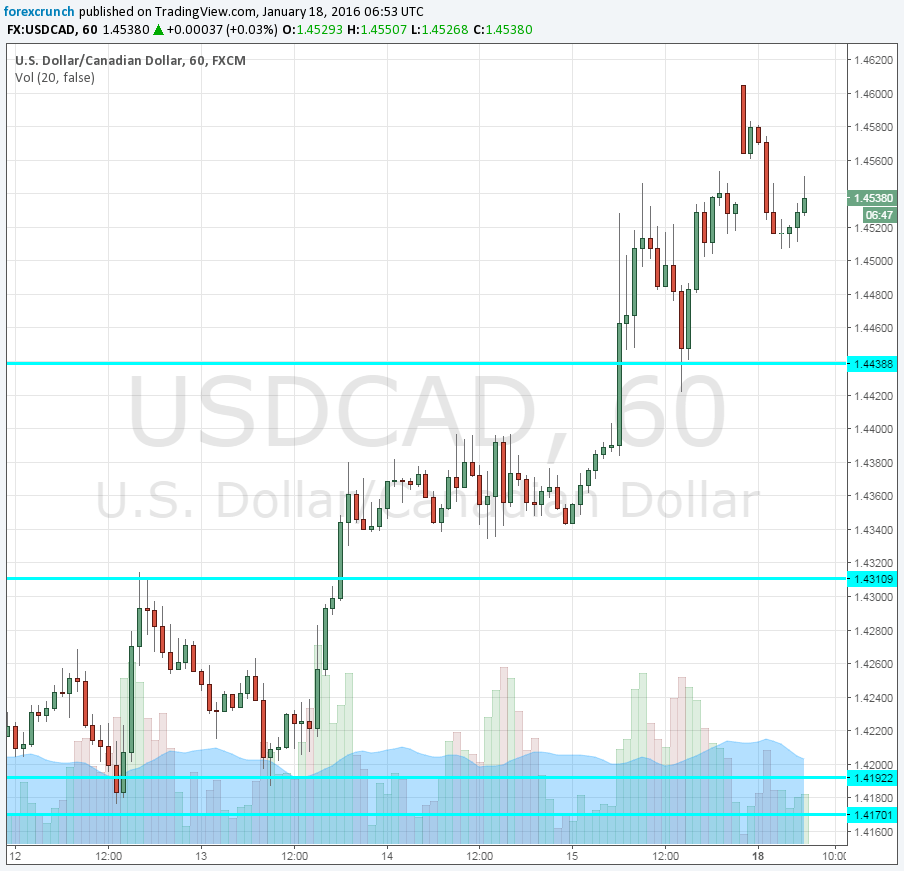

Both WTI and Brent prices are below $29, and USD/CAD continues higher. At the early hours of trade, USD/CAD reached out all the way to 1.4605, a new high since 2003. Since then it fell back to around the closing levels seen on Friday, but it certainly doesn’t seem to correct downwards.

The Canadian dollar faces another big test: the decision by the Bank of Canada, which consists of the option to cut interest rates.

For Dollar/CAD, resistance can be found at the new high of 1.4605, with the round level of 1.50 not looking too far away. Support can be sketched at 1.44.