UK Prime Minister Theresa May surprised the world and announced a snap election on June 8th. With Labour’s consent, the elections will indeed be held on June 8th. May made a calculated gamble to head to the polls. She is aware of her high popularity and is likely to win.

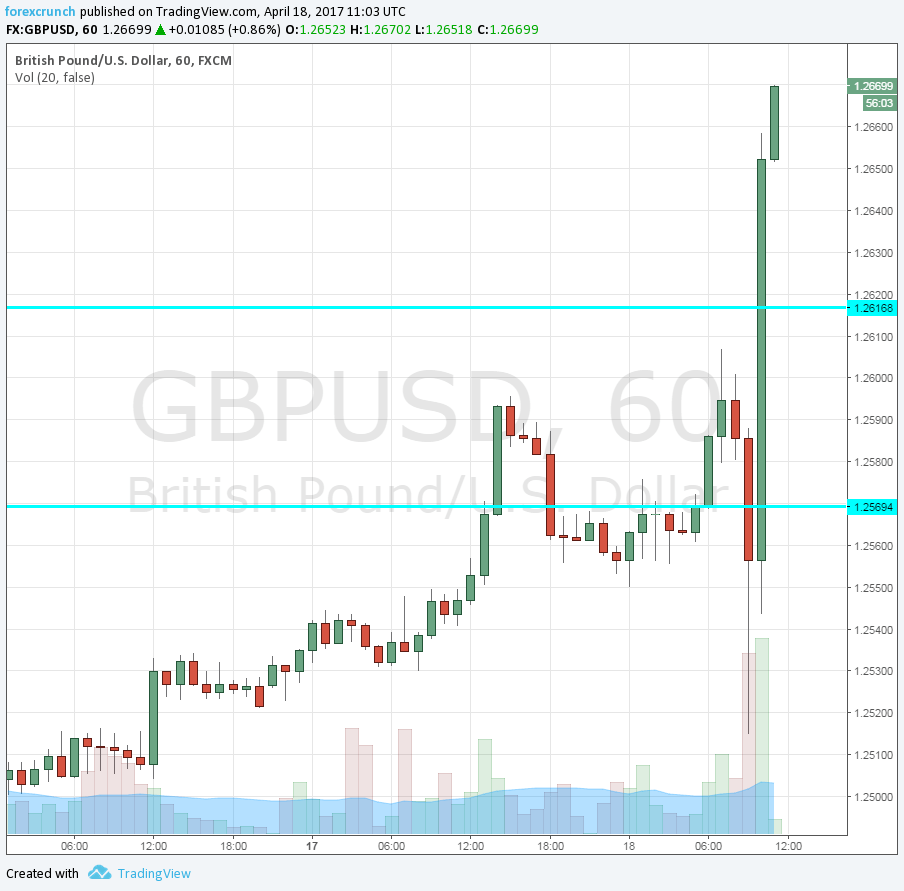

GBP/USD is already on the rise, topping 1.2665. Here are more reasons why the elections should be pound positive, allowing sterling to run to much higher ground.

- Mandate for May: Theresa May became PM after David Cameron quit abruptly and after her rivals for the leadership fell out one by one. She was never elected by her party members nor the public. Winning a general election will give her a wider mandate to shape Britain’s EU departure. More importantly, it will give her more wiggling room perhaps to pursue a softer Brexit. May was a Remain-er and she was tasked with leaving. After June 8th, she will have room also to move back to a softer Brexit, perhaps closer to her beliefs.

- Weaker Brexiteers: When May entered No. 10, she got rid of some of the old guard, such as former Chancellor Osborne and one of the leading Brexiteers, Michael Gove. However, she gave senior portfolios to the “Three Brexiteers”: Boris Johnson, David Davies, and Liam Fox. Some are more talented than others. Her appointment of Johnson was probably necessary in order to prevent criticism about a potentially soft Brexit. But now, after a win in the elections, she could get rid of this diplomatic liability called Johnson and not face a significant backlash.

- Weaker UKIP: While the single issue UKIP party hardly had any members in parliament, they had an outsized influence on UK politics. Pressure coming from Nigel Farage and his colleagues pushed former PM Cameron to hold the EU Referendum. The party, now embroiled in infighting, is set to get far less than the 14% it received in the 2015 elections. This will weaken demands for a hard Brexit.

- Defeated Labour: The opposition Labour Party elected hard-left Jeremy Corbyn in 2015 and re-elected him in 2016. He will now face the general public and will likely be defeated. This could enforce market-friendly forces, regardless of Brexit.

- Good timing with the rest of Europe: While the French elections seem close, the leading candidate remains pro-European and centrist Emmanuel Macron. A fresh face at the Elysee is set to coincide with a reinforced government in London. Brexit negotiations were not set to begin before June in any case due to the elections in France. Elections in Germany are likely to result in a pro-European leader in any case. All in all, May’s move takes advantage of the quiet period before negotiations begin in earnest. Removing all the political uncertainty in a short period of time is also favorable for markets.

More: Trading the French Elections with EUR/USD – 4 scenarios

Here is the recent jump in pound/dollar: