GBP/USD posted considerable losses, dropping 130 points. The pair closed at 1.2736. There are 10 events this week. Here is an outlook for the highlights of this week and an updated technical analysis for GBP/USD.

The UK elections did not come out like Theresa May hoped for. Her Conservative Party did not win a majority in parliament and was forced to rely on the reactionary DUP for support. The pound tumbled down sharply and pressure is set to continue.

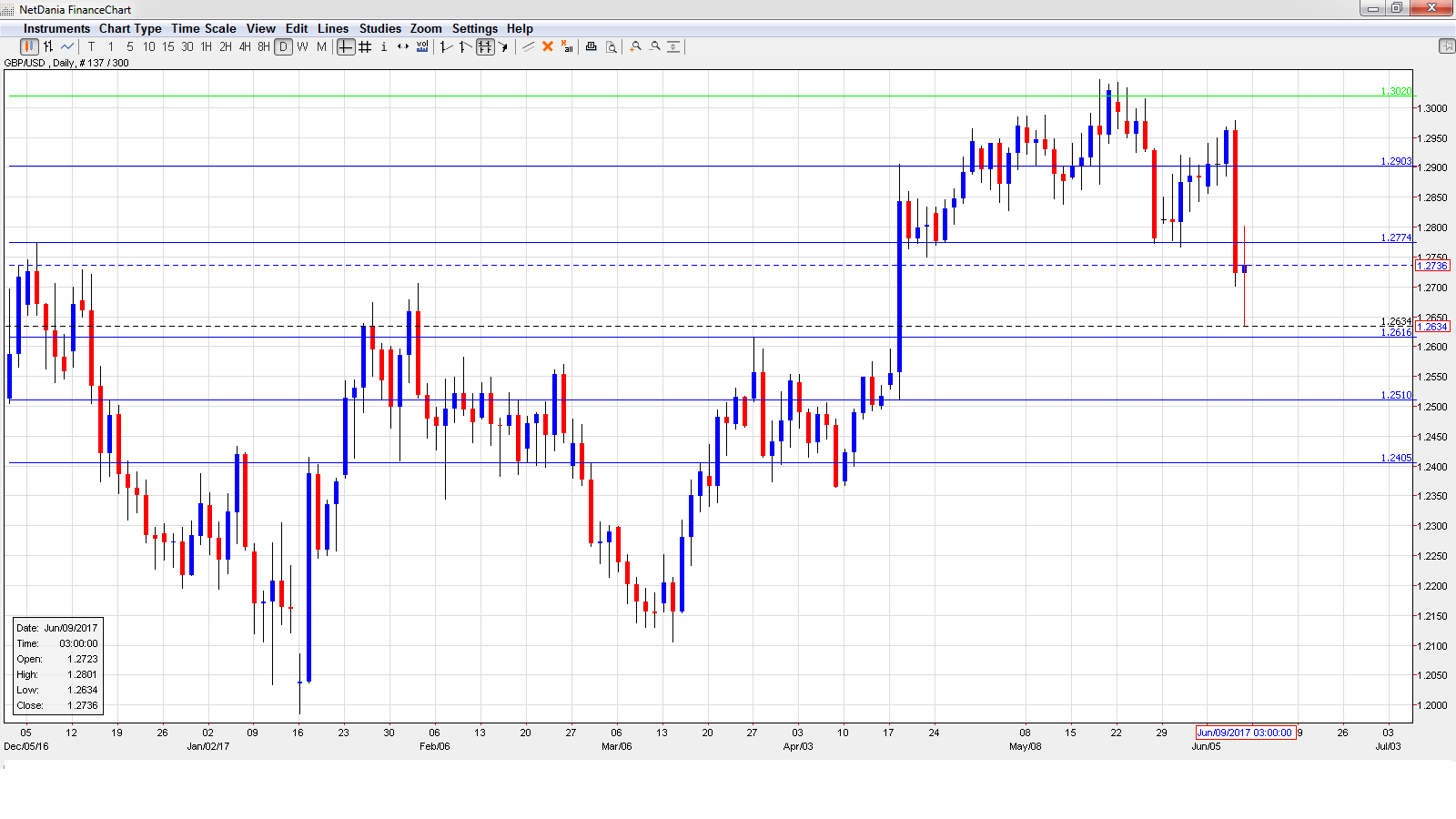

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- CPI: Tuesday, 4:30. CPI continues to move higher, and reached 2.7%. Another gain of 2.7% is expected in May.

- PPI Input: Tuesday, 4:30. The indicator dipped to 0.1%, matching the forecast. The markets for braced for a decline of 0.4% in May.

- RPI: Tuesday, 4:30. RPI continues to climb, and reached 3.5%, edging above the estimate of 3.4%. The estimate for May stands at 3.5%.

- Average Earnings Index: Wednesday, 4:30. Wage growth grew by 2.4%, matching the forecast. Another gain of 2.4% is expected in the April release.

- Claimant Count Change: Wednesday, 4:30. This key indicator dropped to 19.4 thousand, below the estimate of 23.4 thousand. The estimate for the May report is 20.3 thousand.

- CB Leading Index: Wednesday, 9:30. This minor event came in at -0.2% in April, its first decline since June 2016.

- Retail Sales: Thursday, 4:30. Retail Sales is the primary gauge of consumer spending. The indicator rebounded with a strong gain of 2.3$, beating the estimate of 1.2%. The markets are braced for a decline of 0.9%.

- Official Bank Rate: Thursday, 7:00. The BoE is expected to maintain the benchmark rate at 0.25%.

- Asset Purchase Facility: Thursday, 7:00. No change is expected in the asset-purchase scheme, which is currently at 435 billion pounds.

- BoE Quarterly Bulletin: Friday, 7:00. This report provides details on market developments and the the Bank’s monetary operations. It is a minor event.

*All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.2867 and touched a high of 1.2978 late in the week. The pair then dropped sharply, dropping to a low of 1.2634, as support held at 1.2616 (discussed last week). GBP/USD recovered slightly and closed the week at 1.2736.

Technical lines from top to bottom

1.3247 has held in resistance since September 2016.

1.3112 marked a low point in June 2016 as the pound crashed after the Brexit vote.

1.3020 is protecting the symbolic 1.30 level.

1.2902 is next.

1.2775 was tested in support for a second straight week.

1.2616 is next.

1.2512 is the final support level for now.

I am bearish on GBP/USD.

Britain remains shaken from the terrorist attack in London and with polls pointing to a tight race, the political uncertainty could hurt the pound. Although the markets have priced in a rate hike from the Fed, the move could still give the greenback a brief boost.

Our latest podcast is titled US labor market and UK’s Labour comeback

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.