The Australian dollar slipped back after jumping in the previous week. Where will it go next? The rate decision by the RBA and retail sales stand out in the first week of Q4. Here are the highlights of the week and an updated technical analysis for AUD/USD.

The US dollar emerged as a winner from the Fed decision. The central bank raised rates and signaled four more moves until the end of 2019. The removal of the wording about “accommodative policy” initially hurt the greenback, but things turned around afterward.

[do action=”autoupdate” tag=”AUDUSDUpdate”/]

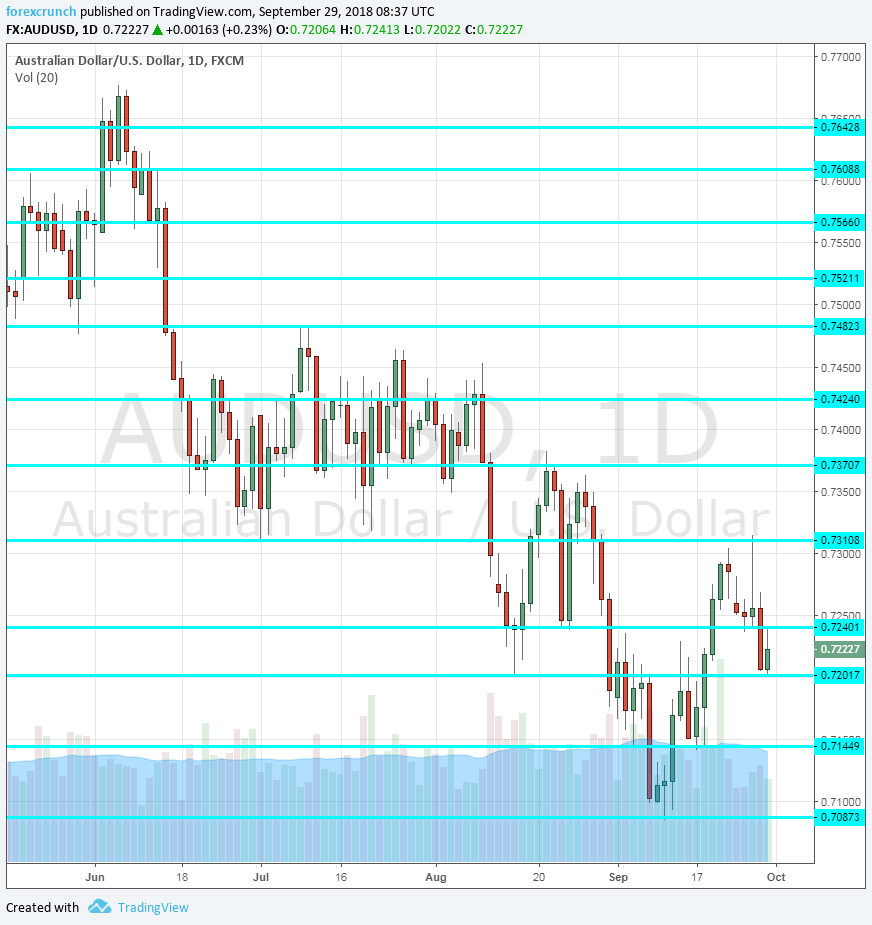

AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- AIG Manufacturing Index: Sunday, 22:30. The Australian Industry Group’s PMI-like indicator stood at a stable 56.7 points in August, reflecting solid growth in the manufacturing sector. A similar figure is likely now.

- Rate decision: Tuesday, 4:30. The Reserve Bank of Australia has not changed interest rates since August 2016 and we cannot expect any change now. Governor Phillip Lowe repeated the message of a neutral policy in recent public appearances. References to the trade wars or the exchange rate may be of interest.

- Building Permits: Wednesday, 1:30. This volatile gauge of the housing sector dropped by 5.2% in June, and the second month of declines is on the cards now. The report for July carries expectations for a slide of 2.5%.

- HIA New Home Sales: Thursday. The gauge of new home sales is not doing much better: it fell by 3.1% in July. We will now receive the numbers for August.

- Trade balance: Thursday, 00:30. Australia enjoyed a trade surplus of 1.551 billion in July. A slightly narrower surplus of 1.4 billion is on the cards for August. The positive figures support the Australian Dollar.

- AIG Construction Index: Thursday, 23:30. Contrary to the manufacturing sector, Australia’s construction sector is hardly seeing any growth. AIG’s forward-looking gauge stood at 51.8 points in August, barely above the 50-point threshold separating growth and contraction.

- Retail sales: Friday, 00:30. This important measure of internal consumption disappointed in July by remaining flat, showing that Australians were not out and about in the winter. The figure for August is expected to see an increase of 0.3%.

*All times are GMT

AUD/USD Technical Analysis

Aussie/USD challenged the 0.7310 level (mentioned last week) but then dropped and found support only at 0.72.

Technical lines from top to bottom:

0.7480 capped the pair in mid-July and defends the round 0.75 level. 0.7420 capped the pair twice in mid-July. 0.7360 was a low point in mid-July.

0.7310 is the low of July 2018. 0.7240 was a swing low in late August and the pair attempted to reach it in mid-September.

The round number of 0.7200 was a temporary low. 0.7150 was a stepping stone on the way down in early September. 0.7085 is the 2018 trough.

Below, we are back to levels last seen in January 2017: 0.7050 could provide some temporary defense against an assault on the round 0.70 level. Even lower, 0.6880 is the next level to watch.

I am bearish on AUD/USD

The Fed’s hawkish policy boosts the dollar and the trade tariffs weigh on risk currencies such as the Australian dollar. Australia’s struggling housing sector does not help.

Our latest podcast is titled Too hot or too cold? The world is watching the Fed

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – projections for dollar/yen

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!