GBP/USD plunged over 5 percent for a second successive week. The pound fell close to the 1.14 before recovering. This week features inflation, retail sales and the BoE rate announcement. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

The BoE cut its main interest rate to 0.10% at an emergency meeting on Thursday. Policymakers also increased the bond-purchase program from 435 billion pounds to 645 billion. Just one week earlier, the bank slashed rates from 0.75% to 0.25%. On the employment front, wage growth accelerated to 3.1% in January, up from 3.0% a month earlier. Unemployment rolls soared to 17.3 thousand, up from 5.5 thousand a month earlier. This was much higher than the estimate of 6.2 thousand. The unemployment rate rose to 3.9%, up from 3.8%.

In the U.S., the Federal Reserve roared into action at the start of the week, slashing rates from 1.25% to 0.25 percent. This emergency cut was in response to the meltdown in the financial markets. Later in the week, the Fed announced it was establishing a Commercial Paper Funding Facility in order to keep credit flowing to the economy. On the manufacturing front, the Empire State Manufacturing Index plunged by -21.5 points, compared to the forecast of +5.1 points. Core retail sales fell by 0.4%, while retail sales declined by -0.5%.

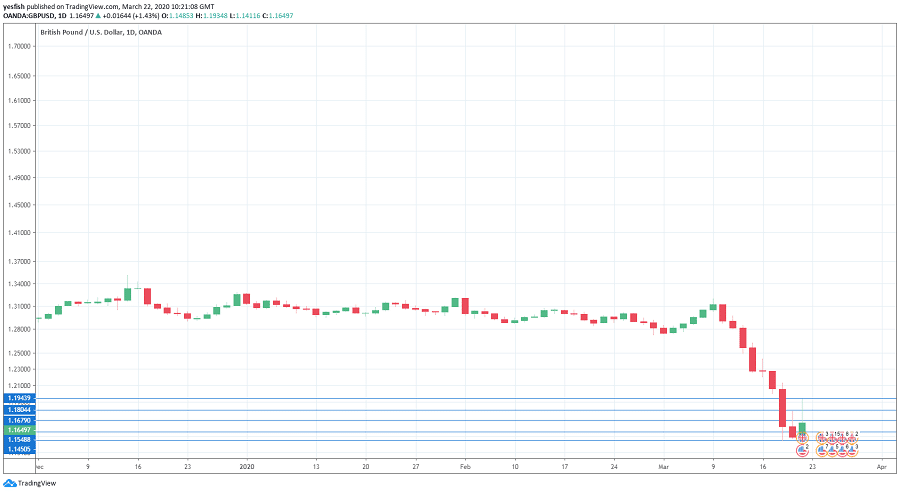

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Manufacturing PMI: Tuesday, 9:30. The PMI came in 51.7 in February, indicative of slight expansion. However, with the CORVID-19 outbreak intensifying, analysts are braced for a contraction in March. The estimate for the initial reading for March stands at 45.7 points.

- Services PMI: Tuesday, 9:30. In February, the PMI pointed to expansion, with a reading of 53.2. March is likely to be much weaker as the estimate for the initial reading is 45.0 points.

- CBI Industrial Order Expectations: Tuesday, 11:00. Manufacturers remain pessimistic about order volumes, as the indicator remains mired in negative territory. In February, there was a slight improvement, with a reading of -18, up from -22 points. However, investors are braced for a sharp downturn in March, with a forecast of -38 points.

- Inflation: Wednesday, 9:30. Consumer inflation was unexpectedly strong in January, with a gain of 1.8%, above the estimate of 1.6%. The estimate for February stands at 1.6%. Core CPI, which excludes the most volatile items in CPI, accelerated to 1.6%, above the forecast of 1.5%. The estimate for February is 1.5%.

- CBI Realized Sales: Wednesday, 11:00. Sales volume managed to eke out a small gain of 1 point in February, but analysts are expecting a dismal March, with an estimate of -15 points.

- Retail Sales: Thursday, 9:30. Retail sales is the primary gauge of consumer spending. In January, the indicator posted a strong gain of 0.9%, ending a nasty streak of three straight declines. The estimate for February stands at 0.2%.

- BoE Rate Decision: Thursday, 12:00. At this week’s scheduled policy meeting, the bank is projected to maintain the current interest rate and QE levels. Still, the monetary policy summary will be closely watched by investors and could affect the exchange rate.

GBP/USD Technical analysis

Technical lines from top to bottom:

With GBP/USD falling sharply last week, we start at lower levels:

We start with resistance at 1.1944 (mentioned last week). The round number of 1.18 follows.

1.1.680 was tested last week and is currently an immediate resistance line.

1.1550 is protecting the 1.15 level. This is followed by 1.1450.

The round number of 1.13 is the final support level for now.

I remain bearish on GBP/USD

The coronavirus crisis is threatening to spiral out of control and has caused a meltdown in the financial markets. The U.S dollar has enjoyed broad gains as investors flock to the safe-haven currency. I expect GBP/USD to remain under pressure this week.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!