- As gold prices rise, the weekly trading range remains the same, allowing gold to re-hit its intraday high.

- The market’s risk appetite improves as it overestimates its concerns about a Covid variant.

- In the past, politicians and experts rejected concerns about large lockdowns and vaccine readiness.

- The Consumer Confidence report and Fed Chair Powell outperformed Friday’s NFP report.

Gold (XAU/USD) price renewed an intraday high of $1,788 early Tuesday, staying in a short-term trading range above $1,780.

–Are you interested to learn more about South African forex brokers? Check our detailed guide-

As Treasury bond yields decline and equity resistance rises, gold buyers are encouraged to bounce off an important support line. The Omicron coronavirus, a variant of the Coronavirus indigenous to South Africa, is creating concerns ahead of the week’s major events to prevent travel.

According to sentiment indicators, the US 10-year Treasury yield fell 1.8 basis points (bps) to 1.51%, while S&P 500 futures were up 0.30%. In addition, the Asia-Pacific stock market has recently increased in value.

In November, China’s manufacturing PMI topped 50 NBS for the first time in three months, immediately boosting sentiment. In addition, the market sentiment was fueled by President Joe Biden’s rejection of isolation, the Federal Reserve chairman’s approval of the inflation and employment report, and the Fed chairman’s support for reflation fears. Moreover, US Treasury Secretary Janet Yellen urged Congress to break the stalemate on the US debt line and stressed the strength of the US economy in a bid to calm market pessimism.

Aside from that, global medicine has encouraged optimism about vaccines available against the strain and politicians’ ability to take quick action to tame the Omicron outbreak in favor of the cops. Moreover, the current state of the global economy appears to be better than at the beginning of the pandemic due to the optimism of market participants.

As a result, the US military attitude emphasizes Sino-American conflicts, which are putting downward pressure on risk-taking. A discussion of risk appetite is also included based on market concerns over important data releases this week, such as the Fed Chairman’s statement on Wednesday and November’s employment report on Friday.

Before Friday’s employment report, in addition to the testimonials, for which the scripts have already been released, we will also see consumer confidence data from the US CB for November and a market update from Covid. Gold prices are likely to fall due to static hopes of a Fed tightening due to fears of reflation.

–Are you interested to learn more about spread betting brokers? Check our detailed guide-

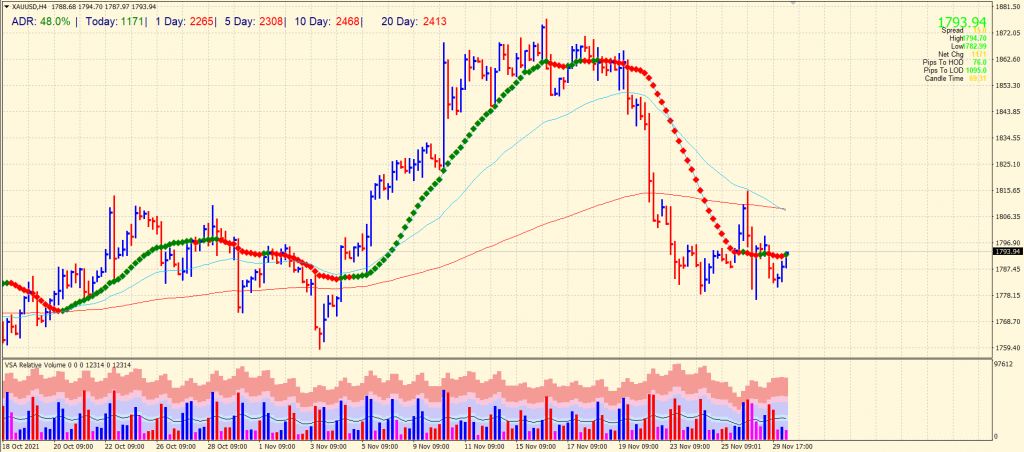

Gold price technical analysis: Bearish crossover to limit gains

The gold price found mild support around the orderblock zone near $1,780 and rose back to the 20-period SMA on the 4-hour chart. However, the bearish crossover between 200-period and 50-period SMA may limit the rallies to just under the $1,800 mark.

Alternatively, if the yellow metal finds acceptance above $1,800, it may test the resistance at $1,815 ahead of $1,825.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.