- EUR/USD is in a two-day downtrend but has risen above an intraday high recently despite the negative outlook.

- Inflation concerns have been calmed by the Fed’s Daley as US Treasury yields have fallen from their highest level since July 2019.

- Villeroy criticized the treatment of the ECB’s monetary policy decision as too restrictive.

Early Wednesday morning in Europe, the EUR/USD price analysis is mixed, recently trading at 1.1425, struggling to hold gains intraday.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

As the US dollar tracks Treasury yields in an otherwise quiet session, the major pair remains firmer for the first time in three days. However, US Treasury yields tumbled back from a multi-day high hit the previous day, resulting in a 0.12% decline of the US Dollar Index (DXY) near 95.50 on the day.

In recent days, the EUR/USD pair has risen due to the market’s hesitancy over the next steps from the European Central Bank (ECB) and the US Federal Reserve (FRS) on inflation concerns.

Yesterday, the US 10-year Treasury yield spiked to its highest level since July 2019 before slipping to 1.945%. San Francisco Fed Chair Mary Daly supported a rate hike in her most recent speech. But, according to the policymaker, “the Fed cannot raise rates excessively,” and “US inflation could worsen before it improves.”

On Tuesday, Francois Villeroy de Gallo, governor of the Bank of France and a member of the ECB Governing Council, claimed that the market’s reaction to last week’s ECB meeting may have been too strong. The ECB’s latest statements echo those made by ECB President Christine Lagarde earlier in the week, which diverged sharply from concerns about a rate hike.

It is noteworthy that Covid optimism favored Euro buyers while depicting a corrective pullback. A Financial Times (FT) report earlier in the day quoted Dr. Anthony Fauci as saying that the United States was exiting the ‘mature’ phase of the Covid19 pandemic.

Next week, German trade data and Fedspeak will help determine intraday moves ahead of key data and events on Thursday. Key indicators are the US Consumer Price Index (CPI) and the Quarterly Economic Forecasts of the European Commission.

–Are you interested in learning more about forex signals telegram groups? Check our detailed guide-

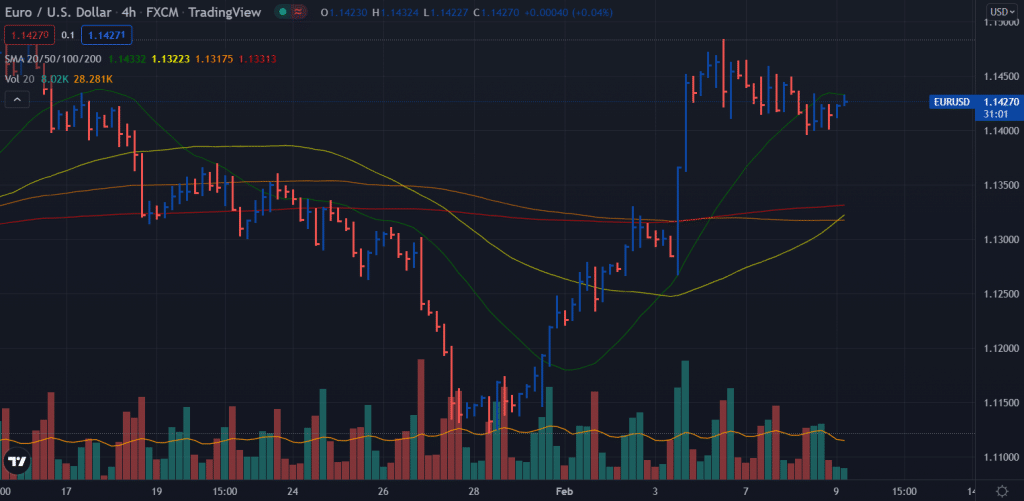

EUR/USD price technical outlook: Consolidating below 20-SMA

The EUR/USD price attempts a recovery but fails to surpass the hurdle of the 20-period SMA on the 4-hour chart. The price is still in a corrective phase, and the volume for the up bars is very low. It indicates that the negative outlook remains unchanged as the broader downtrend remains intact. However, the pair remains rangebound between 1.1400 to 1.1460.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money