Britain’s Consumer Price Index hit an annual pace of 3% in April, the lowest since February 2010 and finally in the 1-3% target.

The outcome is a bit under 3.1% that was expected and down from 3.5% last month. GBP/USD is dropping.

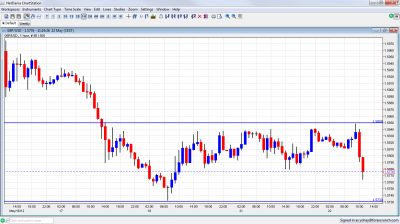

Cable is now at 1.5774, down from nearly 1.5850 early in the day. 1.5730 was seen late last week and is the next target if things worsen. See more lines in the GBP/USD forecast.

Core CPI dropped from 2.5% to 2.1%, also lower than 2.2% that was expected. The Retail Price Index (RPI) slid from 3.6% to 3.5% as expected. The official House Price Index (HPI) for March unexpectedly dropped by 0.4% instead of rising by 0.5% as predicted, but this came on top of an upwards revision for last month’s data.

The return of headline CPI to the target prevents BOE Governor Mervyn King from writing a public letter explaining inflation. The slower inflation goes hand in hand with the rather dovish inflation report last week.

It certainly opens the door for more quantitative easing. The current Asset Purchase Facility stands on 325 billion pounds.