XAUUSD Daily Analysis

XAUUSD (1262.35): Gold prices closed with a doji/spinning bottom on Friday, and the current price action is showing a potential reversal off the $1250 handle. A continued momentum could keep gold prices supported to the upside as long as the support at 1250 holds. The upside correction could see gold likely to retrace back towards the 1310 – 1300 level which previously held as support. A retest back to this level, to test for resistance supports the bullish short-term view in gold.

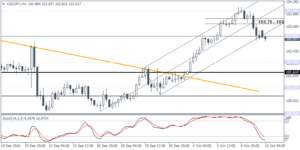

USDJPY Daily Analysis

USDJPY (102.91): The US dollar gapped higher on the open at 103.24Yen, but the price has been edging lower. A break below Friday’s low of 102.86 could trigger further downside towards 102.00. However, the support level of 103.00 could potentially offer some short term support despite price currently trading below this handle. The upside could be limited towards 103.70 – 103.50 region to establish minor resistance. Alternately, a continued decline below 103.00 could see USDJPY extend the declines towards the next main support at 102.00 – 101.61.

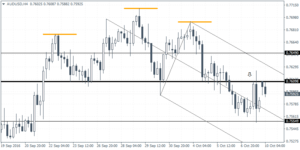

AUDUSD Daily Analysis

AUDUSD (0.7592): AUDUSD completed the head and shoulders pattern noted last week with prices briefly testing the measured target of 0.7555 before quickly pushing back higher. Prices are seen retesting the neckline support at 0.7610, but the further downside can be expected for a more firm test back to the level of 0.7555. A break below 0.7555 could trigger further downside towards the next support at 0.7515. The bearish view could be invalidated if prices settle back above the neckline resistance of 0.7610.