EUR/USD continued the downwards path, reaching a new 7 month low under 1.09. The team at Citi lists 10 reasons for extended falls:

Here is their view, courtesy of eFXnews:

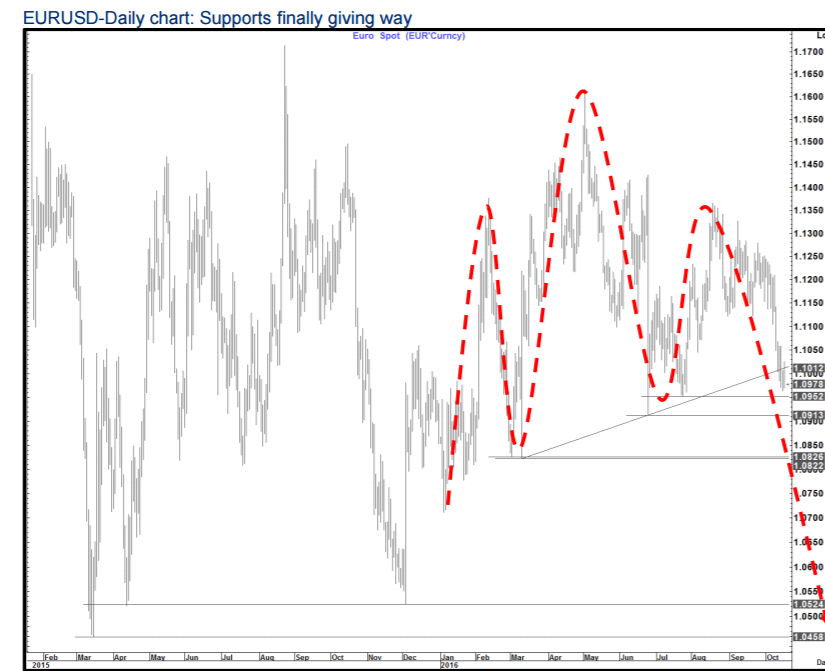

The pattern on the daily chart of EURUSD clearly looks like a head and shoulders top.

The neckline of this pattern at 1.1010 has given way on a daily close basis providing a target of a move towards 1.03 (New lows in the downtrend from the 2008 highs above 1.6000.

Interim support ahead of there is met at 1.0822-1.0826.

Below those ranges the other major support comes in at the 2015-lows between 1.0458 and 1.0524.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

>>>There are a number of factors (Technical and non-technical) which we believe support this move lower in EURUSD (and the EURO overall)

1- Europe is at a different point in the economic/rate cycle. While the ECB may be concerned about the efficacy of ZERO /Negative rates it is unlikely they will raise short-term rates anytime soon. At the same time the FED looks ready to resume the tightening cycle as early as December.

2- Inflation expectations in the US are more elevated than in Europe

3- From an investor perspective Europe provides very low yields with higher risk (periphery) and low to negative nominal yields at the core (Germany). Real yields are negative in Germany on almost all parts of the curve and barely positive out at the 30 year maturity. Even then nominal 30 year German yields are 65 basis points compared to 2.52% in the US. Overall the yield spread continues to move in favour of the US (See chart below)

4- Monetary conditions in Europe remain tight.

5- Fiscal policy adjustment looks increasingly likely to some degree in the US while the bar remains much higher in Europe (particularly in those nations that are economically troubled).

6- Brexit 2 (Brexit 1 was the ERM exit in September 1992) creates uncertainty for Europe as well as the UK.

7- Concerns about capitalization of European banks.

8- Italian referendum (December 4th).

9- Political turmoil/ immigration challenges etc.

Citi maintains a short EUR/USD position* in its technical portfolio.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.