The pressure on the common currency continued after Draghi basically said he’ll have news for us in December. On the other side of the equation, the US dollar resumed its strength after a taking a breather.

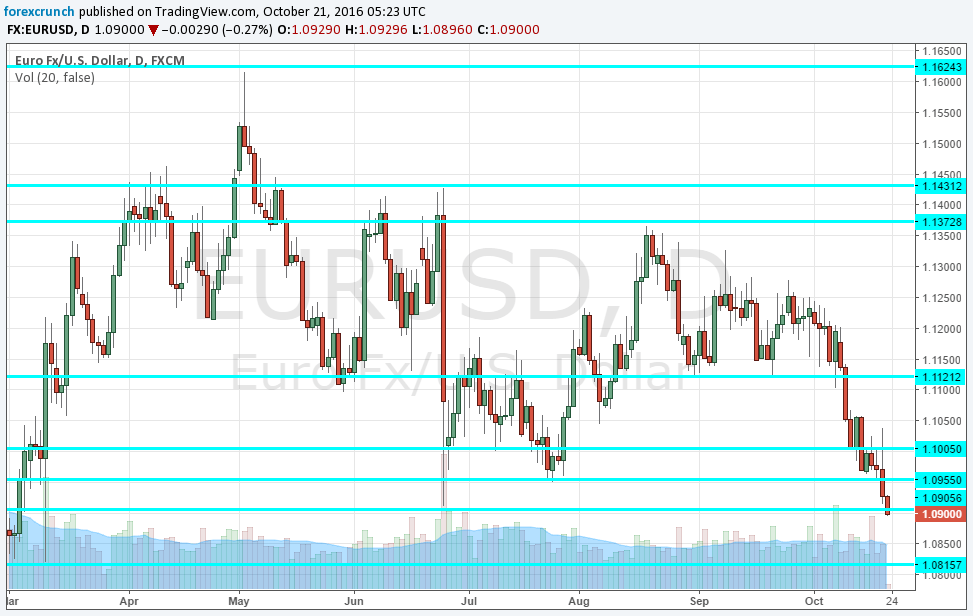

For EUR/USD, the outcome is a drop under 1.0910, the swing low seen on June 24th. We are trading in levels last seen in March: the last tie the ECB expanded its QE program.

The European Central Bank was expected to provide some hints about what happens after the current bond-buying program ends in March 2017. At first, Draghi said they had not discussed an extension of the program. An end to money-printing sent the single currency shooting up. However, he then clarified they also hadn’t discussed anything else: no talk of tapering but no abrupt end to the program.

All in all, he left us waiting. That is quite different than back in March 2016.

Back then, the ECB expanded the QE program from 60 to 80 billion, cut interest rates but also said they’re done. Instead of the desired fall in the euro, the reaction was a big bounce up. We are now seeing the power of silence: Draghi gets a weaker euro by not revealing any of his cards.

In the US, the dollar took a breather early in the week, after gaining across the board and especially against the pound. The beat on existing home sales provided the necessary boost for the greenback to resume its gains.

What’s next for EUR/USD? The next level of support is 1.0820, the same level seen back in March 2016. It is followed by 1.0710. On the topside, 1.0910 and 1.10 are of note. The team at Citi lists 10 reasons for downside pressure on EUR/USD including a Head and Shoulders pattern.

Here is how it looks on the chart:

More: EUR/USD To Gradually Grind Towards 1.05 But Prefer Holding EUR/JPY Shorts – Deutsche Bank