Dollar/yen got used to the 113 handle early in the week and attempts to settle above 114 were heavily fought by sellers. The Fed decision, the nomination of a new Fed Chair and the NFP all moved the pair, but the ranges were not challenged.

USD/JPY fundamental movers

BOJ, Fed, the new Fed Chair and the NFP

It certainly was a busy week. The Bank of Japan made no changes to its policy and seems to be pleased with the weaker yen. The Fed also kept interest rates unchanged. Despite an acknowledgment that inflation is “soft”, the Fed refrained from sending a signal that it will not raise rates.

Jay Powell has been nominated by Trump as the next Fed Chair. The move was well-telegraphed and he represents continuation rather than a change. This is not helpful to the US dollar.The Non-Farm Payrolls disappointed, especially on wages. Salaries are up only 2.4% y/y, not enough to push inflation higher.

US housing data, Dudley speech

The upcoming week is not as busy, but US building permits, housing starts, and consumer confidence should provide some action. Also note a speech from the President of the New York Fed, the first after the nomination of Powell.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

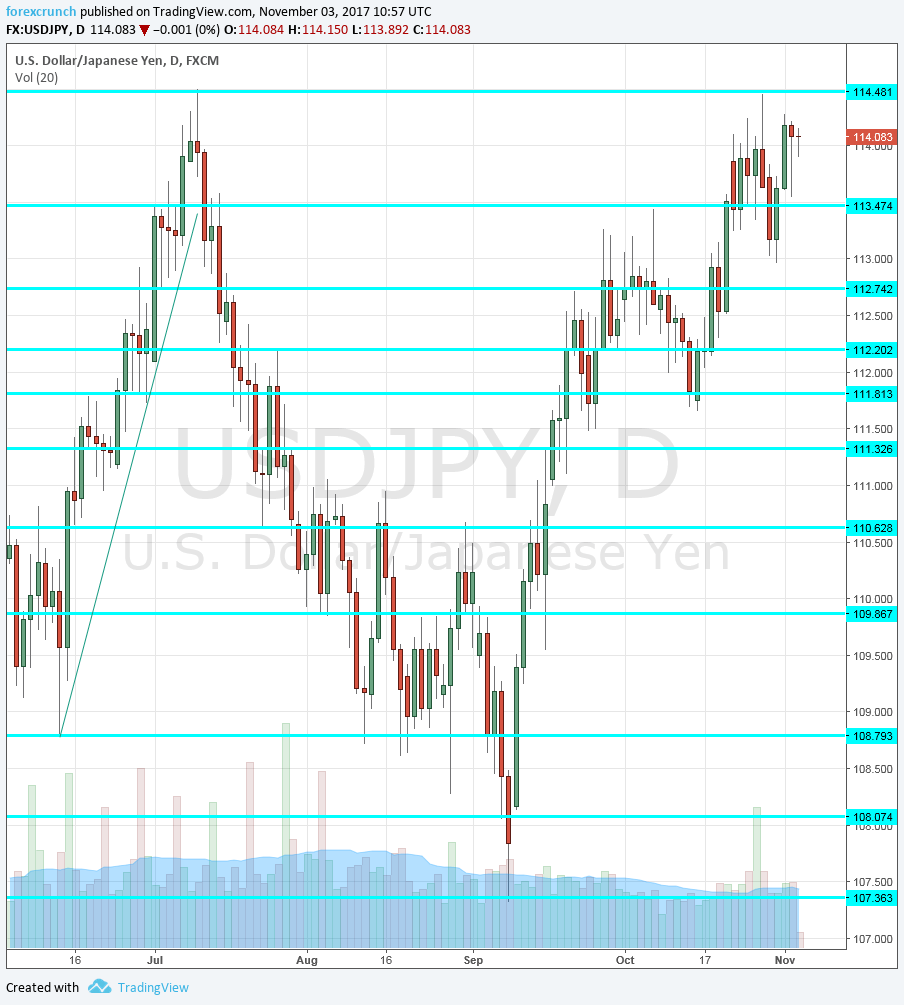

115.35 is an old line that served as support when the pair traded on higher ground. 114.50 is the cycle high last seen in early July. The pair got close to that level.

113.50 was a temporary line of resistance on the way up in July. 113.70 was a separator of ranges in June.

112.20 used to be important in the past. It is closely followed by 111.80, which capped the pair in May. The swing high of early September at 111.30 serves as another point of interest.

Looking down, 110.70 was a separator of ranges in June and remains important. 109.60 was a gap line in late April, a gap that was never closed.

In June, the pair found support several times at 109.10 and this also works as support. Further below, the cycle low of 108.10 is of high importance.

USD/JPY Daily Chart

USD/JPY Sentiment

I am bearish on USD/JPY

Dollar/yen is close to the top of the range and seems to struggle to make another move to the topside. From this point, it can slide within the range.

Our latest podcast is titled New normal NFP, reluctant rate rise

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!