Best Forex Brokers Australia 2021

Want to trade forex in Australia? Then you’ll need a top forex broker to access the market.

In this guide, we highlight the 10 best forex brokers in Australia for 2021 and offer Australian forex broker reviews for the top platforms.

Best Forex Brokers Australia 2021 List

Here is our list of the 10 best forex brokers in Australia for 2021:

- eToro – Overall Best Forex Broker in Australia for 2021

- Capital.com – Best Australian Forex Broker for Exotic Pairs

- VantageFX – Best ASIC-regulated Forex Broker with 500:1 Leverage

- Libertex – Top Tight Spread Forex Broker in Australia

- AvaTrade – Best Forex Options Broker in Australia

- Pepperstone – Lowest Cost Australian Forex Broker

- Forex.com – Best Forex Broker in Australia for Advanced Traders

- IG – Top ASIC-regulated Multi-asset Broker

- CMC Markets – Best Australian Forex Broker for Spread Betting

- FXCM – Top Forex Broker for Forex Indices

Best Forex Brokers in Australia

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$50

Spread min.

-

Leverage max

50

Currency Pairs

52

Trading platforms

Funding Methods

Regulated by

FCACYSECASICCFTCNFABAFIN

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

2.5

EUR/USD

1

EUR/JPY

2

EUR/CHF

5

GBP/USD

2

GBP/JPY

3

GBP/CHF

4

USD/JPY

1

USD/CHF

1.5

CHF/JPY

2.7

Additional Fee

Continuous rate

-

Conversión

-

Regulation

Yes

FCA

Yes

CYSEC

Yes

ASIC

Yes

CFTC

Yes

NFA

Yes

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

Min.Deposit

$20

Spread min.

0.0 pips

Leverage max

20

Currency Pairs

100

Trading platforms

Funding Methods

Regulated by

FCACYSECASICCFTCNFABAFIN

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

1.4

EUR/USD

0.6

EUR/JPY

1.5

EUR/CHF

2.2

GBP/USD

0.8

GBP/JPY

1.9

GBP/CHF

2.4

USD/JPY

1.3

USD/CHF

1.3

CHF/JPY

2.6

Additional Fee

Continuous rate

-

Conversión

0.0 pips

Regulation

Yes

FCA

Yes

CYSEC

Yes

ASIC

Yes

CFTC

Yes

NFA

Yes

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

Min.Deposit

$0

Spread min.

-

Leverage max

2

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSEC

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

from 0,0003%

EUR/USD

from 0,0003%

EUR/JPY

from 0,0003%

EUR/CHF

from 0,0003%

GBP/USD

from 0,0003%

GBP/JPY

from 0,0003%

GBP/CHF

from 0,0003%

USD/JPY

from 0,0003%

USD/CHF

from 0,0003%

CHF/JPY

from 0,0003%

Additional Fee

Continuous rate

-

Conversión

-

Regulation

No

FCA

Yes

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

70.8% of retail investor accounts lose money when trading CFDs

Find the Best Forex Brokers Australia – Comparison

Top Australia Forex Brokers Reviewed

Now that you’ve seen our Australian forex brokers list, let’s dive into detailed reviews of the top forex trading platforms.

1. eToro – Overall Best Forex Broker in Australia for 2021

eToro is our #1 pick for traders in search of the best forex broker in Australia right now. Apart from assets like ETFs, and cryptocurrencies, this trading platform also offers more than 40 currency pairs to trade as CFDs. All forex trading at eToro carries no commissions and you’ll find competitive spreads as low as 1.0 pips.

What makes eToro special is its custom online trading platform, which is available for the web and mobile devices. The platform includes a beginner-friendly charting interface that’s packed with more than 100 technical studies and drawing tools. It also includes a news feed, economic calendar, and market research from professional analysts.

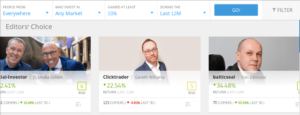

Even better, eToro has a built-in social trading network. You can easily see what other traders think about a currency pair and monitor changes in momentum. The platform also lets you copy the moves of more experienced traders. So, it’s simple to put your portfolio on autopilot and trade using a variety of advanced forex trading strategies.

eToro is regulated by ASIC (the Australian Securities and Investment Commission ), counts with its AFSL licence and offers 24/5 support for traders. It only takes $250 to open a new account, and you can pay by credit card, debit card, PayPal, Neteller, Skrill, or bank transfer.

- Trade over 40 forex pairs commission-free

- Trading platform includes 100+ studies and drawing tools

- Professional market research

- Social network with market sentiment and copy trading

- Regulated by ASIC with 24/5 support

Cons

- A withdrawal low fee of $5

67% of retail investor accounts lose money when trading CFDs with this provider.

2. Capital.com – Best Australian Forex Broker for Exotic Pairs

Capital.com is another one of the best Australian forex brokers. It’s especially good for traders who want to buy and sell exotic forex pairs since Capital.com offers over 140 different currency pairs to trade! Since the exotic pairs trade as CFDs and Capital.com is a popular platform, liquidity is relatively high even for the most unusual currency pairs.

Trading forex with Capital.com is 100% commission-free. In addition, the broker charges some of the cheapest spreads in Australia – the EUR/USD currency pair spread starts at 0.7 pips. Capital.com doesn’t have deposit, withdrawal, or inactivity fees, either, so it’s relatively cheap.

This broker has its own custom trading platform, which we liked for its ease of use. The platform includes AI software that analyses your trades and makes suggestions for how to improve your trading experience, which is also nice. But the best thing about Capital.com’s trading platform is that it integrates with TradingView. This means you get access to highly customisable charts and forex signals.

Capital.com puts a lot of emphasis on trader education, which is another thing we think traders will appreciate about this platform. You’ll find dozens of tutorials and videos explaining the basics of CFD broker trading and popular strategies. Plus, inside Capital.com financial products it offers a free, unlimited forex demo account so you can try out new strategies.

Capital.com is a regulated broker by the UK’s Financial Conduct Authority – a top-tier global regulator – but not by ASIC. The platform requires just a $20 minimum deposit to open an account, and all Australian traders get access to 24/7 customer support.

- Over 140 currency pairs to trade

- Trading platform includes TradingView integration

- Spreads starting from 0.7 pips with no inactivity fee

- Unlimited demo account and video tutorials

- FCA-regulated and 24/7 customer support

Cons

- As a disclaimer, please consider it’s not regulated by ASIC

71.2% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

3. VantageFX – Best ASIC-regulated Forex Broker with 500:1 Leverage

VantageFX is one of the best forex brokers in Australia for traders who want to take big positions in the currency market. The brokerage offers leverage up to 500:1 for major currency pairs (such as USD/JPY) and 250:1 for minor currency pairs. Even exotic forex pairs can be traded on margin of 75:1 or more!

The VantageFX financial services also stands out because it offers both STP accounts (straight-through processing) and ECN accounts (electronic communications network). Both types of accounts offer lightning-fast execution speeds, but they do differ in fee structure.

With an STP account, you’ll pay spreads starting at 1.4 pips – slightly above average among Australian forex brokers – but no commissions. You can open an STP account with a $200 minimum deposit. With an ECN account, you’ll pay spreads starting at 0.0 pips, but also a commission of $3 per lot per side. It’s worth noting, too, that VantageFX offers swap-free Islamic forex accounts with both STP and ECN processing.

VantageFX is a homegrown Australian broker and is regulated by ASIC. The platform offers 24/5 customer support and accepts AUD as a base currency for all accounts.

- Trade with leverage up to 500:1

- ECN accounts with spreads from 0.0 pips

- Offers MetaTrader 4 and 5 trading platforms

- 24/5 customer support

- Based in Australia and regulated by ASIC

Cons

- STP account charges above-average spreads

Your capital is at risk.

4. Libertex – Top Tight Spread Forex Broker in Australia

For traders who hate paying spreads, Libertex is a top Australian forex broker that offers tight spreads. This broker makes money instead by charging fixed commissions for every forex trade, which can be as low as 0.01% – equivalent to 1.0 pips. While that won’t save you money in and of itself, knowing exactly how much you’ll pay to trade can be a huge advantage in volatile and financial markets with high risk.

Libertex offers trading on more than 50 currency pairs, including all the majors and minors and a handful of exotics. You can trade with leverage up to 30:1.

This broker offers its own trading platform as well as integrations with MetaTrader 4 and MetaTrader 5. The Libertex trading platform is easy to get started with, but it doesn’t offer much in the way of technical analysis. If you want to trade with forex signals or develop your own customised indicators, for example, you’ll need to move to MetaTrader.

Libertex is regulated by the Cyprus Securities and Exchange Commission and is widely considered to be safe. However, the broker isn’t regulated by ASIC and only offers support by email. To open an account, you’ll need to make a minimum deposit of just $10.

- Tight spreads

- Trade over 50 forex pairs with 30:1 leverage

- Integrates with MT4 and MT5

- Minimum $10 deposit to open an account

- Regulated by CySEC

Cons

- Not regulated by ASIC

- Customer support by email only

83% of retail investor accounts lose money when trading CFDs with this provider.

5. AvaTrade – Best Forex Options Broker in Australia

AvaTrade is one of the best forex brokers in Australia if you want to trade options. This broker offers 55 currency pairs, nearly all of which can be traded either through CFDs or through European-style vanilla options.

What makes AvaTrade great for options trading is that it offers a custom web, ctrader and mobile trading platform specifically built for options analysis. The AvaOptions platform lets you quickly build multi-leg options strategies, analyse profit and loss, and even check your probability of profit based on historical volatility. While the platform offers tools for advanced traders, it’s simple enough for beginners to use.

AvaTrade also has a social trading and copy trading platform, called AvaSocial. With this platform, you can chat with other traders, follow like-minded forex traders, and even automate your portfolio to mimic the moves of more experienced and active traders. AvaSocial is only available as a mobile app and it’s separate from the main AvaTrade platform, but it’s easy to switch back and forth between the platforms.

Trading with AvaTrade is fairly inexpensive. Spot and options forex trading is 100% commission-free and spreads start from just 0.9 pips for the EUR/USD trading pair. There are no deposit and withdrawal fees to worry about. However, be sure to watch out for the inactivity fee, which kicks in after 3 months and can be quite expensive.

AvaTrade is regulated by ASIC and provides traders with 24/5 customer support by phone, email, and live chat. You’ll need to make a minimum deposit of $100 to open a new account.

- Trade spot CFDs and vanilla options

- Dedicated options analysis and trading platform

- Social and copy trading mobile app

- 100% commission-free with spreads from 0.9 pips

- ASIC-regulated with 24/5 customer support

Cons

- High inactivity fee after 3 months

Your capital is at risk.

Best Forex Brokers in Australia Comparison

Now that you’ve read our detailed Australian forex broker reviews, let’s compare forex brokers’ fees and leverage:

| Pricing Structure | USD/GBP Spread | Deposit/Withdrawal Fee | Maximum Leverage | |

| eToro | Spread | 2.1 pips | $5 withdrawal fee | 30:1 |

| Capital.com | Spread | 1.3 pips | None | 30:1 |

| VantageFX | Spread (STP)

Commission (ECN) |

1.4 pips (STP)

$3 per lot (ECN) |

None | 500:1 |

| Libertex | Commission | 0.01% | None | 30:1 |

| AvaTrade | Spread | 1.6 pips | None | 400:1 |

How to Choose the Right Forex Broker for You

Wondering how to pick the best forex broker in Australia to trade with? We’ll cover some of the key aspects you should consider when choosing a forex company.

Safety

The first thing every trader should think about when comparing the top Australian forex brokers is safety.

Most of the online brokers we reviewed are regulated by ASIC, which is not only a strong regulator in Australia but one of the most widely respected financial watchdogs in the world. ASIC-regulated forex brokers have to follow specific guidelines that protect traders, such as keeping client funds in segregated accounts and minimising slippage when executing trades.

Several of the forex brokers in Australia we reviewed, including Capital.com and Libertex, aren’t regulated by ASIC. However, that doesn’t mean they’re unsafe. Capital.com is regulated by the UK’s FCA, another top-tier global regulator, while Libertex is regulated by CySEC.

Fees

A major concern for traders when picking a forex broker is the trading costs. As you can see from our forex trading broker comparison above, trading fees for currency trading can vary widely from one broker to the next. That’s especially true if you’re interested in trading minor or exotic currency pairs.

Most Australian top forex brokers offer commission-free trading and instead charge a spread. This is typically around 1.0 pips – or 0.01% – for major currency pairs, but some brokers charge more or less. Importantly, the spread for a specific currency pair can change over time depending on foreign exchange market conditions.

Alternatively, brokers like Libertex charge a fixed commission that remains constant over time. VantageFX’s ECN account charges both a variable spread and a fixed commission.

It’s also important to look at account fees. Most of the brokers we reviewed don’t charge deposit or withdrawal fees, but you could face an inactivity fee if you go several months without trading. Be sure to check what fees your broker charges and know how to avoid them.

Range of Assets

The range of assets that forex brokers provide is also important to consider. Nearly every Australian forex broker offers trading on all of the major and minor currency pairs. However, if you want to trade exotic forex pairs or forex options, you’ll need a broker that offers these assets.

We think Capital.com is the best forex broker in Australia for trading exotic currency pairs and AvaTrade is the best for trading forex options.

Trading Tools

Your broker will be your main source of research, analysis, and tools for navigating the forex market. So it’s important that you choose a broker that has functionalities that are both comprehensive and easy to use.

Important tools to look for include a market news feed, an economic calendar, price alerts, and watchlists. You may also want to look for a market sentiment gauge, which shows whether other traders are buying or selling a specific currency pair. Forex signals and customisable technical studies are also critical for advanced forex traders who want to dive into market analysis.

Having a social trading platform – like the ones that eToro and AvaTrade provide – can also be important, particularly for newer forex traders. These platforms enable you to share ideas and strategies with other traders and can help you learn the ropes of fx trading.

Past performance does not guarantee future results.

Platforms

Forex brokers in Australia offer trading platforms that differ widely in complexity.

Some brokers, like eToro and Capital.com, have created their own custom platform that provides user-friendliness while also giving traders access to advanced tools. Brokers like Libertex, AvaTrade, and VantageFX each offer their own platforms as well as integrations for MetaTrader 4 and 5.

One thing to note when comparing Australian forex trading platforms is whether they are available through a mobile app for iOS and Android devices. All of the top brokers we reviewed offer forex apps.

Account Types

While many forex brokers only offer a single, standard account type, some let you choose between multiple different account options. For example, VantageFX has both STP accounts and ECN accounts with different pricing structures. Think carefully about the amounts of forex you will buy and sell with each trade and what type of account best suits your needs.

Payments

Finally, it’s important to think about how payments work at different forex brokers. All of the top brokers in Australia we reviewed accept credit cards, debit cards, and bank transfers to fund your trading account. eToro makes payments even easier by accepting e-wallets like PayPal, Neteller, and Skrill.

Be sure to check brokers’ minimum deposits, too. These can vary widely, from just $10 to open a Libertex account to $250 to open an eToro account.

How to Get Started with an Australian Forex Broker

Ready to start trading with the best forex broker in Australia? We’ll show you how to open an account and place your first trade with eToro, which offers commission-free trading and a rich social trading network.

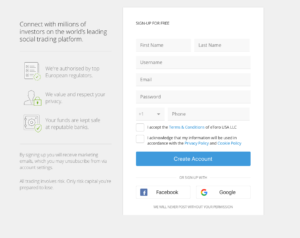

Step 1: Open an eToro Account

To open a new account with eToro, head to the broker’s website and click ‘Join Now.’ Enter your email along with a new username and password for your account. You can also sign up using your Google or Facebook credentials.

67% of retail investor accounts lose money when trading CFDs with this provider.

Step 2: Verify Your Identity

eToro is regulated by ASIC and follows the regulator’s Know Your Customer (KYC) requirements. This means that you must upload a copy of your passport or driver’s license along with a copy of a recent bank statement or utility bill before you can start trading.

Step 3: Deposit Funds

Next, you’ll need to make a minimum deposit of $250 to fund your new trading account. You can pay by credit card, debit card, PayPal, Neteller, Skrill, or bank transfer.

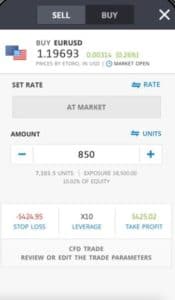

Step 4: Start Trading

Now you’re ready to trade forex with eToro. From the eToro dashboard, click on ‘Currencies’ to see all of the available forex pairs. Click on the pair you want to trade, then click ‘Trade’ to open a new order form.

Enter the amount you want to buy or sell in AUD and choose how much leverage to apply to your trade. You can also set a stop-loss or take-profit order if it makes sense for your trading strategy.

When you’re ready, click ‘Open Position’ to complete your first forex trade.

When you’re ready, click ‘Open Position’ to complete your first forex trade.

Conclusion

Trading forex in Australia is simple when you have the right currency trading broker for the job. Thanks to our Australian forex brokers review, you can easily find the best one for you.

Ready to start trading with the overall best forex broker in Australia? Click the link below to sign up for an eToro account and place your first commission-free trade!

eToro – Best Australian Forex Broker for 2021

67% of retail investor accounts lose money when trading CFDs with this provider.