GO Markets Australia Review 2024

GO Markets is a global CFD broker that launched in Australia in 2006. The broker offers CFD trading for stocks, forex, cryptocurrencies, commodities, stock indices, and treasures. Plus, Aussies can buy and sell ASX-listed shares outright.

In our GO Markets Australia review, we’ll cover everything Aussie traders need to know about this CFD and stock trading platform.

GO Markets Pros & Cons

- Trade forex, global stocks, commodities, crypto & more

- Buy ASX-listed shares outright with dedicated app

- Offers MetaTrader 4 and 5 trading platforms

- Commission-free trading accounts available

- Leverage up to 30:1

- 24/5 phone and email support

Cons

- Cannot buy US or European stocks outright

64% of retail investor accounts lose money when trading CFDs with this provider.

GO Markets AU Tradable Assets

GO Markets offers more than 1,000 CFDs for a variety of asset classes, including forex, stocks, indices, cryptocurrencies, commodities, and treasuries. The broker also offers direct share trading for ASX-listed stocks and ETFs.

Forex

GO Markets offers trading on 50+ forex pairs. This includes all major pairs and most minor pairs. Maximum leverage for forex trading is 30:1.

Stocks

GO Markets offers trading on global stocks through CFDs. Traders will find more than 1,000 shares from the Australian Stock Exchange (ASX), New York Stock Exchange (NYSE), NASDAQ, London Stock Exchange (LSE), Frankfurt Stock Exchange (DAX), and Hong Kong Stock Exchange (HKEX). Share CFDs can trade with leverage up to 5:1.

Aussies can also buy and sell ASX-listed shares and ETFs outright through a dedicated share trading platform. Only shares from the ASX are available – traders cannot buy US-listed stocks directly, although that will change in early 2023.

Indices

GO Markets offers CFD trading for 12 major stock indices, including the ASX 200, the FTSE 100, the S&P 500, and the NASDAQ 100. Futures CFD trading is also available for the China 50 index, the US Dollar index and the Volatility Index. Indices can be traded with leverage up to 20:1.

Commodities

Traders at GO Markets can go long or short on commodities like gold, silver, oil, and agricultural products. The broker offers spot CFDs for gold, silver, WTI crude, and Brent crude. Futures CFDs are available for US and UK oil prices, soybeans, and wheat. The maximum leverage for commodities trading is 20:1.

Treasuries

Treasuries CFD trading enables Aussie traders to speculate on future interest rates in countries around the world. There are CFDs for 5 treasury bills: 5-year US treasury note futures, 10-year US treasury note futures, Eurozone BUND futures, UK Gilt futures, and Japanese government bond futures. Treasury CFDs offer leverage up to 5:1.

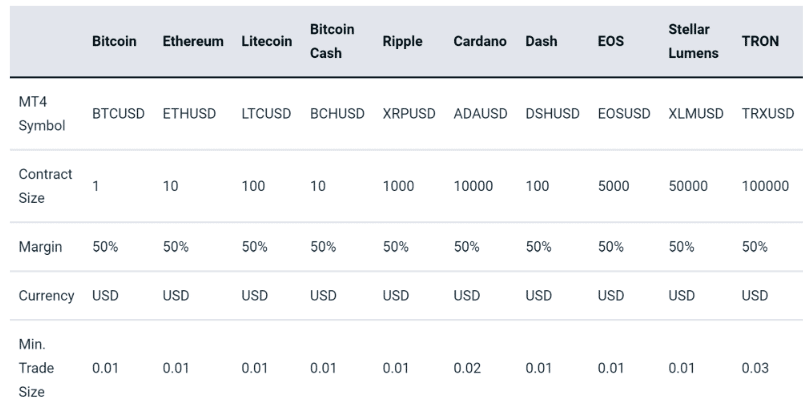

Cryptocurrencies

GO Markets offers CFD trading on 10 major cryptocurrencies: Bitcoin, Ethereum, Litecoin, Bitcoin Cash, Ripple, Cardano, Dash, EOS, Stellar, TRON, Dogecoin, Chainlink and Polygon. Traders can apply leverage up to 2:1.

GO Markets is not a crypto exchange and does not enable traders to buy cryptocurrency outright.

64% of retail investor accounts lose money when trading CFDs with this provider.

GO Markets Australia Fees

GO Markets charges a combination of commissions and spreads, depending on traders’ account type and the assets they’re trading. These fees are slightly above average for Australian forex brokers, but GO Markets charges zero account fees.

GO Markets AU Trading Fees

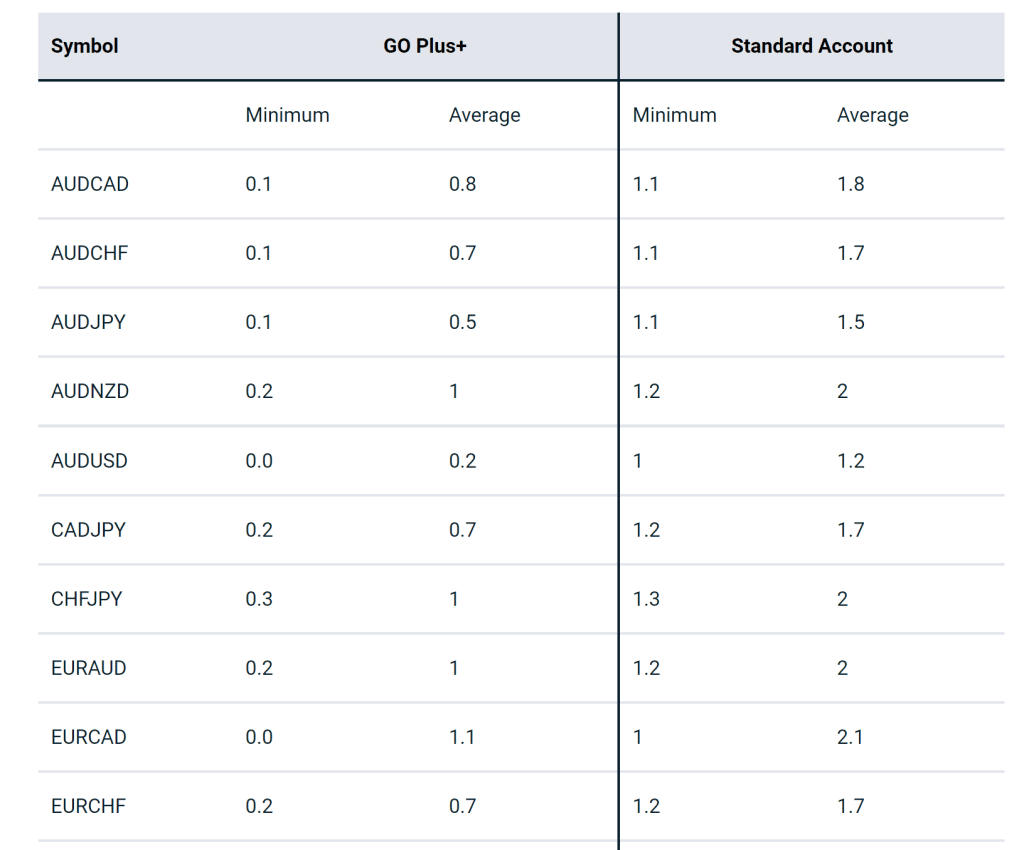

Traders can choose between 2 pricing options for forex trading.

A Standard account is a commission-free account with spreads starting from 1.0 pips. Traders will pay an average spread of 1.2 pips for AUD/USD and 2.0 pips for EUR/AUD.

A GO Plus+ account is a commission account with reduced spreads. Each trade incurs a commission of A$3 per lot per side. Spreads start from 0.0 pips, but traders will pay an average spread of 0.2 pips for AUD/USD and 1.0 pips for EUR/AUD.

There is no minimum commission fee except on Hong Kong shares, where there is a charge of around HK$50, depending on what currency is being used

GO Markets also charges a data fee for the ASX and HKEX exchanges. The fee is A$22 per month for the ASX and HK$120 per month for the HKEX. Traders who place at least 4 trades on the exchange per month will receive a rebate for their data fees.

The commission for direct ASX-listed share trading is A$7.70 per trade or 0.05% for trades involving more than A$100,000 in volume. Traders must buy a minimum of A$500 per trade, which equates to a commission of 1.54%.

Therefore, GO Markets is more cost-effective than competitors on large trades, as users can take advantage of the fixed 0.05% rate compared to typical rates of 0.07 to 0.09%.

| Standard | GO Plus+ |

| Spread: From 1.0 pips

Commission: None |

Spread: From 0.0 pips

Commission: A$3 per lot per side |

GO Markets AU Account Fees

GO Markets stands out from other Aussie forex brokers by not charging any account fees. There are no fees to open an account and no inactivity fees. There are also no deposit or withdrawal fees.

The minimum deposit to open a new GO Markets account is A$200.

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

64% of retail investor accounts lose money when trading CFDs with this provider.

GO Markets AU Trading Platforms

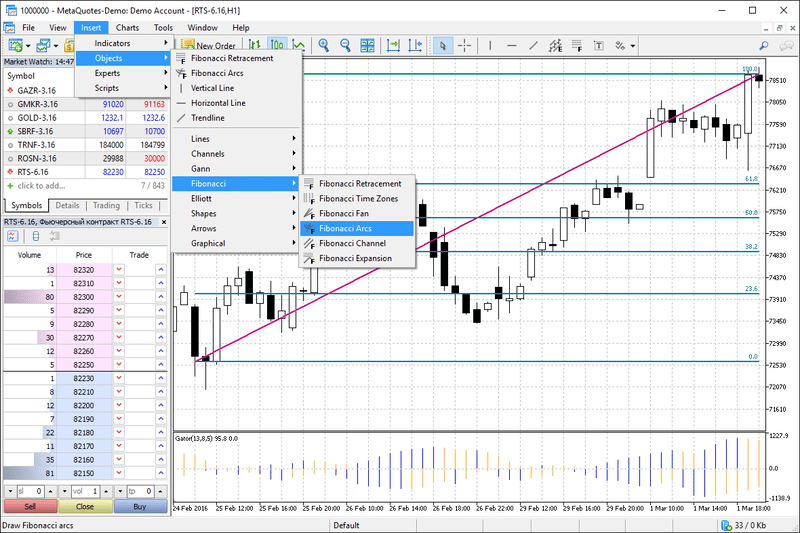

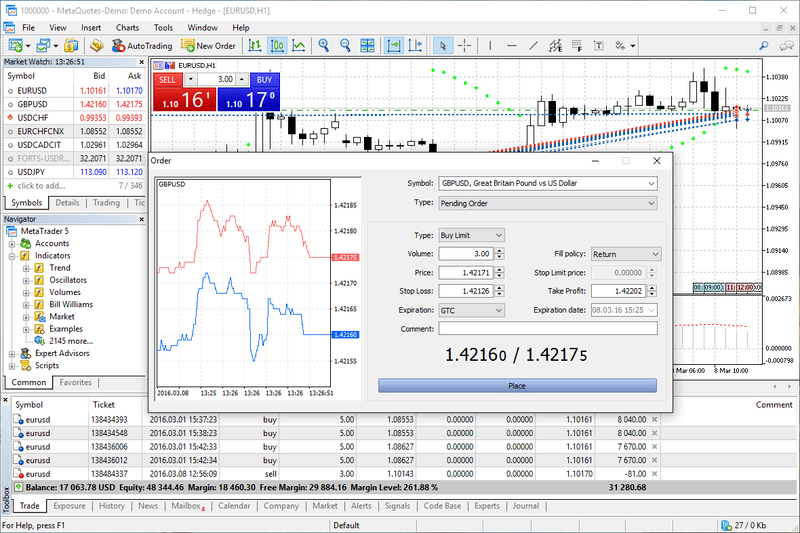

GO Markets offers 2 platforms for CFD trading: MetaTrader 4 and MetaTrader 5. These are popular and powerful platforms for forex day trading.

Both MetaTrader 4 and 5 are available as desktop, web, and mobile platforms.

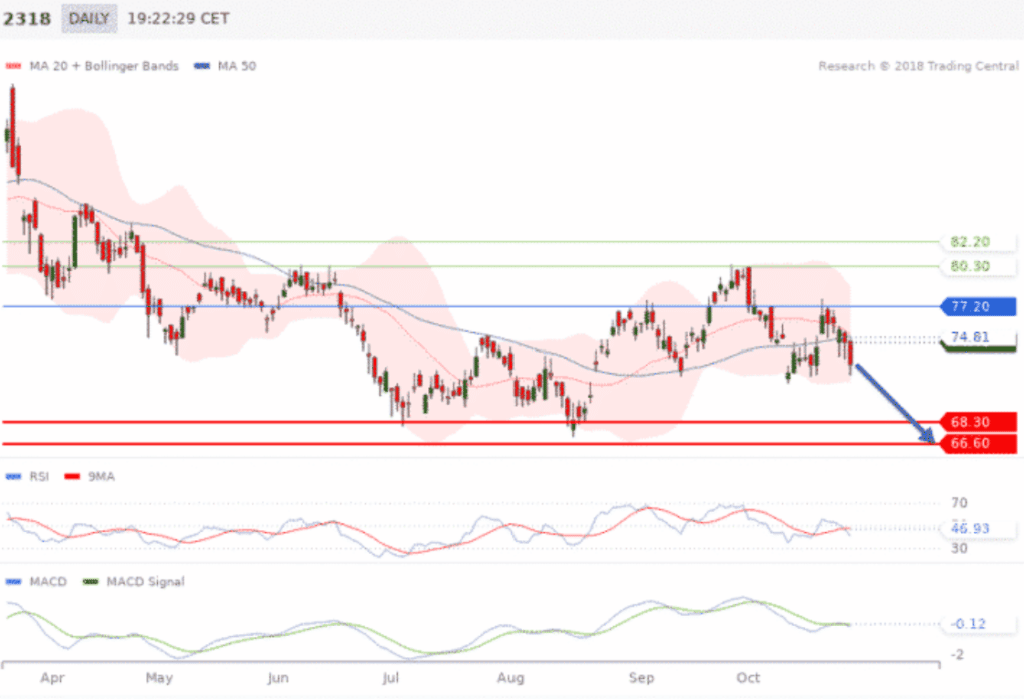

MetaTrader 4 and 5 offer a ton of capabilities for charting, technical analysis, order management, and algorithmic trading. Traders can also build or import forex robots to run automated trading strategies in these platforms.

Along with MT4 and MT5, GO Markets offers a variety of analysis add-ons for traders. Autochartist is an automated technical analysis software that can identify support and resistance areas, trendlines, and candlestick patterns. a-Quant is a forex signals service that issues 9-12 forex trade recommendations per day for several major currency pairs.

GO Markets also includes a virtual private server (VPS) for running high-frequency trading algorithms. An integration with Myfxbook enables traders to log their trades and track their performance over time

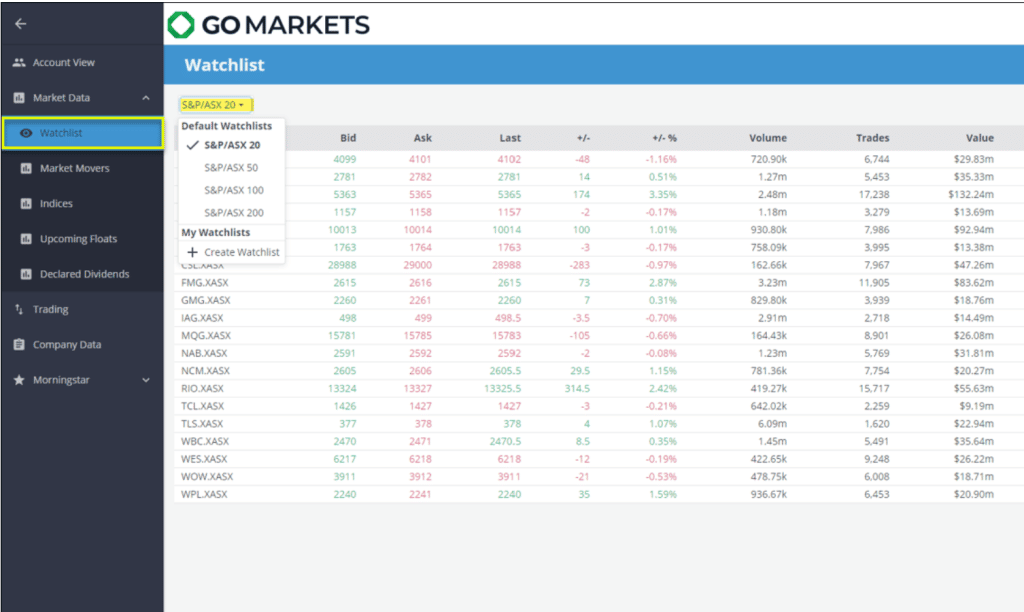

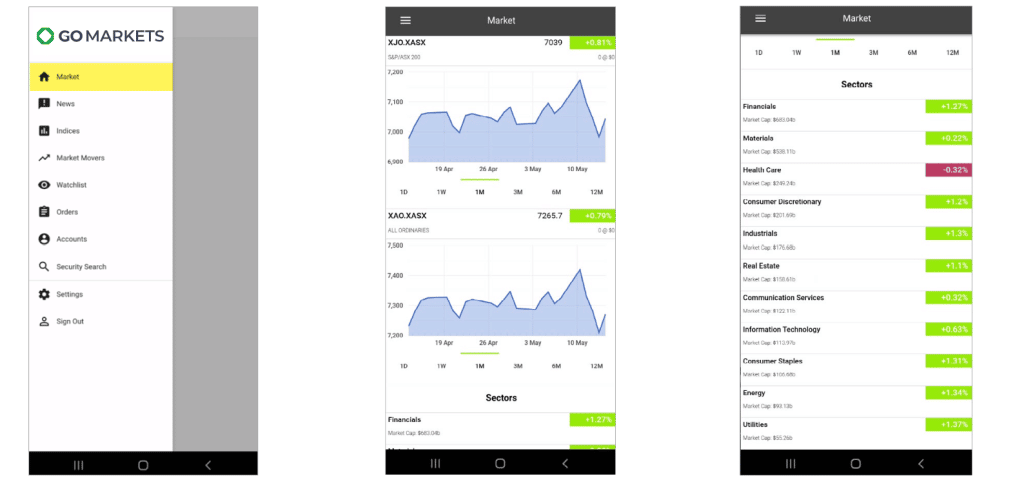

GO Markets has a separate platform for ASX-listed share trades. The GO Markets Securities Share Trading platform is available on the web and for iOS and Android.

GO Markets Securities Share Trading is much less capable than MetaTrader 4 and 5. It offers limited charting capabilities, instead focusing on portfolio management tools to help traders keep track of their holdings.

One of the features that GO Markets offers for share trading is ShareSmart, a stock scanning tool. ShareSmart automatically scans the ASX daily for stock trade ideas based on technical analysis. It’s not quite a signals service, but can be used to begin deeper research into stock trades.

Is GO Markets User-friendly?

GO Markets itself is easy to use, although traders will primarily be using MetaTrader 4, MetaTrader 5, or the GO Markets Securities Share Trading platform after creating an account. Registering a new trading account with GO Markets only takes a few minutes and deposits are seamless.

MetaTrader 4 and 5 have a relatively steep learning curve for traders who have not used these trading platforms before. It only takes a few minutes to launch charts and perform basic technical analysis, but more in-depth analyses require diving deep into the platforms’ settings and tools. Traders will also want to spend time creating default chart displays and importing all the custom indicators they need for their strategy.

The GO Markets Securities Share Trading platform is relatively simple to use, although this simplicity is due in part to a lack of features. Traders can set up watchlists and alerts in a matter of minutes, and the charting tools are fairly accessible.

GO Markets Charting and Analysis

MetaTrader 4 and 5 are among the most in-depth trading platforms available for chartists. These platforms come with dozens of built-in technical indicators and traders can code their own custom indicators as well. Nearly all of the parameters for indicators are customizable.

Traders also have access to a huge suite of drawing and annotation tools. These include tools for Fibonacci retracement analysis and Gann pattern analysis. Autochartist integration makes it easier for traders to use all of the available drawing tools more efficiently to spot patterns.

Charting and analysis capabilities in GO Markets Securities Share Trading are much more limited. Traders will find basic charts with popular technical indicators, but there’s no way to create custom indicators and customization options are limited.

GO Markets Australia Accounts

GO Markets Australia offers 2 account options: Standard and GO Plus+. These 2 accounts primarily differ in pricing for forex trading.

The Standard account is a commission-free account with spreads starting from 1.0 pips. The GO Plus+ account has a commission of A$3 per lot per side and spreads starting from 0.0 pips.

Both accounts are free of account fees and require a minimum deposit of A$200 to open. Which account is right depends mainly on the volumes a user expects to trade.

GO Markets also offers specialized accounts for corporations and trusts.

Any trader can open a demo account at GO Markets to try out the platform.

GO Markets Australia Apps

MetaTrader 4 and 5 are available as mobile apps – these forex trading apps include all of the advanced features of the desktop platform, but optimized for a smaller screen. The main limitation that traders will find is that charts on a small mobile screen can get crowded.

The MT4 and MT5 apps support position management, automated trading strategies, price alerts, and indicator-based alerts. Traders can also move funds into or out of their GO Markets account through the mobile apps.

GO Markets Securities Share Trading is also available as a mobile app for iOS and Android. The app is best for monitoring open positions and can be used to execute buy and sell orders. The app also supports price alerts.

64% of retail investor accounts lose money when trading CFDs with this provider.

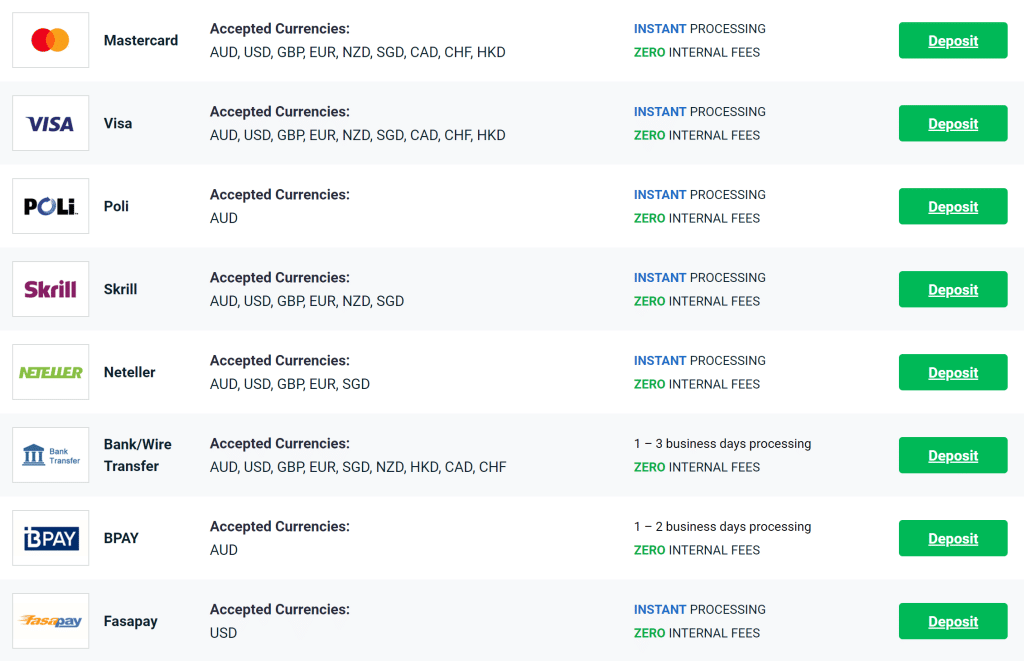

GO Markets AU Payments

Deposits and withdrawals at GO Markets are free. The platform accepts a wide variety of payment methods including:

- Visa

- Mastercard

- Bank transfer

- Wire transfer

- Poli

- Skill

- Neteller

- BPay

Card and e-wallet deposits are available for trading instantly. Bank and wire transfers take 1-3 days to reach a trader’s account.

GO Markets supports 9 base currencies: AUD, USD, GBP, EUR, AED, SGD, CAD, CHF, and HKD.

GO Markets Minimum Deposit

GO Markets requires a minimum deposit of A$200 to open a new trading account.

GO Markets Withdrawal Times

Withdrawals from GO Markets are free. Processing takes 1-2 business days, and then it may take another 1-3 days for money to reach a trader’s account.

GO Markets Bonus & Promos

GO Markets currently has a promotion for traders who migrate an ASX share trading account from another brokerage. When traders transfer a HIN with at least $10,000 in value, they’ll receive 50 commission-free trades at GO Market.

GO Markets AU Demo Account

GO Markets offers a free demo account for all traders. There’s no minimum deposit required to start paper trading – traders simply need to register with the brokerage. The demo account offers full access to MetaTrader 4, MetaTrader 5, and GO Markets Securities Share Trading.

Traders can choose their starting account value for the demo account. There’s no time limit and the account can be reset at any time.

GO Markets AU Customer Support

GO Markets offers 24/5 phone and email support from an Australia-based support team.

GO Markets Australia Regulation & Security

GO Markets operates in Australia under the entity GO Markets Pty Limited. This brokerage is regulated by the Australian Securities and Investment Commission (ASIC). All Aussie traders receive negative balance protection.

GO Markets uses SSL encryption to protect traders’ account. However, the brokerage does not support two-factor authentication.

64% of retail investor accounts lose money when trading CFDs with this provider.

How to Trade with GO Markets Australia

We’ll take a closer look at the steps to open a GO Markets account in Australia and start trading.

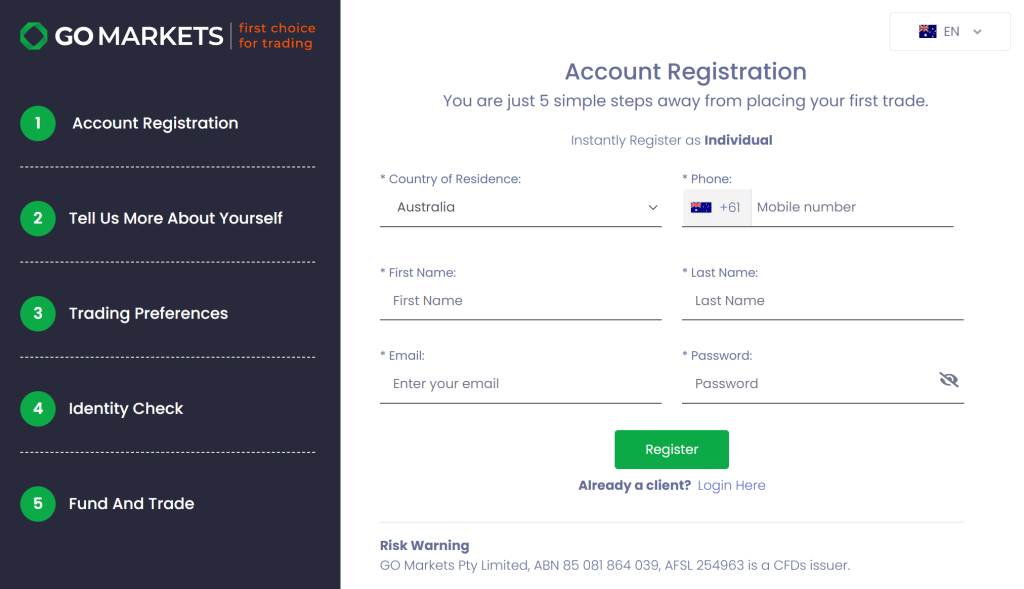

Step 1: Register

Head to GO Market’s website and click Open Account, then select Individual Account. Select Australia as the country of residence, then enter a name, email address, phone number, and password. Traders then need to answer a series of questions about their trading experience.

Step 2: Verify

GO Markets follows Know Your Customer (KYC) requirements, so all new traders must verify their identity and Australian residence. Traders can upload a copy of their passport or driver’s license and a copy of a recent bank statement or utility bill to complete this step.

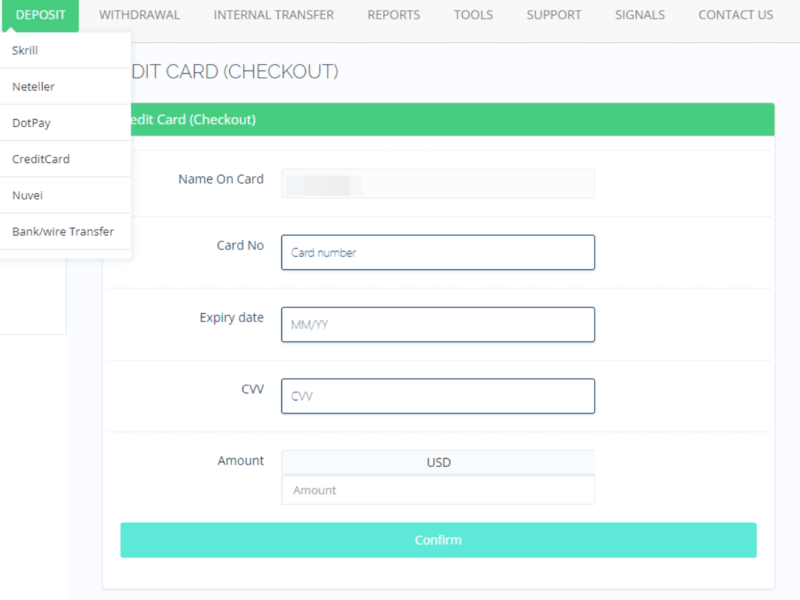

Step 3: Deposit

In the GO Markets dashboard, click Deposit. Choose a payment method and enter the amount to deposit. GO Markets requires a minimum deposit of A$200 for new accounts.

Step 4: Trade

Download and install MetaTrader 4 or 5, then log into a GO Markets account. Select an instrument to trade and open a new order form. Choose the trade details, including the amount to trade, whether to go long or short, and whether to use a stop loss or take profit. When the trade is ready, click Place to complete the trade.

64% of retail investor accounts lose money when trading CFDs with this provider.

Conclusion

GO Markets is an Aussie CFD broker that offers trading on forex, stocks, indices, commodities, cryptocurrencies, and more. The broker also offers direct share trading on ASX-listed stocks. GO Markets offers access to the powerful MetaTrader 4 and 5 trading platforms, plus a handful of extra tools for automated charting and forex analysis.

Ready to get started with GO Markets? Sign up for an account to start trading in Australia today!

64% of retail investor accounts lose money when trading CFDs with this provider.