The Australian dollar seems to seek a new direction around the 0.75 handle. What’s next? The RBA convenes after two months and it matters.

Here is their view, courtesy of eFXnews:

Low Q4 Australian CPI sees the market reduce probability of a rate hike over the next twelve months.

Recent renewed focus of RBA on financial stability considerations suggests deteriorating labour market outlook will be required to prompt further easing.

NAB continues to forecast two rate cuts in 2017. This view reflects the expectation that GDP growth will slow in 2018 as housing construction slows, resource exports are no longer expanding and the benefit of the earlier large AUD depreciation starts to wane.

Without further stimulus, this slow growth outlook should likely see the unemployment rate begin to rise, something that is seen as inconsistent with the RBA’s charter given inflation is likely to continue to run below target for an extended period.

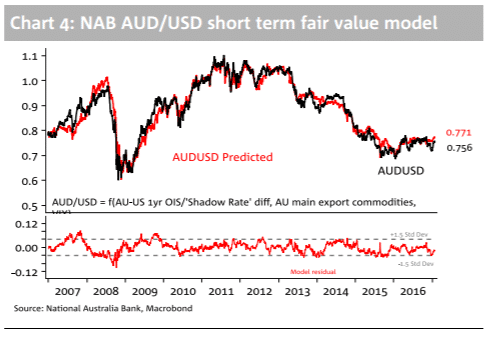

AUD still on the weak side of fair value. We noted in our previous update that one reason for the AUD/USD recovery off its last December 2016 lows – weaker USD aside – was the failure of concerns about heightened Chinese capital outflows and a weaker CNY/EM Asia FX in general, to materialise. Pressure on the Yuan has been successfully resisted by the PBoC. There may still be residual concerns about President Trump initiating a trade war with China, such that risk appetite – at least as it affects the AUD – is not as buoyant as that simply reflected in the VIX (the risk proxy in our short term fair value model). This might help explain why AUD/USD continues to trade on the weak side of our STFV estimate (currently ~0.77, see Chart 4). If so, it probably continues.

NAB targets AUD/USD at 0.73, 0.72, 0.70, and 0.70 by the end of Q1, Q2, Q3, and Q4 respectively.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.