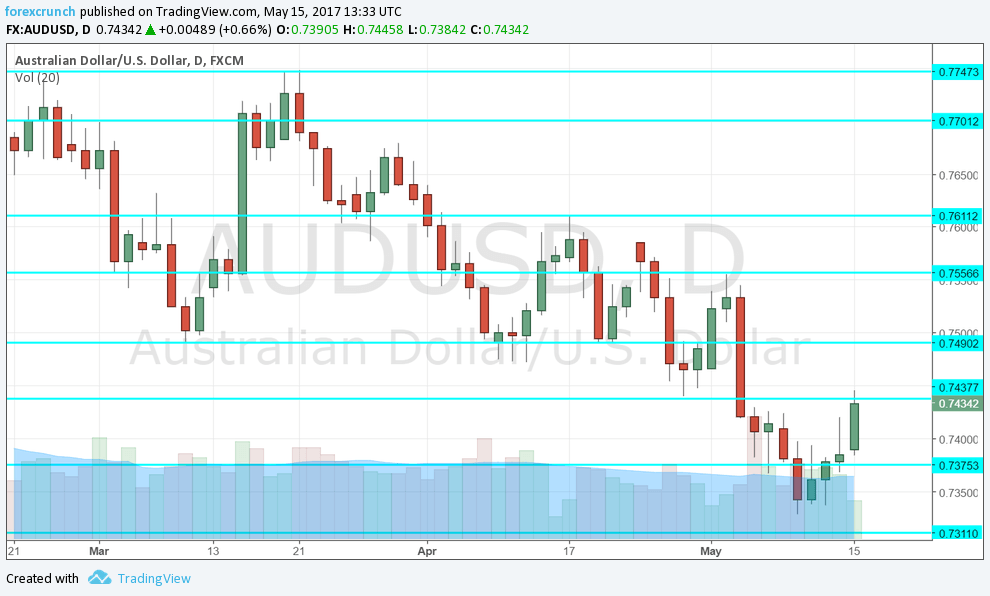

The Australian dollar was hit but succeeded in bouncing from those levels. What’s next? The team at Nomura analyzes everything moving the Aussie:

Here is their view, courtesy of eFXnews:

Nomura FX Strategy Research outlines 3 AUD’s bearish factors that are in play against other 3 bullish factors.

On the bearish side: 1) Softer near-term growth momentum. 2) Lower level of Australian-centric commodity prices such as iron ore. 3) Lack of a positive monetary policy impulse.

On the bullish front: 1) The synchronised global recovery. 2) Australia’s improved balance of payments picture. 3) Relative stability in the long end Australian-US real yield spread.

Strategy-wise, Nomura recommends holding a bearish AUD bias on key crosses such as against the EUR and GBP.

EUR/AUD is trading circa 1.4745, and GBP/AUD circa 1.3760 as of writing.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.