The Australian dollar has been trading in range for a very long time. Can it move to lower ground? Here is the view from TD:

Here is their view, courtesy of eFXnews:

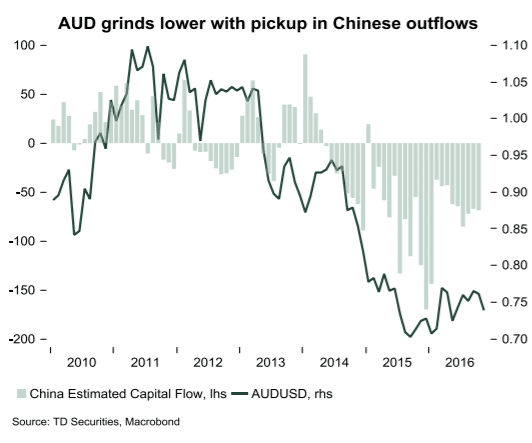

AUD has recovered a bit the past few weeks following the steep losses in the wake of the US election. Recently, the news around China has helped to stabilize AUD. This reflects policy makers decision to seek and limit capital outflows to try and stabilize the renminbi and a string of stronger data releases. We prefer fading rallies in AUD and still see a move lower towards 0.7150 in the offing.

This week’s release of the November employment report will get close attention following the sharp downside miss in Q3 GDP. The growth miss reflects the roll-off of government spending but also suggests the handover to private investment remains incomplete. A soft employment report could fuel fears that the economy looks weak into Q4, prompting a possible shift of RBA pricing next year.

Ahead of the release, we think AUD could benefit from some pullback in the greenback but look to fade rallies ahead of the 200dma near 0.75. This could also favor shorts in AUDNZD.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.