The Australian and New Zealand dollar both weathered the Brexit quite well, but this may not be the end.

Here is their view, courtesy of eFXnews:

Our antipodean view in the wake of the Brexit vote is predicated on two observations:

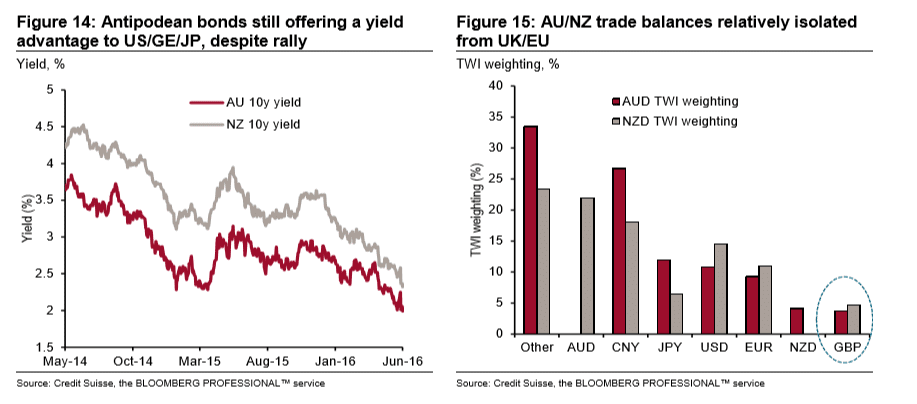

In the short-term context of high volatility, elevated risk aversion and high correlations, currencies like the AUD and NZD tend to trade in line with broader risk sentiment without much differentiation. Given that we expect the current climate of politically-induced market dislocations to continue for some time, AUD and NZD are likely to underperform ‘safe-haven’ currencies such as JPY, CHF, and USD.

Balanced against this is the ongoing political instability in the UK and Europe, as well as potential “Trumpxit” risk from the US, which can drive longer-term portfolio capital flows to Australia and New Zealand. As they are highly rated sovereigns with stable political environments and still carry some risk free yield, they have considerable potential to become viewed as ‘safe-haven’ currencies in their own right.

Thus, we express this sentiment by downgrading our 3m AUDUSD forecast from 0.74 to 0.72, and our 3m NZDUSD forecast from 0.7250 to 0.7060 (continuing to target 3m AUDNZD 1.02), while leaving our 12m forecasts unchanged at 0.70 and 0.66, respectively.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.