The Australian dollar enjoyed an upswing following the upbeat trade balance and building approvals data as well as Trump’s behavior.

Here is their view, courtesy of eFXnews:

In early January, we identified four reasons why the AUD would test range highs (around USD0.78) in the near-term: a rise in liquidity, an improvement in global growth, a decline in market volatility and signs of undervaluation.

These reasons remain valid in our view. What has changed since then? Positively for the AUD, momentum in the global economy has continued to improve and broaden beyond our expectations. The preliminary January PMIs in the developed countries rose further after a strong Q4 and export growth across much of Asia has sharply accelerated. That said, there are growing risks that the AUD may underperform other cyclical currencies in this global growth upswing. This means that the AUD may still rise against the USD but struggle on the crosses.

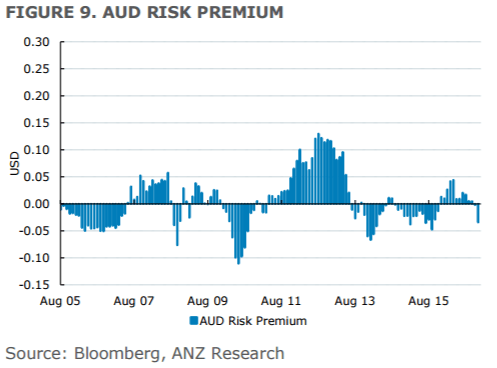

Firstly, the new US administration’s tone on trade has been aggressively protectionist and there is some risk that the US administration will label China a ‘currency manipulator’. Australia is often seen as a ‘China proxy’ suggesting that a ‘political risk premium’ may need to be factored into the AUD if tensions rise. This could see the AUD trade at a discount to fundamentals for an extended period.

Secondly, the Australian Q4 CPI data confirmed that core inflation – while stabilising – is showing few signs of picking up. In a global reflationary environment, this could see the AUD struggle against currencies where core inflation is picking up.

*ANZ maintains a long AUD/USD position from 0.7380 targeting 0.78.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.