The Australian dollar made a move to the upside and seems to be consolidating for ages. What’s next?

Here is their view, courtesy of eFXnews:

The AUD has continued to defy predictions – including our own – for its imminent descent from the high to the low 0.70s.

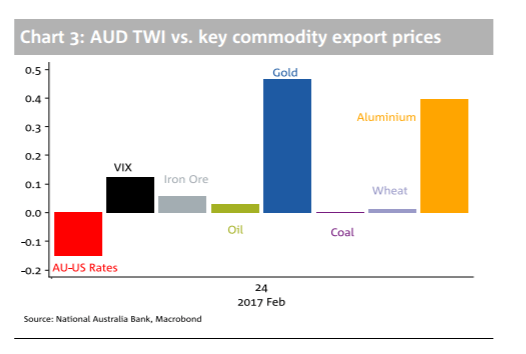

Alongside the inability of the USD to recapture almost any of the ground it lost in January, the global economy, commodity prices and risk appetite have all been travelling on a higher plane than we envisaged when reaffirming our AUD forecasts earlier in the year.

To the extent this momentum can continue for a while longer, commodity currencies can hold up for an extended period.

Alongside general revisions to our USD forecasts for the next few quarters, we are lifting our AUD/USD forecast to 0.77 for end Q1 (was 0.73); to 0.75 for Q3 (0.72) and to 0.73 for Q3 (0.70). We retain our 0.70 end-2017 forecast and still contend we can spend some time slightly below there in 2018.

A resumption of USD strength, weaker commodity prices and less buoyant risk appetite are all implicit in this view.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.